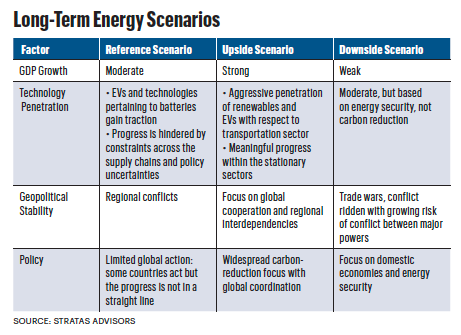

Several years ago, Stratas Advisors developed three long-term energy scenarios covering the period through 2050:

Scenario 1: Muddling Through One “Crisis” After Another

Scenario 2: Shifting to a New Global Framework to Facilitate Energy Transition

Scenario 3: Breaking Down into Multi-polarization with a Focus on Energy Security

The first scenario describes the world through the lens of reality and pragmatism in which policymakers need to strike the appropriate balance between basic societal and economic needs and more ideological objectives within the context of addressing short-term disruptions and crises. Since the development of the scenarios, the first scenario most closely resembles our reference scenario that is used as the basis for our forecasted supply, demand and prices.

The alternative scenarios, in simple terms, can be equated with a more optimistic view of the world (Scenario 2) and a more pessimistic view of the world (Scenario 3).

The macro-level inputs, along with the associated supply and demand fundamentals, lead to dramatically different scenarios with each scenario encompassing unique risks, challenges and opportunities.

Three scenarios

The first scenario, “Muddling Through One ‘Crisis’ After Another,” presents a future in which the energy transition is happening but progress ebbs and flows with the potential for shifts in policies. Within this scenario, oil prices remain relatively high until oil demand finally peaks later in the forecast period. This dynamic creates strategic ambiguity for decision-makers in the energy sector.

The second scenario, “Shifting to a New Global Framework to Facilitate Energy Transition,” presents a future in which there is global buy-in and cooperation in pursuing carbon reduction and energy transition. Within this scenario, oil prices can move higher during the earlier part of the forecast period because of tighter supply/demand conditions resulting from reduced oil-related investment coupled with lagging availability of low-carbon alternatives.

The third scenario, “Breaking Down into Multi-Polarization with a Focus on Energy Security,” presents a future that is a return to a global dynamic that is more akin to the 1960s and 1970s when there was less integration, more economic friction and more potential for conflict, including conflict between the major powers.

Within this scenario, oil prices bounce between an upper band and lower band of prices. The future described by this scenario can present the most significant challenges, given that there will be the need to manage the non-market risks more proactively and ensure appropriate level of strategic and operational flexibility to react to “shocks” and the resulting aftermath.

Multitude of challenges

Based on the last couple of years—and recent events—the third scenario has the potential to be a more likely description of the future than the first scenario and certainly more likely than the second scenario. There are ongoing regional conflicts with the risk of becoming broader in nature, including geographically, as well as involving the major powers in direct conflict. There is also the threat of trade wars that will affect economic growth and market conditions.

While it is not a given that this pessimistic scenario best represents the future, it seems that an inflection point is close to being reached. Additionally, each region and major economy are facing not only short-term challenges, but also long-term challenges that are structural in nature and with the potential to have substantial consequences that only add to the uncertainty about the future.

Recommended Reading

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Alliance Resource Partners Adds More Mineral Interests in 4Q

2025-02-05 - Alliance Resource Partners closed on $9.6 million in acquisitions in the fourth quarter, adding to a portfolio of nearly 70,000 net royalty acres that are majority centered in the Midland and Delaware basins.

Chevron Targets Up to $8B in Free Cash Flow Growth Next Year, CEO Says

2025-01-08 - The No. 2 U.S. oil producer expects results to benefit from the start of new or expanded oil production projects in Kazakhstan, U.S. shale and the offshore U.S. Gulf of Mexico.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.