On Nov. 20, oil prices rose modestly to extend gain from last week on market speculation that OPEC+ would deepen cuts to shore up prices after four weeks of declines, Reuters reported. (Source: Shutterstock)

OPEC+ meets in Vienna on Nov. 26 but it’s Saudi Arabi and the question of will the kingdom extend voluntary 1 MMbbl/d production cuts that will take centerstage, according to a Nov. 20 report by Rystad Energy.

OPEC+ implemented quotas, but Saudi Arabia’s cuts will “ultimately shape the short-term future of global oil prices,” Jorge Leon, Rystad senior vice president, wrote in a market update.

“The kingdom is balancing the desire to keep prices high by limiting supply with the knowledge that doing so will lead to a further drop in overall market share,” Leon said.

Prices have experienced downward pressure in recent weeks as prices dipped below $80/bbl last week after a selloff driven by oversupply.

“This recent nosedive could be an indicator of what’s to come at the OPEC meeting, as the Saudis have repeatedly demonstrated that their price floor is above $80/bbl,” Leon said.

On Nov. 20, oil prices rose modestly to extend gain from last week on market speculation that OPEC+ would deepen cuts to shore up prices after four weeks of declines, Reuters reported.

Brent crude futures rose $1.78 to $82.39/bbl at 1350 GMT while WTI was up $1.71 at $77.60/bbl.

Rystad’s forecast for inventory — which assumes Saudi voluntary cuts will not extend into 2024 — shows supply surprising on the upside. Leon now expects a balanced market for next year’s first quarter.

“More importantly, a looming market surplus of over 600,000 bbl/d is in sight for the second quarter,” he said. “Going forward, the second half of next year is expected to show a deficit of around 450,000 bbl/d.”

Rystad previously forecasted a 2024 deficit of 400,000 bbl/d.

Overall, Rystad now expects the oil market in 2024 to be fairly balanced compared to the significant deficit (-1.2 MMbbl/d) in 2023.

Scenarios

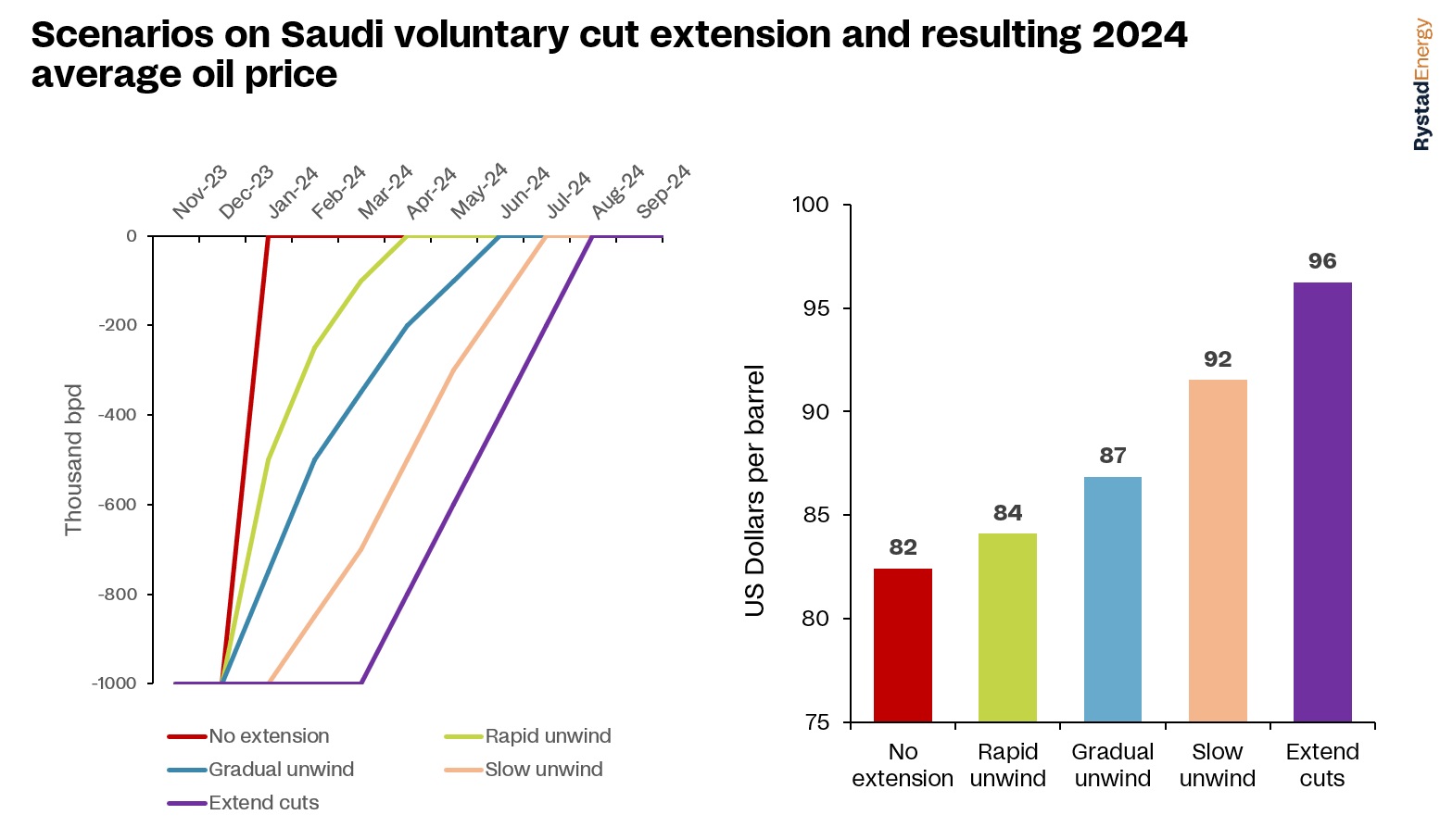

Rystad ran five scenarios dependent on Saudi production policy for the next few months and estimated the effect each would have.

Here’s how Rystad sees each playing out:

- No extension: Saudi cuts are not extended into 2024;

- Rapid unwind: Saudi Arabia unwinds the voluntary cuts rapidly, restoring its 1 MMbbl/d to the market by April 2024;

- Gradual unwind: Saudi Arabia unwinds voluntary cuts gradually until June 2024;

- Slow unwind: The kingdom extends the 1 MMbbl/d voluntary cuts into January and February 2024, and then very gradually unwinds them until July 2024; or

- Extended cuts: Saudi Arabia extends the 1 MMbbl/d voluntary cuts until April 2024 before gradually unwinding them until August 2024.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.