How about a 2012 ambling Permian Basin Preamble?

Oil and gas operators, like grizzled buyers at a cattle auction, are finding the Permian a cut above the regional competition.

The region is in the midst of a technology play that may top the glory days of 1981, when Midland rivaled Houston as the center of the universe in oil and gas.

While a cowboy has to throw a wide loop to include the Permian within the nation’s unconventional hot spots, operators in the region are applying techniques such as multistage hydraulic fracturing perfected in unconventional plays to coax production out of stacked tight formation vertical plays.

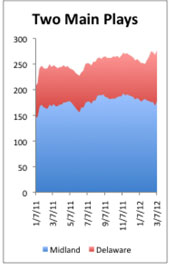

Operators are also accelerating horizontal drilling programs to exploit source rock oil in the Delaware and Val Verde basins, which has brought about a 30-unit increase in rig count since the first of 2012.

Meanwhile high oil prices are shining down on the region with the benevolent intensity of the mid-summer West Texas sun and it is possible to argue Permian Basin will add dozens of additional rigs to the employment rolls in 2012—more rigs, in fact, than any other U.S. region.

For comparison, the Permian Basin recorded a 135-unit, 53% increase in rig employment between January 2011 and March 2012 -- nearly double that of South Texas, the next most active growth region domestically. In contrast, the dry gas-oriented ArkLaTex witnessed a 118-unit decline during the same period.

Not Their First Rodeo

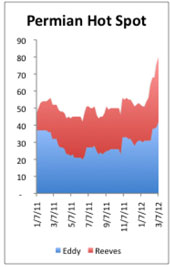

Not Their First RodeoThough many programs came up to running speed in 2011, led primarily by Apache and Occidental, significant activity expansion is possible in 2012, assuming service providers can overcome bottlenecks involving labor and materials — and if midstream players can build infrastructure connecting the broader market to the nascent tight formation plays attracting development in Eddy County, New Mexico and Culberson, Reeves, Winkler and Ward counties in Texas.

While the greatest growth in rig count on a percentage basis has occurred in the new horizontal tight oil formations variously rounded up into a corral that includes Bone Spring, Avalon and Wolfcamp, the most significant driver from a numerical standpoint originates with a thundering herd of stacked vertical targets. The Permian Basin contains seven of every 10 rigs drilling vertical oil wells in the U.S. onshore sector.

Over the last 15 months, Permian Basin oil-directed vertical rig count rose 44%, with the Permian Basin accounting for 84 of the 115 rigs added nationally during the period.

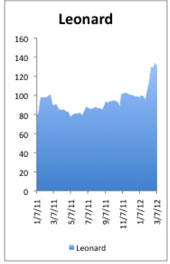

Credit the Midland Basin with its Wolfberry/Spraberry combo plays as a major driver for the drilling activity. But gains were also recorded in the shallower San Andres/Grayburg targets on the Central Basin Platform and in numerous vertical plays across the state line in New Mexico’s Lea County.

Surprisingly, the Permian Basin remains largely egalitarian despite a sharp consolidation effort as private operators sell out to bigger, publicly held firms.

It takes eight operators to reach a 67% share for rig employment in the region’s horizontal drilling efforts. Three of those operators, including Devon, Cimarex, and Energen, each employ seven or more rigs horizontally.

Similarly, the Top Five operators account for a 45% share of rig count in the vertically stacked Wolfberry/Spraberry drilling campaign, including Pioneer Natural Resources, Apache Corp, Concho Resources, Endeavor Energy Resources, and Laredo Petroleum Inc.

The other certainty beyond rising Permian Basin rig count in 2012 is the likelihood of further consolidation. February 2012 proved an active month for regional transactions with the spotlight focused on both the Delaware and Midland basins. In all, operators consummated or announced $192.5 million in deals. While the dollar figure is low compared to the $3.5 billion the region has witnessed over the last 15 months, the most recent deals illustrate the theme of publicly held operators adding bolt on acreage to existing holdings, or consolidating ownership in tracts for which operators have held a minority interest.

A third theme was evident as a hint of things to come and that is the $18 million JV prequel between BHP Billiton and Energen in which the Australian mining magnate acquired a 50% working interest in three wells and 4,829 net acres in Reeves County. Essentially the deal calls for BHP to underwrite completion costs for two Energen horizontal wells after which BHP may exercise an option to increase its stake to a 50% share of Energen Corp.’s 56,549 net acres as part of a larger joint venture.

The largest Permian deal year-to-date involves Forest Oil Corp.’s $104 million acquisition of 63,000 net acres targeting the Wolfbone in Pecos and Reeves cos. Texas. Forest is paying $66 million in cash plus 2.7 million in shares at $14.40 to an undisclosed seller for the parcel. After selling Permian Basin acreage to SandRidge Energy three years ago to focus on gas in the Haynesville and Granite Wash, Forest decided to return to the Permian in a bid to expand its liquids portfolio. Forest claims it will be one of the largest Wolfbone acreage holders in Pecos and Reeves counties following the acquisition and the company will begin delineation drilling via a one-rig program in March 2012, targeting the Wolfbone and commingling production from several formations in the stacked vertical play.

The acquisition adds a second platform to Forest’ 51,500 net acres in the Wolfcamp shale in Crockett County. When the dust clears, Forest will own 114,500 net acres in two up-and-coming Permian Basin tight formation plays. Forest is acquiring the Wolfbone acreage for $1,665 per acre.

Meanwhile Energen Corp. has become a serial Permian dealmaker. The company added 3,200 net acres in Midland County Wolfberry assets in February, including 29 producing wells and 8.5 MMboe of 2P reserves for $68.5 million. Energen then ended the month with the BHP-Billiton joint venture prequel.

Energen efforts also include the October 2011 transaction in which Energen executed two deals with private sellers to enlarge its Wolfberry holdings in Martin, Howard and Glasscock counties. Both deals brought a combined 24.2 MMboe in 2P reserves and 1.5 Kboepd. In the first transaction, Energen spent $157.5 million to acquire the remaining interest in Wolfberry properties in Martin and Howard counties, where it was a minority participant. The acreage holds 24 producing wells and 113 undeveloped locations, including 2P reserves of 16.5 MMboe (63% PUD). The second, smaller $54.4 million package enabled Energen to consolidate its Wolfberry position in Glasscock County.

Other Energen Corp. deals include the acquisition of 11,000 Bone Spring/Avalon acres as part of a $37 million Texas General Land Office sale in April 2011, and the December 2010 $110 million buyout of SandRidge Energy Inc.’s holdings in 40,000 net acres scattered across Loving, Reeves, Ward and Winkler counties, part of which SandRidge originally acquired from Forest Oil in 2009.

Recommended Reading

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Beetaloo Juice: US Shale Explores Down Under

2024-06-28 - Tamboran Resources has put together the largest shale-gas leasehold in Australia’s Beetaloo Basin, with plans for a 1.5+ Bcf/d play. Behind its move now to manufacturing mode are American geologists and E&P-builders, a longtime Australian wildcatter, a U.S. shale-rig operator and a U.S. shale pressure-pumper.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Industry Consolidation Reshapes List of Top 100 Private Producers in the Lower 48

2024-06-24 - Public-private M&A brings new players to top slots in private operators list.

The ‘Necessary Evil’ of Four-mile Laterals

2024-05-23 - While extended length lateral wells can lead to massive profits, the risk might not always be worth it. At Hart Energy’s SUPER DUG, Diamondback Energy, SLB, NOV and others weighed the risk and rewards of drilling three- and four-mile laterals.