(Shutterstock, HartEnergy.com)

At the most recent OPEC and non-OPEC ministerial meetings at the end of June, OPEC reiterated that its goal is to return Organisation for Economic Co-operation and Development (OECD) OECD crude stock levels to the five-year average seen in 2015.

The 2015 average was specifically cited during the press conference because subsequent years suffer from bloated stock levels and thus provide too high a baseline. However, Stratas Advisors’ most recent forecast of OECD stock levels, released as part of the Short Term Outlook Service’s latest Crude Oil Outlook shows that this may be an impossible target to meet before March 2020, raising the question of what happens next.

- Stratas Advisors forecasts OECD stocks will be ~105 million barrels above the 2015 five-year average level in March 2020;

- This disparity shrinks significantly in April 2020 due to a jump in the historic average level that current inventories would be compared against (March 2010-2014 average = 985 million barrels April 2010-2014 average = 1,000 million barrels).

- If OPEC remains significantly far from its target, the likelihood rises of another continuation in the production agreement or a change to the stated goal.

OPEC claims (correctly) that crude stocks were inflated by several years of oversupply, and measuring against today’s five-year average does not paint an accurate picture. Measured against today’s five-year average, total OECD crude stocks are quite healthy, averaging 2.6 million barrels below the average May stock level seen in 2014-2018 (also referred to as the “current five-year average”).

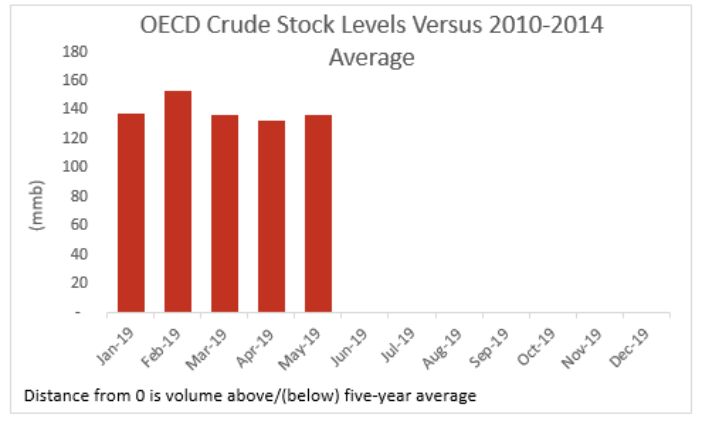

However, change the timeline and a very different picture emerges. And it is this picture that OPEC is concerned with. Looking at the chart below you can see that OECD crude stocks today are still well above the 2015 five-year average, the average inventory size in a given month from 2010 to 2014. In fact, crude stocks are 136 million barrels above the 2015 level.

This would imply that OPEC has quite a bit of work to do. In our latest Quarterly Crude Oil Outlook, we released updated expectations for OECD crude stock movements. Below, we append that forecast to current stock levels to see if OPEC will be successful before their self-imposed March 2020 deadline in hitting their target of parity with 2015 average stock levels.

Recommended Reading

ConocoPhillips Shopping Marathon’s Anadarko Assets for $1B— Source

2025-04-02 - ConocoPhillips is marketing Anadarko Basin assets it picked up through a $22.5 billion acquisition of Marathon Oil last year, Hart Energy has learned.

NOG Spends $67MM on Midland Bolt-On, Ground Game M&A

2025-02-13 - Non-operated specialist Northern Oil & Gas (NOG) is growing in the Midland Basin with a $40 million bolt-on acquisition.

Whitecap, Veren Enter $10.4B Merger of Western Canadian Basin E&Ps

2025-03-10 - Whitecap Resources and Veren Inc. will create the largest light oil and condensate producer in the Alberta Montney and Kaybob Duvernay in an all-share combination valued at CA$15 billion (US$10.43 billion).

Report: Diamondback in Talks to Buy Double Eagle IV for ~$5B

2025-02-14 - Diamondback Energy is reportedly in talks to potentially buy fellow Permian producer Double Eagle IV. A deal could be valued at over $5 billion.

Exclusive: Camino Steps Back from $2B Midcon Sale Process—Sources

2025-04-08 - NGP-backed Camino Natural Resources, which had reportedly been seeking a $2 billion sale of its Midcontinent assets, has paused marketing the company, sources told Hart Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.