Mexico expects to lessen its foreign fuel dependence, including its reliance on U.S. fuel, with the completion of the $16-billion Dos Bocas refinery. (Source: Shutterstock)

MEXICO CITY, Mexico—Mexico’s President Andrés Manuel López Obrador said a drastic reduction in fuel stolen from state-owned Petróleos Mexicanos (Pemex) has allowed his administration to finance the construction of the country’s new Olmeca refinery in Dos Bocas, as well as fund the 2022 purchase of the Deer Park refinery in the U.S.

“What we saved is [more or less] what the Dos Bocas refinery cost, do your calculations,” López Obrador, also known as AMLO, said July 11 during his daily “mañanera” press conference with local Mexican media outlets.

Pemex expects to complete construction of its 340,000 bbl/d Dos Bocas refinery in 2025. Once up and running, it is expected to significantly reduce Mexico’s dependence on fuel from the U.S., AMLO said.

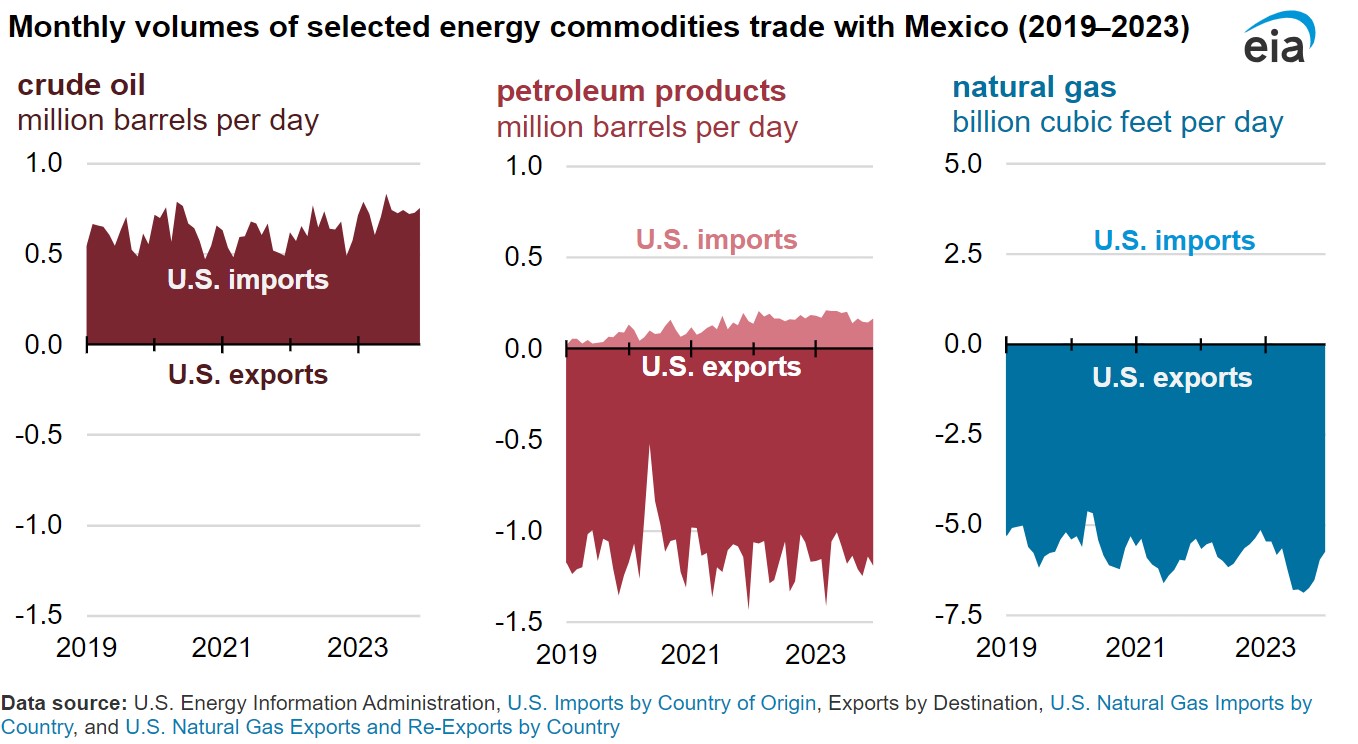

In 2023, Mexico was the largest export market for U.S. petroleum products.

Mexico has an aging refinery system and struggles to maintain the output needed to satisfy its domestic petroleum product demand, according to a July 15 report by the U.S. Energy Information Administration (EIA).

As a result, Mexico imports U.S. petroleum products such as gasoline, diesel fuel and propane.

Despite increased volumes of energy trade between the U.S. and Mexico, the value of inflation-adjusted U.S. energy exports to Mexico declined by 19% in 2023, EIA said.

All energy trade between the two nations decreased nearly 15% to $66.5 billion in 2023 compared to $77.8 billion the year before, according to EIA figures adjusted for inflation.

“Lower fuel prices more than offset the increase in the volume of energy trade between the two countries. Energy trade value represents the total value of energy imports and exports between the two countries. It is influenced by both commodity prices and the volume of commodities imported and exported,” the EIA reported.

In 2023, the U.S. imported more crude oil from Mexico and paid less per barrel than in 2022, the EIA said. U.S. crude oil imports from Mexico averaged 733,000 bbl/d, 15% more than in 2022.

Lately, Mexico has had more oil to export from cracking down on fuel thefts.

Between Dec. 1, 2018 and June 30, 2024, thefts fell 94.2% AMLO said, allowing Mexico to recoup funds destined for the two refineries.

During this time period, AMLO said his administration recouped $373.7 trillion pesos (US$18.8 billion). In comparison, he said the cost for Dos Bocas—located in Paraíso, Tabasco—was $16 billion. AMLO said some of the extra funds were also used in connection with the acquisition of Houston’s Deer Park refinery.

Dos Bocas will produce 170,000 bbl/d of gasoline and 120,000 bbl/d of ultra-low sulfur diesel, according to details provided by heavily indebted Pemex on its website.

“The Dos Bocas refinery, which is producing and [at peak production] will provide 20% of all the gasoline that we consume in the country,” AMLO said.

“Huachicol,” as fuel theft is known in Mexico, is one of the most lucrative businesses for organized crime in the country. The business consists of stealing fuel from Pemex and then selling it on the black market, AMLO said.

AMLO said during his meeting with the press that actions by his administration to reduce the fuel thefts and use the funds to build or acquire refineries were proof that “fighting against corruption benefits the people.”

“This represents income that is used in welfare programs and public works that strengthen economic development and the reduction of poverty and inequality,” he said.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.