Petro-Victory Energy is growing its footprint in Brazil’s onshore Potiguar Basin through M&A. (Source: Shutterstock.com)

Petro-Victory Energy, in a 50-50 partnership with Azevedo & Travassos Petroleo (ATP), has acquired 13 onshore oil fields in Brazil.

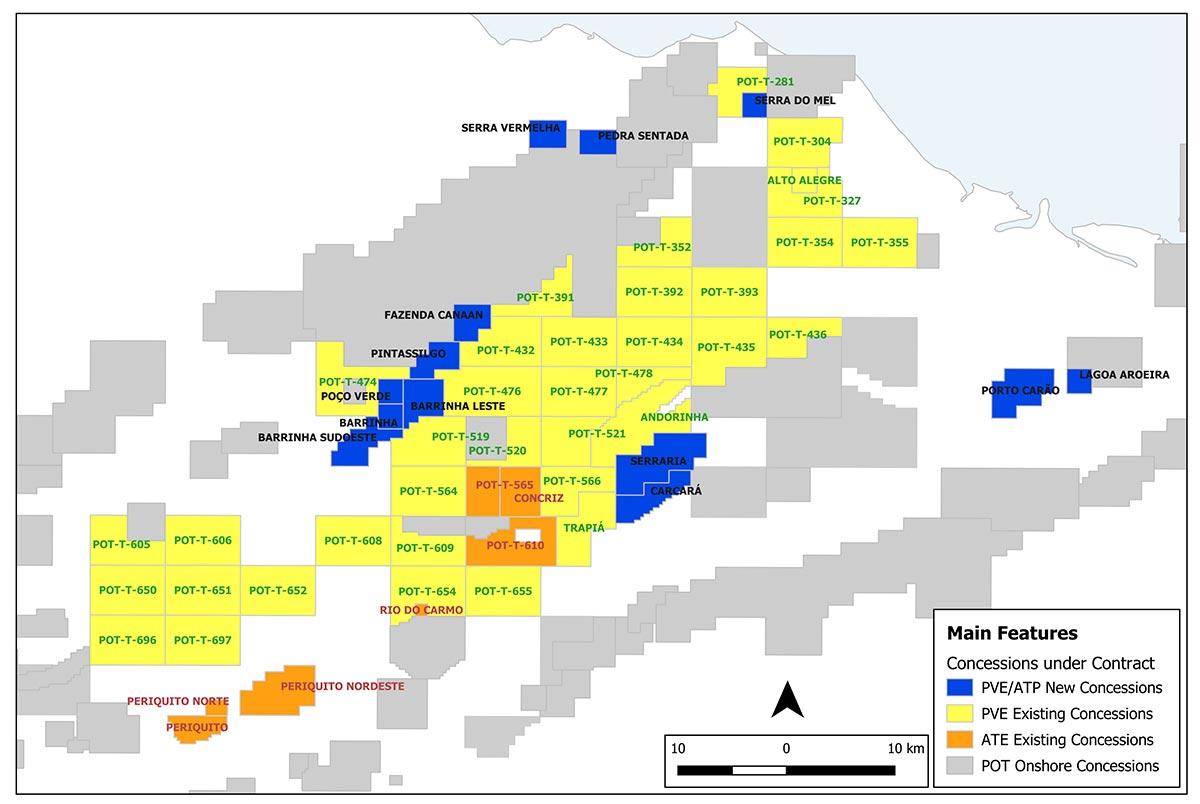

The oil fields, comprising 38,301 acres, are within the Potiguar Basin in Brazil’s Rio Grande do Norte state, the companies said Feb. 10.

The total acquisition value was US$15 million, or $7.5 million net to both Petro-Victory and ATP. The assets were acquired from subsidiaries of Brava Energia SA.

The acquired assets are strategically located adjacent to Petro-Victory’s existing footprint in the Potiguar Basin. Current output averages 250 bbl/d of oil. Petro-Victory has a work program in place “to significantly increase oil production.”

Brazil’s National Agency of Petroleum has reported 125 MMbbl of recoverable oil in place, Petro-Victory said.

““This acquisition marks a transformative milestone for Petro-Victory, significantly enhancing our oil production capacity and increasing our proven reserves,” said Petro-Victory CEO Richard Gonzalez. “We expect the updated reserve report will increase our proven reserves by 50%.”

Petro-Victory currently has three producing oil fields and 34 exploration blocks within the Potiguar Basin.

The transaction also included tanks, pumps, flow lines, power lines and other related field infrastructure.

The deal is expected to close in the second half of 2025.

RELATED

Recommended Reading

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

Riverstone’s Leuschen Plans to IPO Methane-Mitigation-Focused SPAC

2025-01-21 - The SPAC will be Riverstone Holdings co-founder David Leuschen’s eighth, following the Permian Basin’s Centennial Resources, the Anadarko’s Alta Mesa Holdings and the Montney’s Hammerhead Resources.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.