Occidental sold non-core assets in Wyoming’s Powder River Basin in the third quarter to reduce debt from a $12 billion Permian acquisition this summer. (Source: Shutterstock.com)

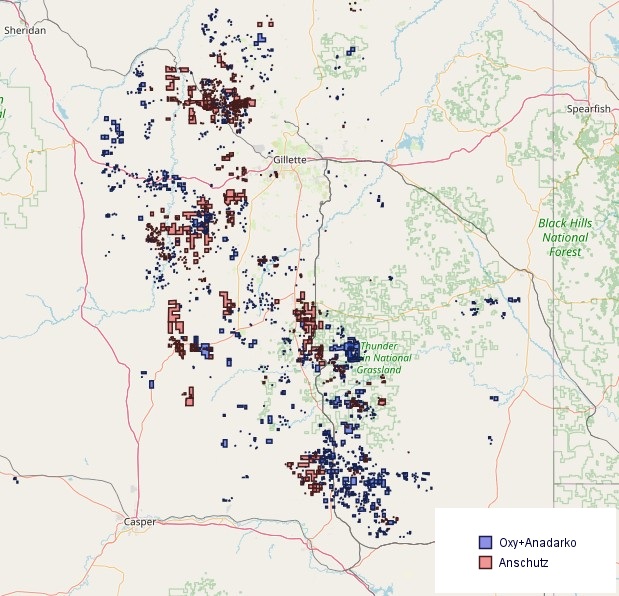

Occidental Petroleum sold northern Powder River Basin (PRB) assets to Anschutz Exploration last quarter, CEO Vicki Hollub confirmed.

Occidental picked up its holding in Wyoming’s Powder River Basin through the blockbuster acquisition of Anadarko Petroleum in 2019.

“But we saw early on that the southern part of the Powder River Basin was by far the most contiguous and the part that we felt like we could get the most value out of,” Hollub said Nov. 13 during the company’s third-quarter earnings call.

Occidental sold its assets in the northern part of the PRB to Anschutz “because it’s in a better area for them to be able to develop,” Hollub said.

Occidental held approximately 100,000 net acres in the PRB at the end of the third quarter, down from the 300,000 listed in second-quarter investor materials.

Joe DeDominic, Anschutz Exploration president, told Hart Energy this week, “We did acquire a portion of Oxy’s assets in the Powder River Basin, with Oxy retaining their core Converse County position.”

In a statement, Occidental said it retained its core PRB assets in Converse and Niobrara counties, Wyoming.

Occidental is working to reduce debt after closing a $12 billion acquisition of private Permian Basin producer CrownRock LP.

During the third quarter, the company also sold Barilla Draw assets in the southern Delaware Basin to Permian Resources for about $818 million.

Company affiliates also sold 19.5 million common units of Western Midstream Partners for $700 million this summer.

Occidental repaid $4 billion of debt in the third quarter, outpacing its previous expectations of repaying debt of $3.1 billion by quarter-end, “as we believe Oxy sold some incremental non-core acreage in the Powder River Basin,” J.P. Morgan Securities analyst Arun Jayaram said in a Nov. 12 report.

The company aims to repay around $4.5 billion of debt within 12 months of closing the CrownRock deal.

Occidental remains committed to hitting its medium-term principal debt target of $15 billion, Hollub said. The company had long-term net debt of $25.5 billion as of the end of the third quarter.

RELATED

Oxy Divests Some Powder River Basin Assets to Anschutz

Permian power-up

Occidental’s oil and gas segment set a new company record for the highest quarterly U.S. production in company history.

U.S. production averaged 1.18 MMboe/d during the third quarter, up from 1.03 MMboe/d the previous quarter.

The production outperformance was primarily driven by strong new well performance and higher uptime in the Permian, Hollub said.

“Our Midland Basin teams excelled, surpassing production guidance in our recently acquired CrownRock assets and delivering the highest quarterly production in over five years across our legacy Midland Basin assets,” she said.

Domestic production was led by the Permian, which averaged 729,000 boe/d.

Production from the Rockies, including the PRB, and Oxy’s other domestic onshore holdings averaged 321,000 boe/d.

Gulf of Mexico output averaged 136,000 boe/d—slightly below the company’s guidance due to weather-related impacts.

Oxy’s total companywide production averaged 1.41 MMboe/d during the quarter.

RELATED

Oxy’s Hollub Drills Down on CrownRock Deal, More M&A, Net-zero Oil

Recommended Reading

BKV Appoints Dilanka Seimon to New Chief Commercial Officer Position

2025-04-03 - BKV Corp. has created a new chief commercial officer position and placed industry veteran Dilanka Seimon in the role.

NGP Backs Wing Resources with $100MM to Buy Permian Mineral Interests

2025-04-02 - Wing Resources VIII, which is backed by NGP Royalty Partners III, will focus on acquiring “high-quality” mineral and royalty interests across the Permian Basin, the company said.

Exxon Mobil Vice President Karen McKee to Retire After 34 Years

2025-04-02 - Matt Crocker will succeed Karen T. McKee as vice president of Exxon Mobil and president of its product solutions company.

Double Eagle Team Re-Ups in Permian, Backed by EnCap’s $2.5B

2025-04-02 - The fifth iterations of Double Eagle Energy and its minerals subsidiary, Tumbleweed Royalty, have received a $2.5 billion equity commitment from EnCap Investments LP—the day the E&P finalized a $4.1 billion sale to Diamondback Energy.

Waterous Raises $1B PE Fund for Canadian Oil, Gas Investments

2025-04-01 - Waterous Energy Fund (WEF) raised US$1 billion for its third fund and backed oil sands producer Greenfire Resources.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.