Private equity firm OneRock Energy is adding a sizable position in the Powder River Basin in a deal to buy E&P Northwoods Energy.

Houston-based OneRock Energy Holdings LLC agreed to acquire Northwoods Management Co. and certain related entities for an undisclosed sum, the firm announced in a June 28 news release. Northwoods is backed by investment firm Apollo Global Management.

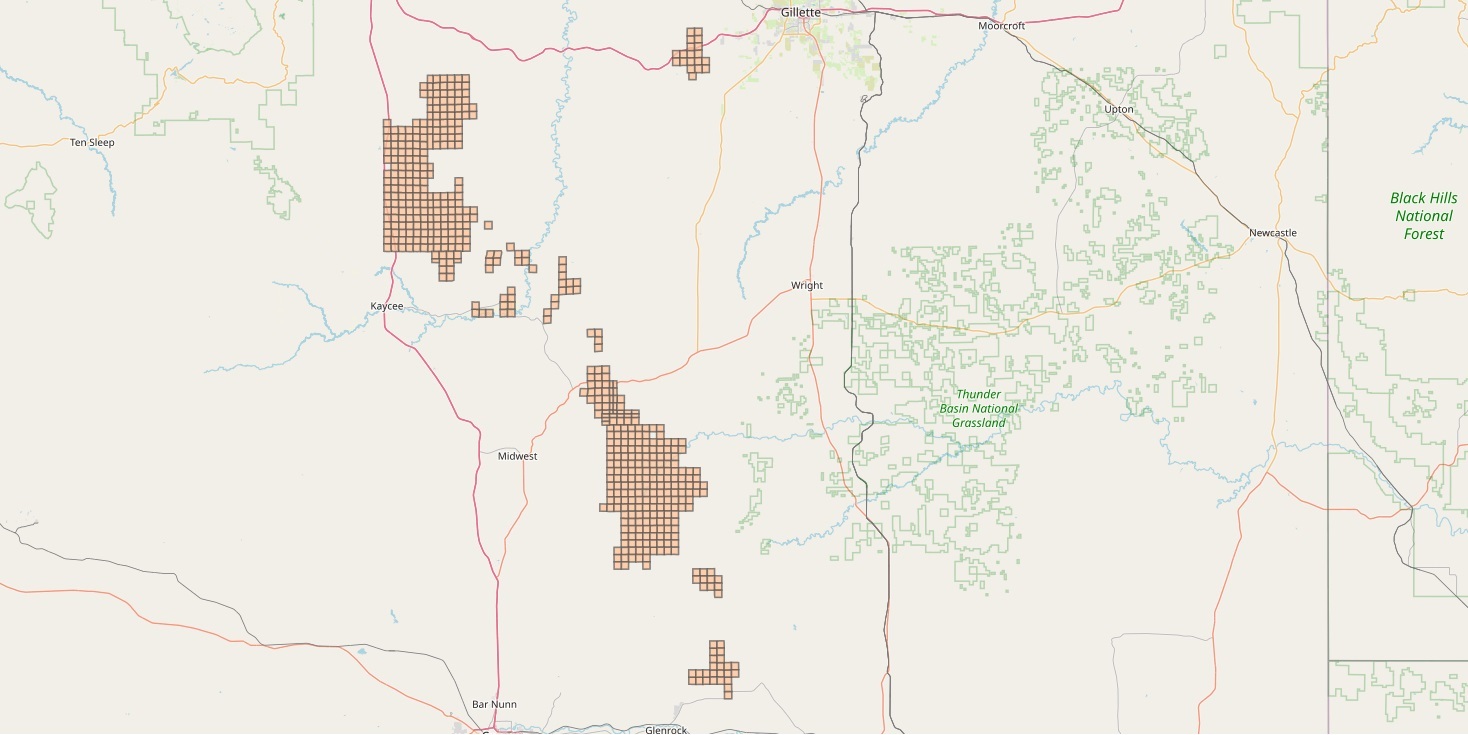

Once closed, the Northwoods acquisition will add more than 160,000 largely contiguous net acres of leaseholds interests spanning Converse, Campbell and Johnson counties, Wyoming.

OneRock, which serves as the upstream investment arm of Houston-based energy investment firm Pan Capital Management, said the acquired assets include average production of approximately 5,000 boe/d.

RELATED

Powder River Basin: In the Zone

Daniel Fan, partner and head of North American E&P investments at Pan Capital Management, said the firm expects to leverage the OneRock platform to acquire more oil and gas assets for future expansion.

“We consider this acquisition to be a pivotal move for OneRock, solidifying our position with a robust presence in resource-rich unconventional plays,” Fan said in the release. “It represents a crucial component of our growth strategy into the E&P business, while concurrently expanding our commodity optionality and seamlessly aligning with Pan Management’s overarching investment strategy.”

The deal, subject to customary closing conditions, is expected to close during the third quarter.

OneRock was represented by Willkie Farr & Gallagher LLP as legal adviser.

With Apollo’s financial backing, Northwoods added more than 112,000 acres in the Powder River Basin through a $500 million acquisition from SM Energy Co. in 2018. The deal represented around 80% of SM’s Powder River acreage at the time.

RELATED

SM Energy’s Powder River Basin Bulk Sale Captures Premium Price

Recommended Reading

Lion Equity Partners Buys Global Compression from Warren Equipment

2025-01-09 - Private equity firm Lion Equity Partners has acquired Warren Equipment Co.’s Global Compression Services business.

Chevron Names Laura Lane as VP, Chief Corporate Affairs Officer

2025-01-13 - Laura Lane will succeed Al Williams in overseeing Chevron Corp.’s government affairs, communication and social investment activities.

Berry Announces Jeff Magids as New CFO

2025-01-21 - Jeff Magids was appointed as Berry Corp.’s new CFO on Jan. 21 in replacement of Mike Helm, effective immediately.

Plains All American Prices First M&A Bond of Year

2025-01-13 - U.S. integrated midstream infrastructure company Plains All American Pipeline on Jan. 13 priced a $1 billion investment-grade bond offering, the year's first to finance an acquisition.

J. Douglas Schick Succeeds PEDEVCO Majority Owner Simon Kukes as CEO

2024-12-12 - Simon G. Kukes, who took over PEDEVCO in 2018, said the company has since worked toward entering joint development agreements in the Permian and Denver-Julesburg basins.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.