Cash from operations from 21 publicly listed shale drillers stood near record levels in the third quarter at about $13 billion, according to consultancy Rystad Energy. (Source: Hart Energy)

U.S. shale oil producers spent much of last year holding back on new supply despite a 54% rally in crude prices.

The restraint was understandable. The onset of the coronavirus pandemic in 2020 crushed demand for oil and share prices of drillers big and small suffered. To win back investors listed drillers focused on strengthening their balance sheets and boosting shareholder returns.

That discipline is now being put to the test. WTI, the U.S. benchmark, topped $90/bbl for the first time since 2014 last week.

With the price needed to break even on a new well in the Permian Basin at about $43/bbl to $56/bbl (and much less for existing wells), there is more temptation to chase greater cash flow by increasing output. Even the largest explorers, such as Exxon Mobil Corp. and Chevron Corp., last week pointed to the production growth to come from their acreage in the southwestern Permian shale region.

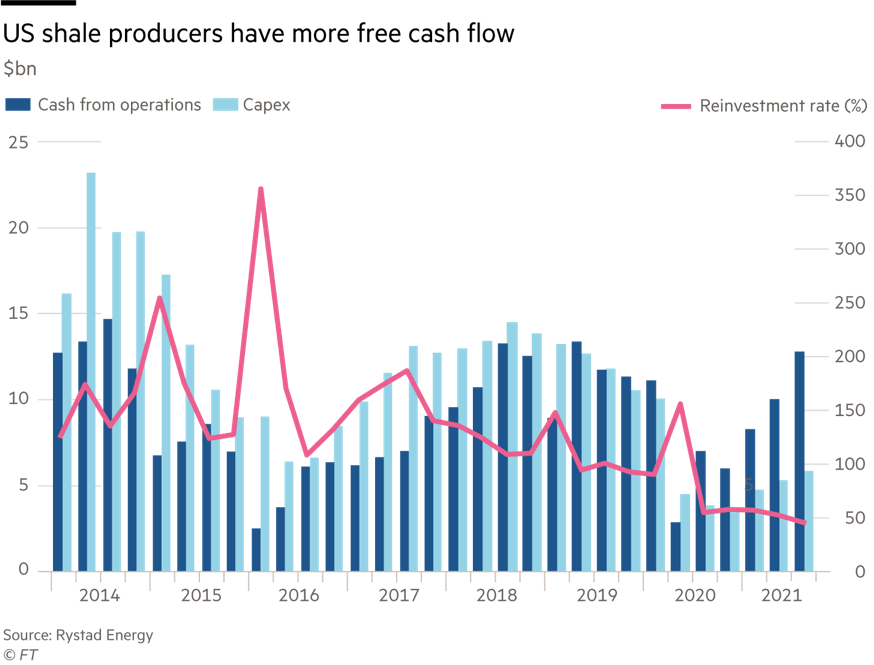

Most producers can afford to drill and keep investors happy with higher payouts. Cash from operations from 21 publicly listed shale drillers stood at about $13 billion, in the third quarter of 2021, according to consultancy Rystad Energy. That approaches record levels. However, this group spent only $5.9 billion in capex during the period. That is less than a quarter of their levels at the height of the boom. For the nine months, the free cash flow looks the highest since at least 2013.

Shale producers account for about 70% of U.S. oil output. The latter, at about 11.5 million bbl/d, lies well below the 13 million bbl/d high reached in early 2020. Much of that gap should close in the next year or so on current prices, says Rystad.

The danger comes if shale producers increase output too quickly. But drillers look unlikely to return to the days of 30% annual production growth. Rising labor costs and the risk of OPEC retaliating, given its sufficient spare capacity, should balance any runaway optimism.

Energy stocks were the best performers on the S&P 500 in January. They remain a good bet if higher oil prices help deliver healthy payouts to shareholders.

About the author: Lex is a premium financial commentary service from the Financial Times.

Recommended Reading

Kissler: Gas Producers Should Still Hedge on Price

2025-03-27 - Recent price jumps and rising demand don’t negate the need to protect against future drops.

Plains All American President Pefanis to Retire

2025-03-27 - Current CEO Willie Chiang will take over as the next president of Plains All American Pipeline following co-founder Harry Pefanis’ retirement.

Japan’s JAPEX Backs Former TreadStone Execs’ New E&P Peoria

2025-03-26 - Japanese firm JAPEX U.S. Corp. made an equity investment in Peoria Resources, led by former executives from TreadStone Energy Partners.

CPP Wants to Invest Another $12.5B into Oil, Gas

2025-03-26 - The Canada Pension Plan’s CPP Investments is looking for more oil and gas stories—in addition to renewable and other energies.

Shell Raises Shareholder Distributions and LNG Sales Target, Trims Spending

2025-03-25 - Shell trimmed its annual investment budget to a $20 billion to $22 billion range through 2028 after spending $21.1 billion last year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.