(Source: Shutterstock, Pembina)

Canada’s Pembina Pipeline Corp. and the Haisla Nation, partners in Cedar LNG Partners LP, have taken a $4 billion (CA$5.4 billion) final investment decision (FID) on their 3.3-million tonnes per annum (mtpa) Cedar LNG project.

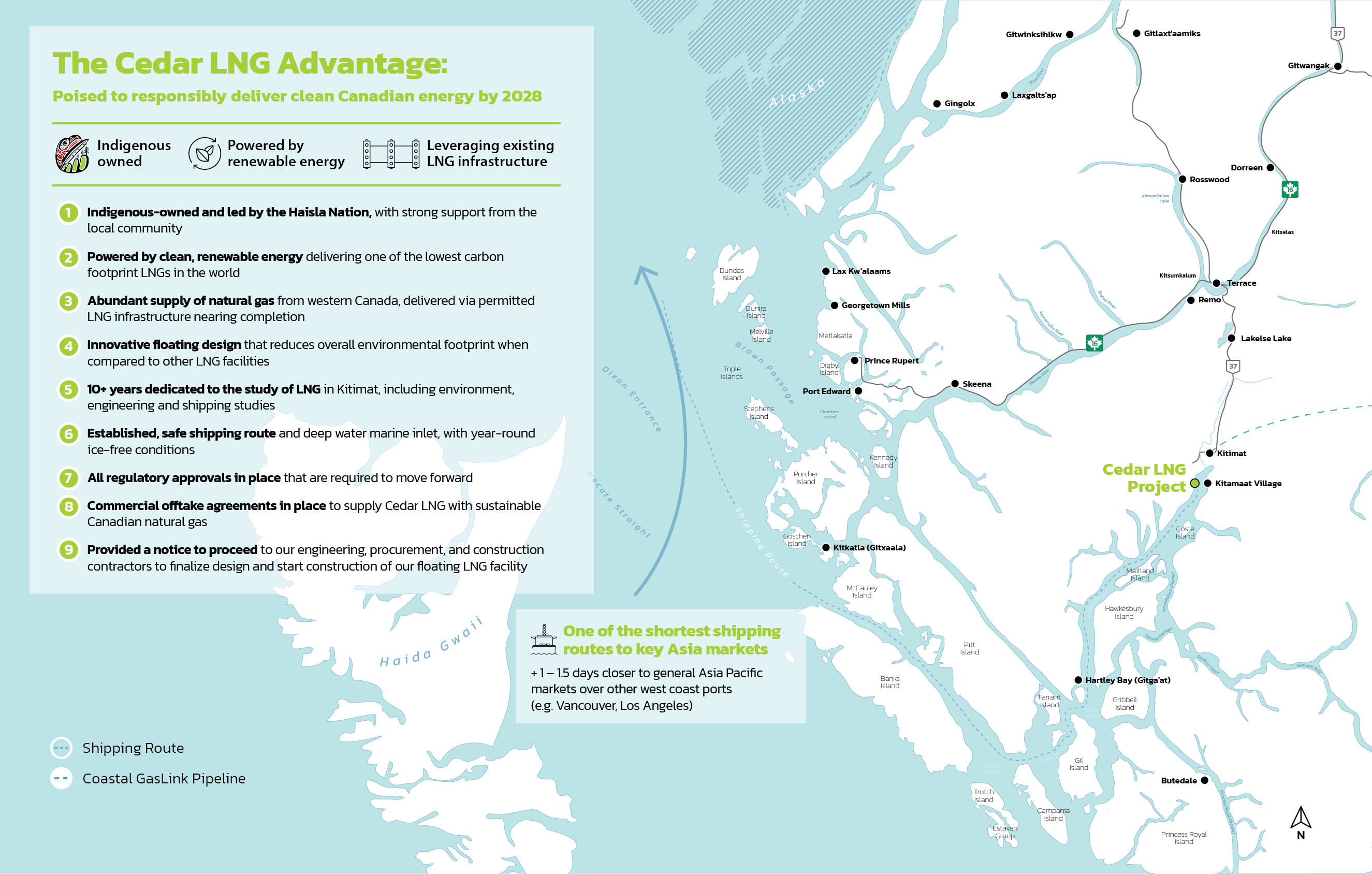

Cedar LNG is majority-owned by the Haisla Nation by 50.1%. Pembina holds 49.9% ownership. The floating LNG (FLNG) project, located on Canada’s West Coast, is expected to start operations in late 2028.

The total estimated cost of Cedar LNG includes capital costs of $3.4 billion, of which 70% is under a fixed-price, lump-sum agreement. The other $0.6 million includes interest during construction and transaction costs, Pembina said June 25 in a press release.

Cedar LNG secured 20-year take-or-pay liquefaction tolling services agreements with ARC Resources Ltd. and Pembina for 1.5 mtpa each. Commercial discussions are ongoing with numerous other prospective customers for Pembina to assign its contracted capacity to a third-party, the company said in the release.

Cedar LNG is located in the traditional territory of the Haisla Nation. The facility’s location on the West Coast provides one of the shortest shipping routes to key Asian markets, according to Pembina.

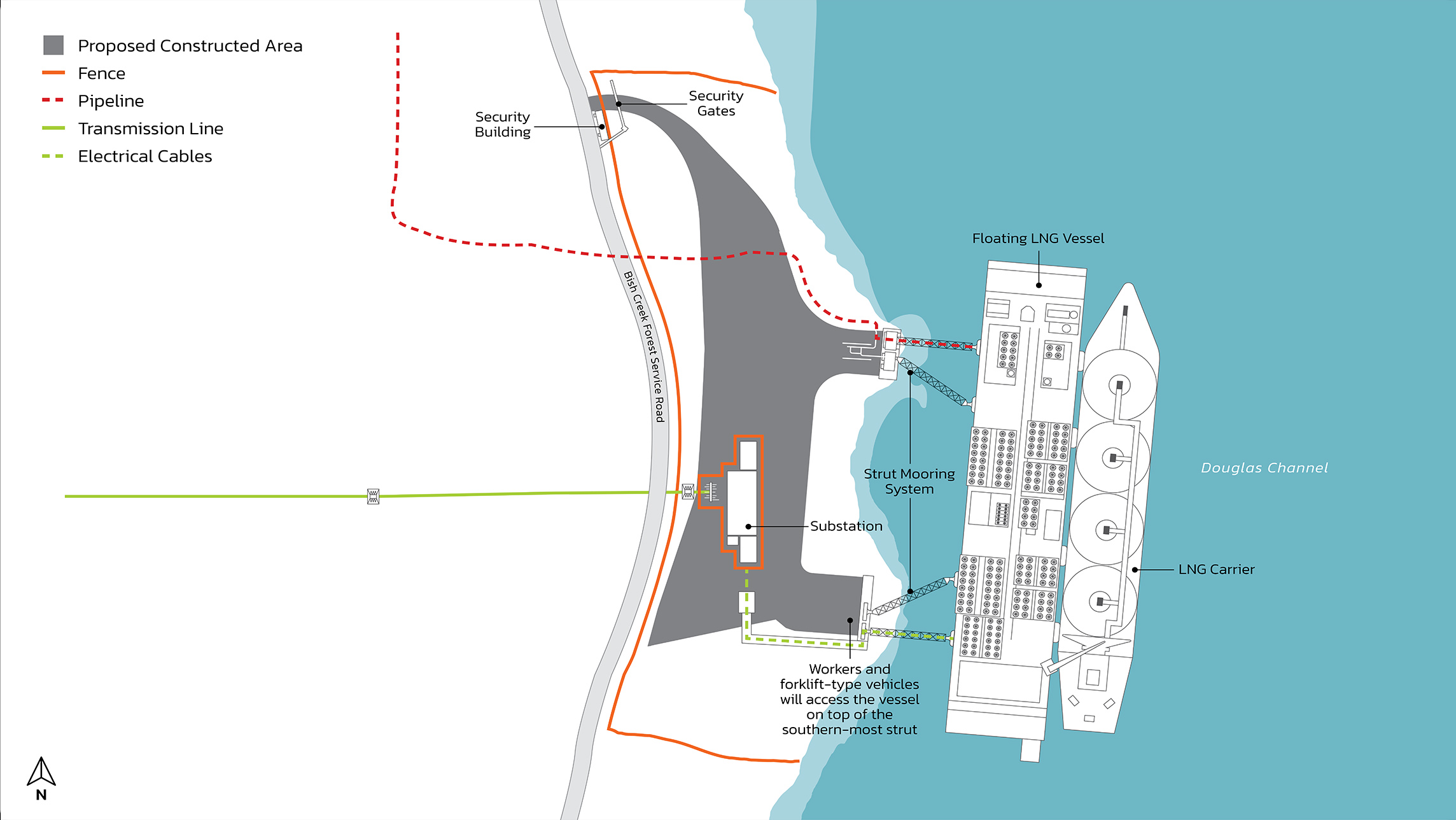

The FLNG facility is being designed and constructed by Samsung Heavy Industries and Black & Veatch. The facility will be powered by renewable electricity from British Columbia (BC) Hydro, making it one of the lowest emitting LNG facilities in the world, Pembina said in the release.

Cedar LNG will leverage Canada’s abundant gas supply to deliver low-carbon energy to global markets, Pembina said. The project will also leverage existing LNG infrastructure, including the Coastal GasLink pipeline, a deepwater port, roads and other infrastructure.

Under a long-term transportation agreement with Coastal GasLink Pipeline Ltd. Partnership, the Cedar LNG facility will receive 400 MMcf/d of Canadian natural gas via the Coastal GasLink pipeline.

“We have created a model for how sustainable energy development should be done, with Indigenous Nations as owners, balancing environmental interests with global demand for cleaner energy," Crystal Smith, Chief Councillor of the Haisla Nation said in the release.

Cedar LNG financing

Cedar LNG is expected to be funded with asset-level debt financing for 60% of the project cost. Cedar LNG has secured a construction term loan with a syndicate of banks, Pembina said in the release. The other 40% is expected to be financed through equity contributions from both partners.

The Haisla Nation obtained committed capital through the First Nations Finance Authority to fund its 20% equity contribution.

For its part, Pembina expects its equity contribution will be funded from cash flow from operations. Pembina doesn’t foresee any material changes to its previously disclosed 2024 Cedar LNG equity contributions, it said in the release.

Prior to taking FID, Pembina was required to provide financial assurances to advance project-related upstream infrastructure projects. Required financial assurances will be transferred to Cedar LNG, which has secured a letter of credit facility for ongoing funding.

Cedar LNG has received strong support from domestic and international capital providers on the positive merits of the project, according to Pembina.

Recommended Reading

Gas & Midstream Weekly: Cushing Crude Storage Levels Near All-Time Lows

2025-01-16 - Low levels of crude in storage could cause problems across the U.S. supply chain; a "gas super-cycle" may be coming; and Liberty Energy's Chris Wright testifies to the Senate.

Shale Outlook: Power Demand Drives Lower 48 Midstream Expansions

2025-01-10 - Rising electrical demand may finally push natural gas demand to catch up with production.

Q&A: Crescent Midstream Charts CCS Course with $1B Project

2025-02-05 - CEO Jerry Ashcroft discusses the carbon capture and storage landscape and how the company is evolving.

Kinder Morgan to Build $1.7B Texas Pipeline to Serve LNG Sector

2025-01-22 - Kinder Morgan said the 216-mile project will originate in Katy, Texas, and move gas volumes to the Gulf Coast’s LNG and industrial corridor beginning in 2027.

ONEOK Names Two New Executive Leaders Following Asset Sale

2025-01-06 - Randy Lentz and Sheridan Swords are both stepping into newly created executive leadership roles for ONEOK.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.