The pipeline, which officially started service on July 1, is designed to be expandable to 2.5 Bcf/d. (Source: Shutterstock)

Editor's note: This article has been updated with additional analyst commentary.

The 1.7 Bcf/d ADCC Pipeline began commercial service at the start of the third quarter, connecting Permian Basin natural gas to Cheniere's Corpus Christi LNG export facility.

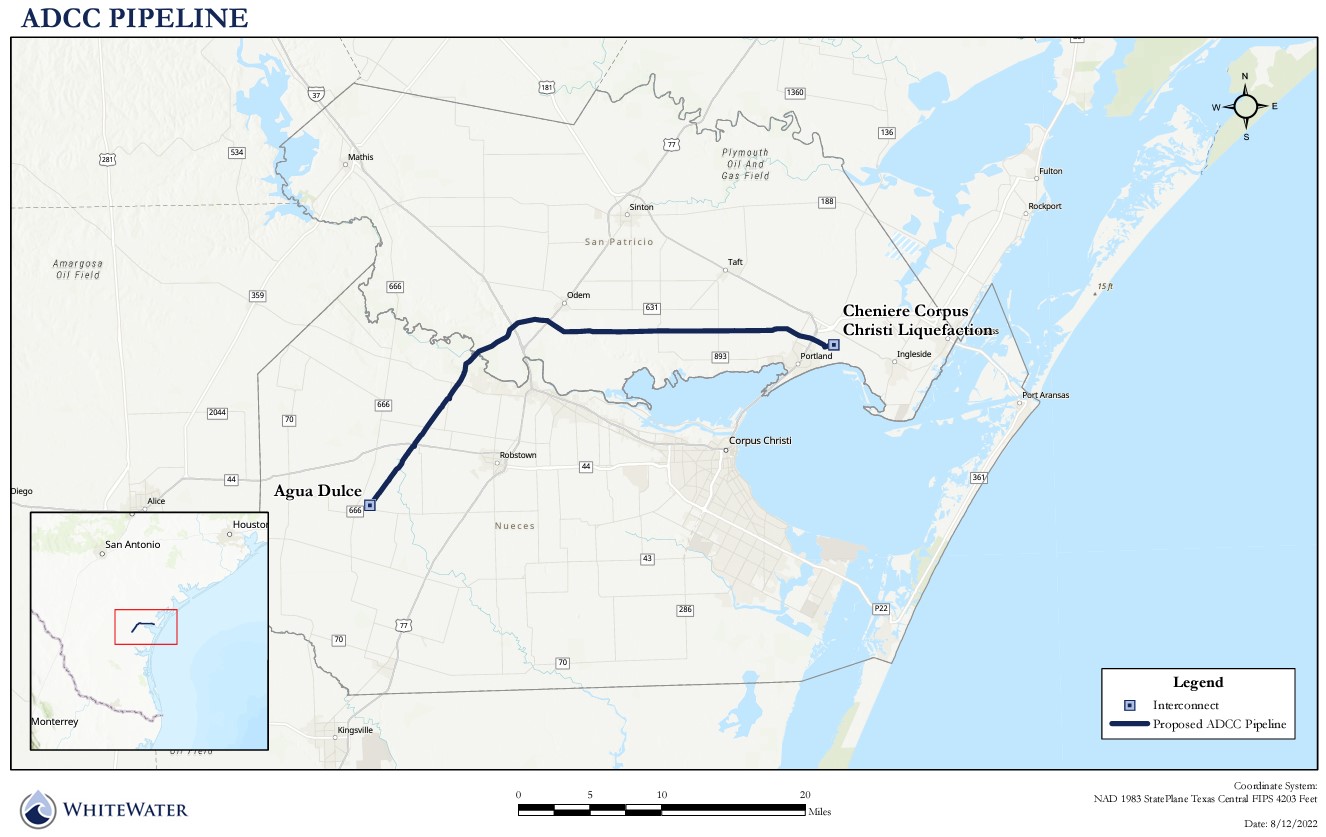

The 40-mile natural gas line runs from the terminus of the Whistler Pipeline in Agua Dulce, Texas, and provides Cheniere with direct access to Permian and Eagle Ford Shale volumes in addition to gas sourced along the Gulf Coast, according to a July 12 press release.

The pipeline, which officially started service on July 1, is designed to be expandable to 2.5 Bcf/d.

The 40-mile, 42-inch line is expected to help reduce flared volumes in the Permian Basin and further support U.S. LNG exports to global markets. East Daley Analytics said it does not expect a big shift in basin dynamics given that Whistler Pipeline already runs full at about 2.5 Bcf/d.

Alex Gafford, an analyst at East Daley, said the ADCC Pipeline is designed to transport to support Cheniere’s Stage 3 expansion at Corpus Christi with supply connections into Whistler and Agua Dulce hub.

“Cheniere is building seven midscale trains capable of producing over 10 Mtpa of LNG (~1.3 Bcf/d),” Gafford said in an email. “In Cheniere’s 1Q24 earnings update in May, executives said the CCL Stage 3 expansion is on track to make first LNG by YE24, and predicted that all seven trains would be brought into service over the 2025-26 period.”

The ADCC line will give Cheniere more flexibility to source gas at Corpus Christi, particularly in in the second half of 2024 and early 2025, when demand from the Stage 3 expansion is unavailable.

Currently, the facility is only served by the Corpus Christi Pipeline.

“The new pipe will move Permian gas further downstream via Whistler and provide access to Eagle Ford supply at the Agua Dulce hub,” he said.

However, East Daley does not expect a big shift in basin dynamics with ADCC online, given that Whistler Pipeline already runs full at ~2.5 Bcf/d to Agua Dulce, Gafford said.

“Looking further out, we expect new LNG demand from projects like CCL Stage 3 will create big shifts in the South Texas market later this decade,” he said. “However, Matterhorn pipeline is expected to start taking line fill this month and be fully operational by September adding 2.5 Bcf/d of egress from the Permian into the Katy market.”

Matterhorn will provide much needed egress from the Permian and will lift Waha pricing out of the negatives through 2026.

The ADCC Pipeline 70% owned by Whistler Pipeline LLC, a joint venture between WhiteWater (50.6%), MPLX LP and Enbridge (19%). The remaining 30% is wholly owned by Cheniere.

Recommended Reading

Expand’s Dell'Osso: E&Ps Show ‘Unusual’ Discipline with $4 NatGas Strip

2025-04-25 - Haynesville Shale’s largest gas producers are displaying restraint with a $4/Mcf forward curve. “That’s really unusual,” said Expand Energy CEO Nick Dell’Osso.

US Drillers Add Oil, Gas Rigs for Second Week in a Row

2025-04-25 - The oil and gas rig count rose by two to 587 in the week to April 25. Despite this week's rig increase, Baker Hughes said the total count was still down 26, or 4% below this time last year.

APA Reveals 2,700 bbl/d Test Results from Sockeye-2 in Alaska

2025-04-24 - APA Corp. said Sockeye-2, located in Alaska’s eastern North Slope, was drilled to a depth of approximately 10,500 ft and averaged 2,700 bbl/d during the final flow period.

Patterson-UTI Sees Uptick in Gas Activity, Oil Uncertainty

2025-04-24 - Natural gas activity picked up more than expected in the first quarter, with the Haynesville Shale leading the way, Patterson-UTI executives said.

Rhino Resources Makes Oil Discovery in Namibia’s Orange Basin

2025-04-24 - Rhino Resources’ Capricornus 1-X exploration well achieved a flow rate exceeding 11,000 bbl/d offshore Namibia.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.