Permian Basin EOR developer Roosevelt Resources aims to access the public markets through a reverse merger with Arcadia Biosciences. (Source: Roosevelt Resources)

Do oil and coconut water mix? Two Dallas-based companies apparently think so.

Permian Basin EOR company Roosevelt Resources LP aims to enter the public markets through a reverse merger with Nasdaq-traded firm Arcadia Biosciences, which owns a coconut water brand.

Roosevelt and Arcadia agreed to combine in an all-stock transaction, the companies announced Dec. 5.

Arcardia will issue shares of common stock in exchange for all equity interests in Roosevelt at the closing of the transaction. Following closing, Roosevelt equity owners will control about 90% of the outstanding Arcadia shares; Arcadia shareholders will hold the remaining 10%. One or more members of Arcadia management and personnel may continue to assist in managing the existing on-going operations of Arcadia, according to a press release.

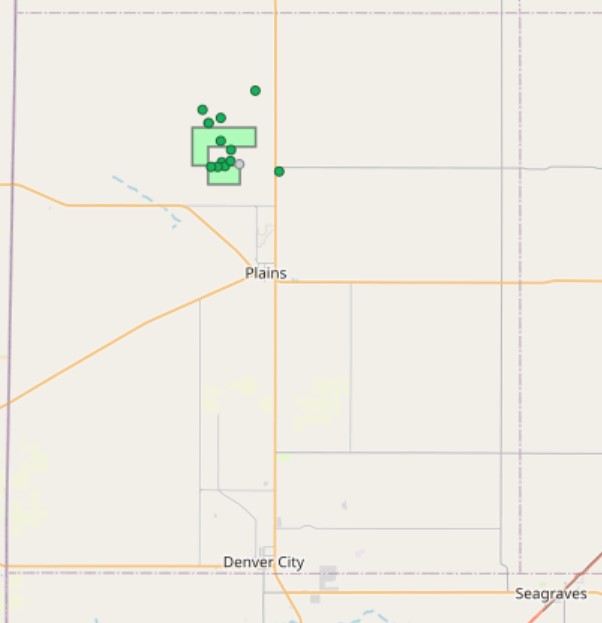

Roosevelt’s primary asset is a carbon capture utilization and storage (CCUS) oil and gas project spanning 13,892 net acres on the Northwest Shelf of the Texas Permian Basin.

The combined company plans to develop the asset as an EOR project, aiming for a peak production capacity of 55,000 gross boe/d in 2051. The project is in the RR-Googins Field in Yoakum County, Texas, and targets the San Andres Formation.

The company aims to drill horizontal CO2 injection wells alongside existing producing wells on the asset. Roosevelt estimates that output will increase by an average 4,000 gross boe/d annually for the first 10 years after CO2 response.

Elliott “Tony” Roosevelt Jr., chairman and CEO of Roosevelt, said the asset has been in the Roosevelt family for more than a century.

“Starting in 2007, we started the study and evaluation of the RR-Googins field to position it for field wide development,” Roosevelt said in a press release. “Through the application of technology, drilling and producing oil and planning and sourcing necessary components for field development, we believe we are positioned to now execute on this promising project.”

A model prepared by SLB estimates 956 MMboe (gross) of technically recoverable resource over a 70-year life of the project.

RELATED

Classic Rock, New Wells: Permian Conventional Zones Gain Momentum

Arcadia Biosciences

Arcadia, a producer of plant-based food and beverage products, has been exploring strategic alternatives to maximize shareholder value since July 2023.

The company streamlined operations to focus on its Zola coconut water brand, sold its GoodWheat brand and wheat intellectual property and reduced operating expenses.

“After a comprehensive and prolonged review, we have concluded that a business combination with Roosevelt Resources is the best alternative to create value for Arcadia and its shareholders,” said T.J. Schaefer, president and CEO of Arcadia.

Upon closing, Arcadia will change its corporate name to Roosevelt Resources Inc. and the company’s shares are expected to trade under a new ticker symbol.

Current Roosevelt management will manage the combined entity, with Tony Roosevelt serving as CEO. Jimmy Hawkins will serve as president and COO and Jerrel Branson will serve as CFO.

Certain Arcadia employees “may continue to assist in managing the existing ongoing operations of Arcadia,” the companies said.

RELATED

Powder River E&P Peak Resources Prices IPO, to Test Markets as MLP

Recommended Reading

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

E&P Highlights: Feb. 10, 2025

2025-02-10 - Here’s a roundup of the latest E&P headlines, from a Beetaloo well stimulated in Australia to new oil production in China.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.