Permian Resources will add Occidental Petroleum’s Barilla Draw assets in an $817.5 million deal as Oxy prepares to pay down debt for its pending $12 billion acquisition of CrownRock LP. (Source: Shutterstock.com)

Permian Resources has agreed to buy Delaware Basin assets from Occidental Petroleum for $817.5 million, in deal that some analysts considered nearly tailor-made for Permian Resources.

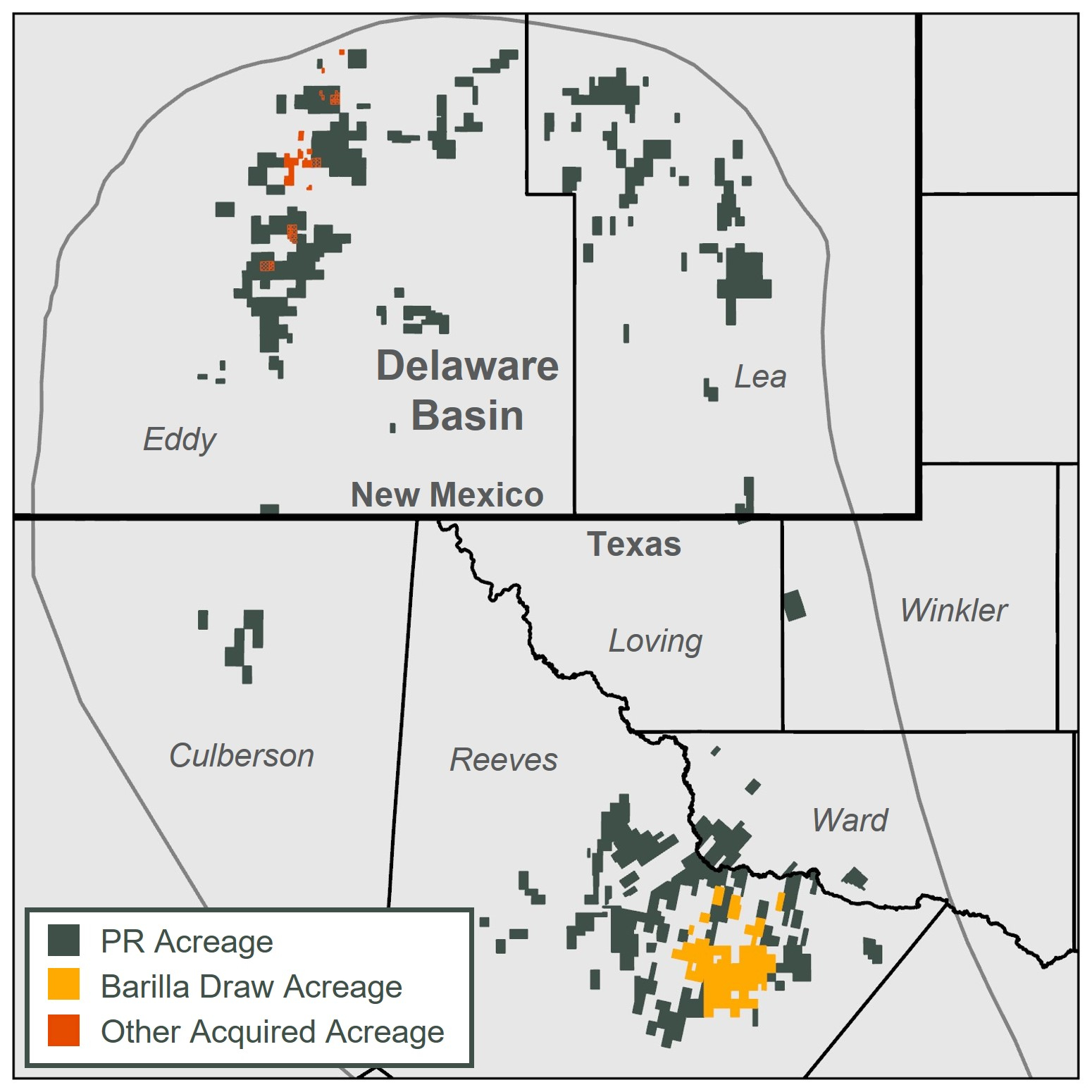

The acquisition includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d predominantly located directly offset the company’s existing position in Reeves County, Texas. Permian Resources will also picked up about 2,000 net acres in Eddy County, New Mexico.

The deal includes assets in Occidental’s Barilla Draw Field, which analysts at TD Cowen had said made “strong industrial [logic] for PR [Permian Resources] given acreage overlap in Reeves County.”

For Occidental, the deal gets continues to move the company toward debt reduction targets of $4.5 billion to $6 billion in sales to be completed within 18 months of closing the acquisition of CrownRock LP.

Occidental said in a separate July 29 press release that it has also completed several 2024 dispositions totaling approximately $152 million. Occidental expects the CrownRock deal to close in August.

“We are pleased with the significant progress to date on our divestiture program, which is aimed at derisking the financing of the CrownRock acquisition and accelerating our shareholder return pathway,” said President and CEO Vicki Hollub.

RELATED

Ecopetrol in Discussions with Oxy to Buy $3.6B Stake in CrownRock

Permian Resources said the Barilla Draw bolt-on adds more than 200 gross operated, 2-mile locations with high net revenue interests, which immediately compete for capital. The asset includes more than 100 miles of oil and natural gas pipelines; water infrastructure, including a 25,000 bbl/d recycling facility; and more than 10,000 surface acres.

Occidental’s operated acreage position contains an average working interest of approximately 65% and is contiguous to the company’s existing positions in both Texas and New Mexico. The acreage has minimal future drilling requirements and is approximately 99% HBP.

The company said the transaction prices is ~3.4x estimated 2025 EBITDAX and ~17% free cash flow yield, based on Permian Resources assumptions of a maintenance production profile and $75/bbl and $3/MMBtu flat pricing.

Permian Resources said the purchase will be “conservatively finances through a combination of equity and debt,” the company maintain a leverage ratio of ~1x net debt to EBITDAX.

“This acquisition is a natural fit for us given its high-return inventory and proximity to our current operated position,” said Will Hickey, co-CEO of Permian Resources. “As the Delaware Basin’s low-cost leader, we are highly confident that our team will be able to leverage its operational expertise of the asset to significantly reduce costs and drive meaningful synergies, maximizing value for our shareholders.”

The company expects the transaction to deliver accretion to free cash flow per share of more 5% per year during the next two-, five- and 10-year periods.

James Walter, co-CEO of Permian Resources, said the company’s overarching goal is to drive value for investors, and the “acquisition of high-quality assets adjacent to our existing position is a perfect example.”

“Consistent with our strategy of pursuing sound M&A opportunities, this bolt-on acquisition adds core inventory which immediately competes for capital and is accretive to key metrics over both the short and long-term,” Walter said. “Furthermore, the substantial midstream infrastructure and surface acres represent material value and will provide us with significant flexibility going forward.”

Permian Resources intends to fund the acquisition, subject to market conditions and other factors, through proceeds from one or more capital markets transactions.

Permian Resources said it expects to close the acquisition by the end of third-quarter of 2024.

Occidental’s financial adviser was RBC Capital Markets LLC, and its legal adviser was White & Case LLP.

Kirkland & Ellis advised Permian Resources Corp. The Kirkland team was led by corporate partners Chad Smith and Will Eiland and associates Luke Strother and Lyle Paul; tax partners David Wheat and Joe Tobias and associate Brooke Schafer; and environmental transactions partner Paul Tanaka and associate Max Anderson.

RELATED

Beyond Permian? Breaking Down E&Ps’ Second Half M&A Prospects

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.