The 14.5 million initial shares are anticipated to price at between $19 and $22, the company reported June 17. (Source: Shutterstock)

Permian Basin surface-acreage-owner LandBridge Co. LLC is set to IPO in an estimated raise of up to $367 million.

The 14.5 million initial shares are anticipated to price at between $19 and $22, the company reported June 17. Underwriters will have a 30-day option to purchase an additional 2.175 million shares, according to LandBridge’s filings with the Securities and Exchange Commission (SEC).

Shares are to trade as LB on the NYSE.

Lead book-running managers are Goldman Sachs and Barclays. Additional managers are Wells Fargo Securities, Citigroup, Piper Sandler and Raymond James. Co-managers are Janney Montgomery Scott, Johnson Rice & Co., Pickering Energy Partners, Texas Capital Securities and Roberts & Ryan.

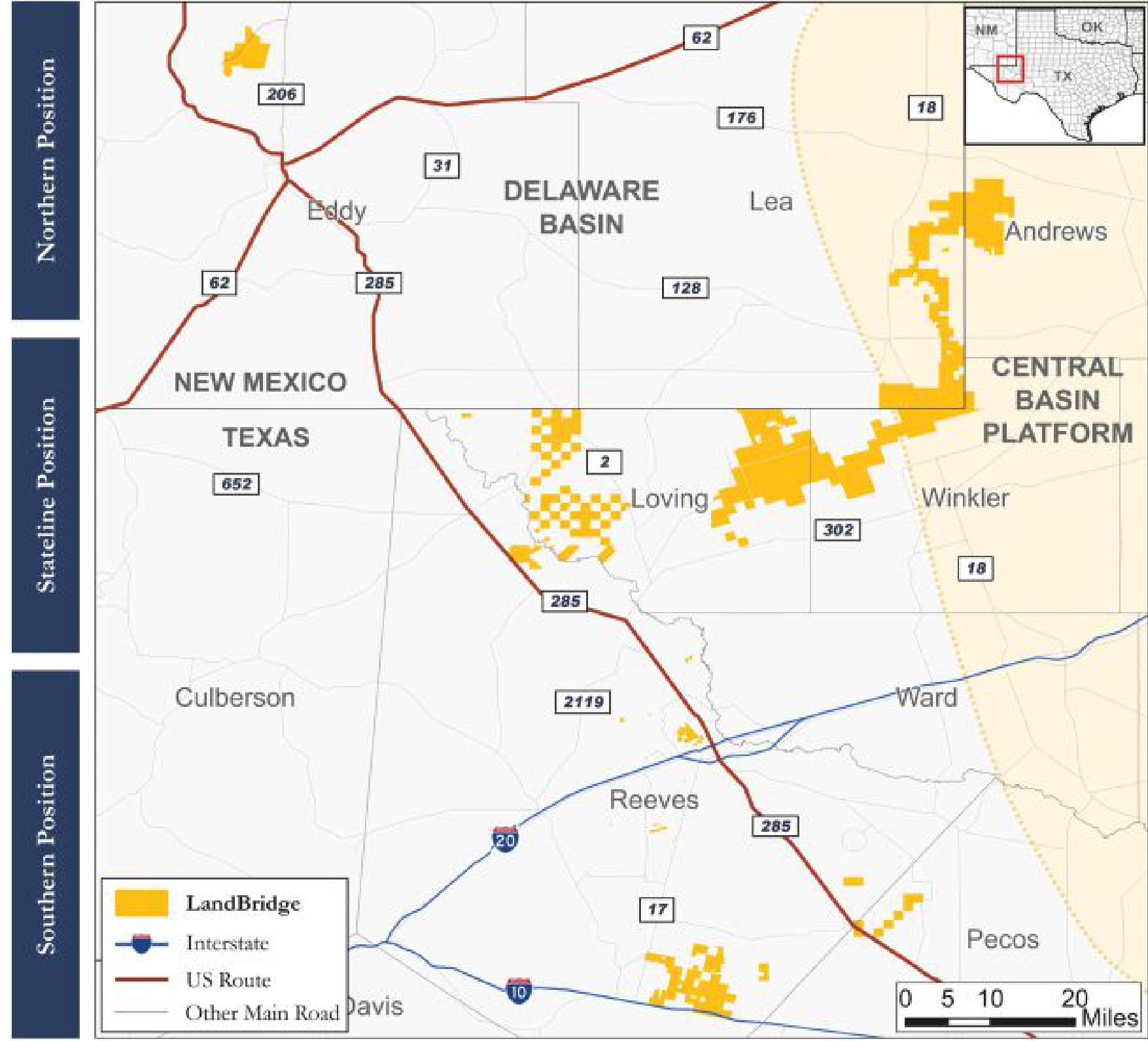

Formed in 2021 by private equity firm Five Point Energy LLC, Houston-based LandBridge owns and manages approximately 220,000 surface acres in Texas and New Mexico, primarily in the Delaware Basin.

In the Stateline area, the company holds 137,000 surface acres primarily in Loving, Reeves and Winkler counties, Texas, and Lea County, New Mexico, along the Texas-New Mexico state border, it reported in its SEC filings.

“… Approximately 11,527 identified well locations across seven formations exist within a 10-mile radius of our surface acreage in our Stateline position,” the company reported.

Also in the northern Delaware, LandBridge holds 49,000 fee-owned surface acres and 14,165 additional surface acres leased from the federal Bureau of Land Management and from the state of New Mexico.

These acres are in Eddy and Lea counties, New Mexico, and Andrews County, Texas.

“… Approximately 1,552 identified well locations across four formations exist within a 10-mile radius of our surface acreage in [this] position,” LandBridge reported.

In the southern Delaware, it holds some 34,000 surface acres in Reeves and Pecos counties, Texas.

“… Approximately 9,117 identified well locations across seven formations exist within a 10-mile radius of our surface acreage in [this] position,” LandBridge reported.

LandBridge also owns 4,180 gross mineral acres in the Delaware with a weighted average royalty interest of 23.9% and an average proved developed producing net revenue interest per well of 4.4%.

RELATED

Energy Execs Plan Blank-check IPO to Buy E&P, Midstream Property

Recommended Reading

Norway’s DNO Discovers Gas Condensate in North Sea’s Cuvette

2024-06-19 - Cuvette is the second well in DNO’s 2024 North Sea exploration program.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.