Ovintiv will retain the ownership of horizontal wellbores and development rights on the leases. (Source: Shutterstock)

Ovintiv Inc. is looking to sell some operated assets in the Permian Basin as rumors swirl on its next buy.

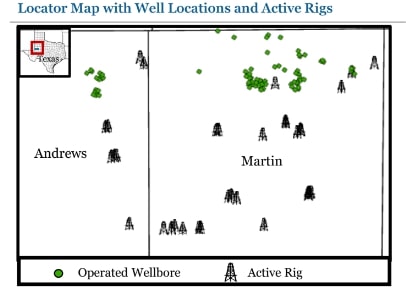

The Denver-based E&P has retained Eagle River Energy Advisors LLC to market a portion of its operated, oil-weighted legacy assets in Andrews and Martin counties, Texas.

The opportunity, for wellbore-only interests, includes 79 vertical wellbores—18 in Andrews County and 61 in Martin County, according to Eagle River’s marketing materials. The daily net production in July was 121 boe/d (99% oil).

The assets, which include production in the Wolfcamp, Spraberry and Dean formations, have proved developed producing (PDP) net reserves of approximately 303,000 boe (96% oil) and a PDP production decline of approximately 11%, Eagle River said.

Average working interest is 93.8% and net revenue interest is 71.8%. The assets’ PDP PV-10 value is estimated at $3.3 million and the next twelve months of cash flow are estimated at approximately $800,000, Eagle River said.

Ovintiv will retain the ownership of horizontal wellbores and development rights on the leases.

The marketed sale comes amid whispers of Ovintiv potentially acquiring Double Eagle IV’s Midland Basin footprint in a deal upwards of $6 billion, according to Reuters estimates.

In August, Bloomberg reported that Ovintiv was thinking about divesting some assets in the Uinta Basin that could go for an asking price of $2 billion. At the time, TD Cowen analyst Gabe Daoud Jr. said an asset sale’s proceeds could be put towards funding a large acquisition such as Double Eagle, or simply to increase the company’s return of capital.

RELATED

Why Buying Double Eagle Does (and Doesn’t) Make Sense for Ovintiv

Access to Ovintiv’s virtual data room opens up Oct. 7. Bids for the assets are due Nov. 4 at 4:00 p.m. MT.

Recommended Reading

Innovex, SLB OneSubsea Reach Supply Agreement for Wellhead Systems

2025-02-24 - SLB Onesubsea will supply Innovex subsea wellhead systems, building on the companies’ long-standing partnership.

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

How DeepSeek Made Jevons Trend Again

2025-03-25 - As tech and energy investors began scrambling to revise stock valuations after the news broke, Microsoft Corp.’s CEO called it before markets open: “Jevons paradox strikes again!”

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.