By 2029, global oil demand is projected to reach 112.3 MMbbl/d. Longer term, demand increases by 18 MMbbl/d from 2023 levels and reaches 120 MMbbl/d in 2050. (Source: Shutterstock)

ABU DHABI, United Arab Emirates—Shale oil is poised to increase by 2.3 MMbbl/d through 2029, but tensions between the oil and gas industry and ESG-centric investors could spark a global energy crisis, the head of OPEC’s energy studies department said.

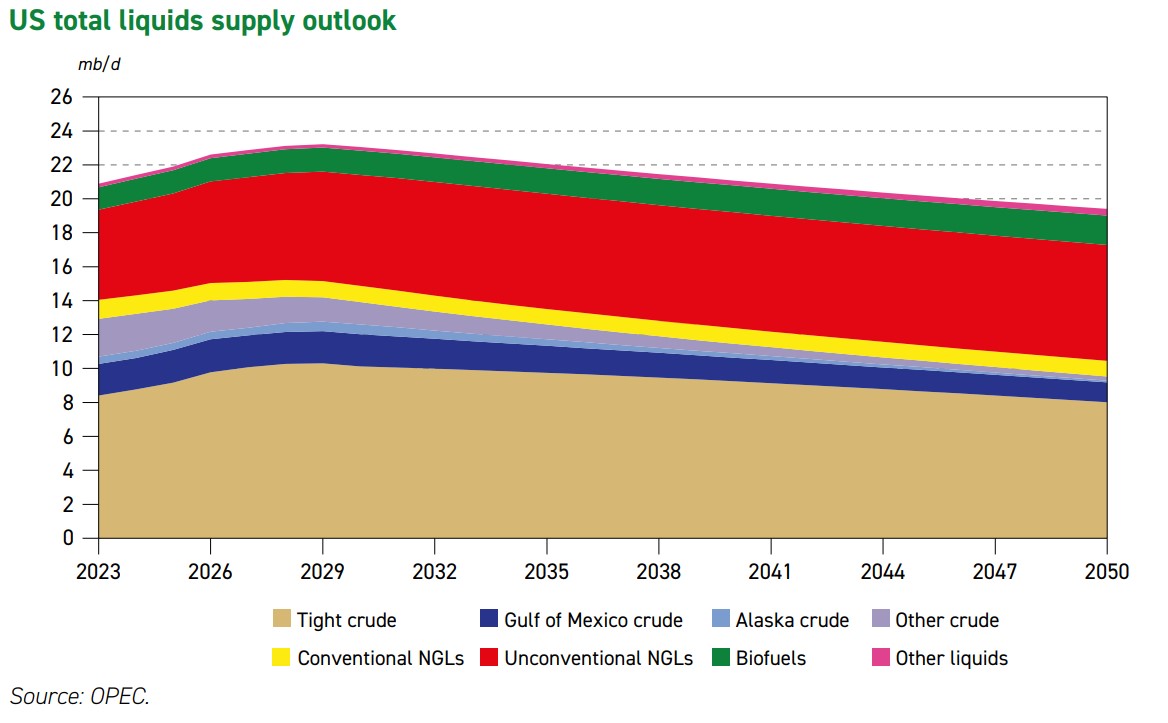

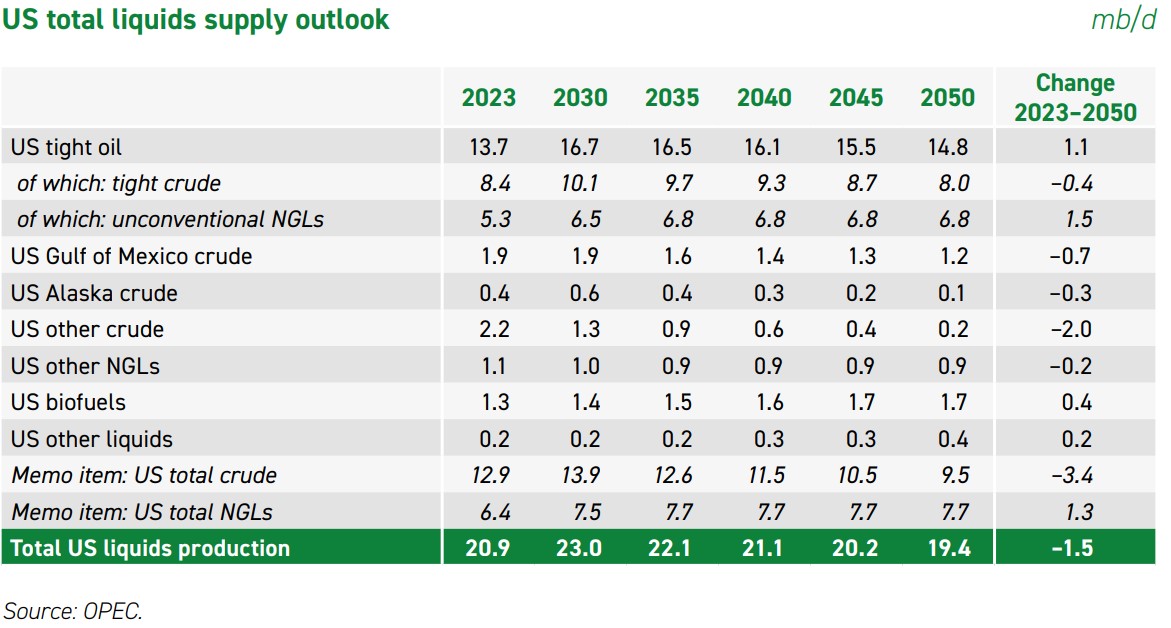

U.S tight oil will be the main driver behind supply growth, rising to 16.7 MMbbl/d in 2029 from 13.7 MMbbl/d in 2023, OPEC’s Abderrezak Benyoucef said Nov. 6 at the ADIPEC Exhibition & Conference.

However, tight oil will peak at the end of the decade and continue producing at an extended plateau above 16 MMbbl/d in the 2030s, he said. Further out, shale volumes decline to an average 14.8 MMbbl/d by 2050.

Benyoucef said that OPEC’s Outlook 2024 shows the world’s energy demand increasing by 24% through 2050. The outlook forecasts oil retaining the largest share in the global energy mix, meeting about 27% of energy needs.

OPEC divides its outlook into short- and long-term pieces. By 2029, global oil demand is projected to reach 112.3 MMbbl/d. Longer term, demand increases by 18 MMbbl/d from 2023 levels and reaches 120 MMbbl/d in 2050, Benyoucef said.

OPEC’s report, released on Oct. 31, stands in sharp contrast to the International Energy Agency’s June forecast, which reported that oil demand would hit a high of 114 MMbbl/d in 2030 and decline thereafter.

“There [are] no signs of global demand peaking anytime soon and continued adequate investments are needed to meet further demand,” Benyoucef, the editor of Outlook 2024, said. “Calls that oil demand has peaked have been proven wrong.

“On the contrary, oil demand continues to expand and is projected to maintain robust growth in the medium and long term. India, Asia, Africa and the Middle East remain the key oil demand growth centers… India alone provides 50% incremental oil demand. Petrochemicals, road transport and aviation drive growth.”

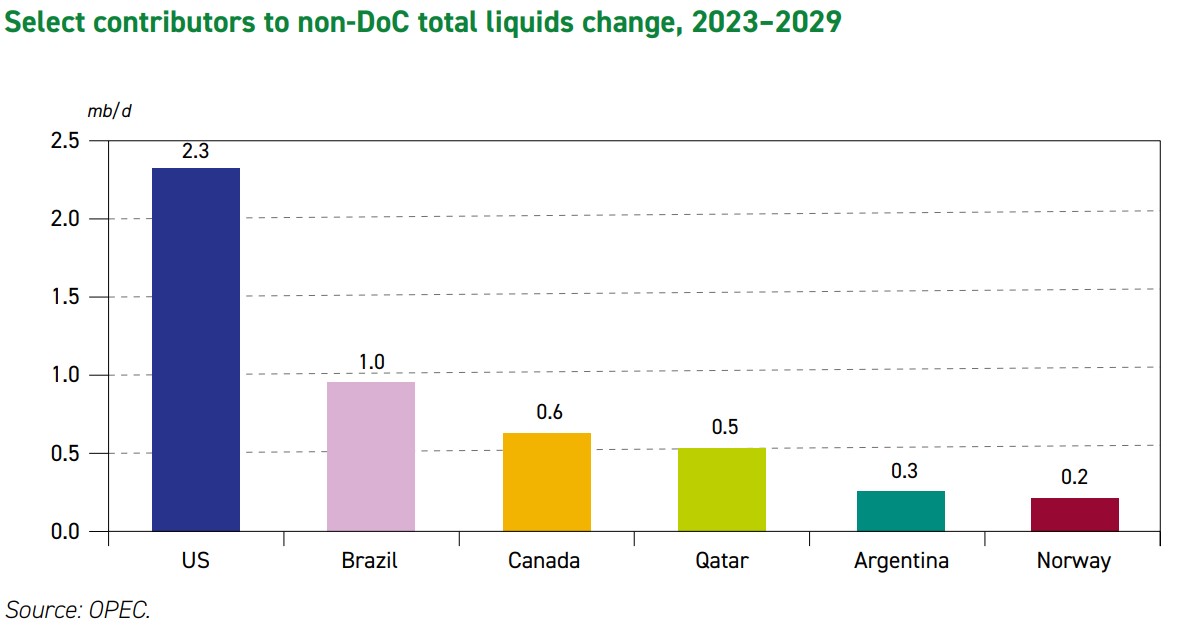

Through 2030, the U.S. will lead growth in non-OPEC+ countries, followed by Brazil (1 MMbbl/d), Canada (600,000 bbl/d), Qatar (500,000 bbl/d) as well as Argentina and Norway.

While shale reservoirs have potential for oil recovery elsewhere in the world, Benyoucef said the bulk of tight oil production is and will remain in the U.S.

“For the shale, the share including crude and NGLs is around 15 million barrels a day and could reach almost 17 million barrels a day,” he said. That will peak and stay at current levels by 2050.

In other regions, including Argentina, Canada and China, “the huge potential is there, and they have not been explored yet,” he said.

While oil gains 17 MMboe/d, Benyoucef said that solar, wind and natural gas will add energy at the fastest clip. Renewables will have the largest growth, adding 43 MMboe/d in the next quarter century.

However, renewables currently represent only about 3% of the global energy mix, and even with meteoric growth, will account for about 14% by 2050, according to the outlook.

Trailing renewables, natural gas growth is projected to grow by 21 MMboe/d between 2023 and 2050. Coal, however, will decrease by 29 MMboe/d due to what Benyoucef called “restrictive policies,” as well as a push for renewable energy.

Part of the assumptions underlying OPEC’s forecast include pushback to “overly ambitious energy policies, even while many targets remain in place” from companies that produce hydrocarbons.

The report also cites a global population that will grow by about 1.6 billion people to 9.7 billion in 2050. OPEC sees global GDP nearly doubling to $358 trillion in 2050 from $165 trillion in 2023. Growth is expected to average 2.9% per annum over the entire forecast period. The report also recognizes incremental progress in technological breakthroughs, but assumes nothing sudden.

“If we put this in the context, if you see the [past] 25 years and historical data, the demand growth was more than 1 million barrels a day” each year, Benyoucef said.

Looking forward 25 years, the outlook sees oil demand slowing to a little more than half, or 600,000 bbl/d.

“If you compare two periods, we halve the growth, whether we are optimistic or pessimistic,” he said.

The tab for oil-related investments is not cheap. Benyoucef said that total cumulative required capital to meet demand from 2024 to 2025 is estimated at $17.4 trillion, or about $640 billion per annum. More than 81% of the capital requirements, about $14.2 trillion, are needed for upstream oil and gas operations. Downstream investments needs are estimated at $1.9 trillion and midstream at $1.3 trillion.

“The problem, the issue is … where we can get this investment?” he said. He cited the reluctance to invest over ESG and other environmental concerns, but warned that a lack of money “could create an issue or energy crisis if you don't invest now in oil and gas.”

In the U.S., where the oil and gas industry considers itself under siege by the Biden administration, OPEC noted that U.S. liquids grew by 1.6 MMbbl/d in 2023. That’s on par with the 2017 to 2019 pre-pandemic period.

However, OPEC does see Democratic policies to likely raise costs for upstream companies and damage the sector. That includes the administration’s increase of royalty rates on federal lands to 16.67% from 12.5%. About 10% of total U.S. oil and gas volumes in the U.S. are produced on public lands. Along with higher bond requirements, the polices could discourage long-term investment, particularly in higher-cost and more mature areas onshore and offshore.

That paints a worrying picture.

Benyoucef cited a scenario OPEC published a few weeks ago on social media. “We said if you don't invest now we can lose more than 40 million barrels a day in the upcoming 10 years,” he said.

“That means the supply will reach around 70 million barrels [per] day by 2035 if we don't invest now, and we're not very aggressive on the decline in the shale [production],” he said. “Imagine, how can we fill this gap between the supply and demand? And for that reason, OPEC, we always ask investors to invest long in oil and gas.”

Recommended Reading

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

New Jersey’s HYLAN Premiers Gas, Pipeline Division

2025-03-05 - HYLAN’s gas and pipeline division will offer services such as maintenance, construction, horizontal drilling and hydrostatic testing for operations across the Lower 48

Exclusive: Metal Tariffs Unlikely to Disrupt Lower 48 Supply Chain

2025-03-25 - With tariffs discussions creating uncertainty in the energy sector, Luca Zanotti, Tenaris’ U.S. president, said he sees minimal impact with tariffs on oil country tubular goods, in this Hart Energy exclusive interview.

BP Earns Approval to Redevelop Oil Fields in Northern Iraq

2025-03-27 - The agreement with Iraq’s government is for an initial phase that includes oil and gas production of more than 3 Bboe, BP stated.

BlackRock’s Fink Calls for Reliable US Power Grid—Now

2025-03-31 - “That starts with fixing the slow, broken permitting processes in the U.S. and Europe,” Larry Fink, the co-founder, chairman and CEO of $12 trillion investment-management firm BlackRock Inc., told shareholders March 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.