Conflict in the Middle East has enabled Brazil’s state-owned Petrobras to change the flow of its oil exports, with China being the primary beneficiary, followed by Europe. (Source: Shutterstock.com)

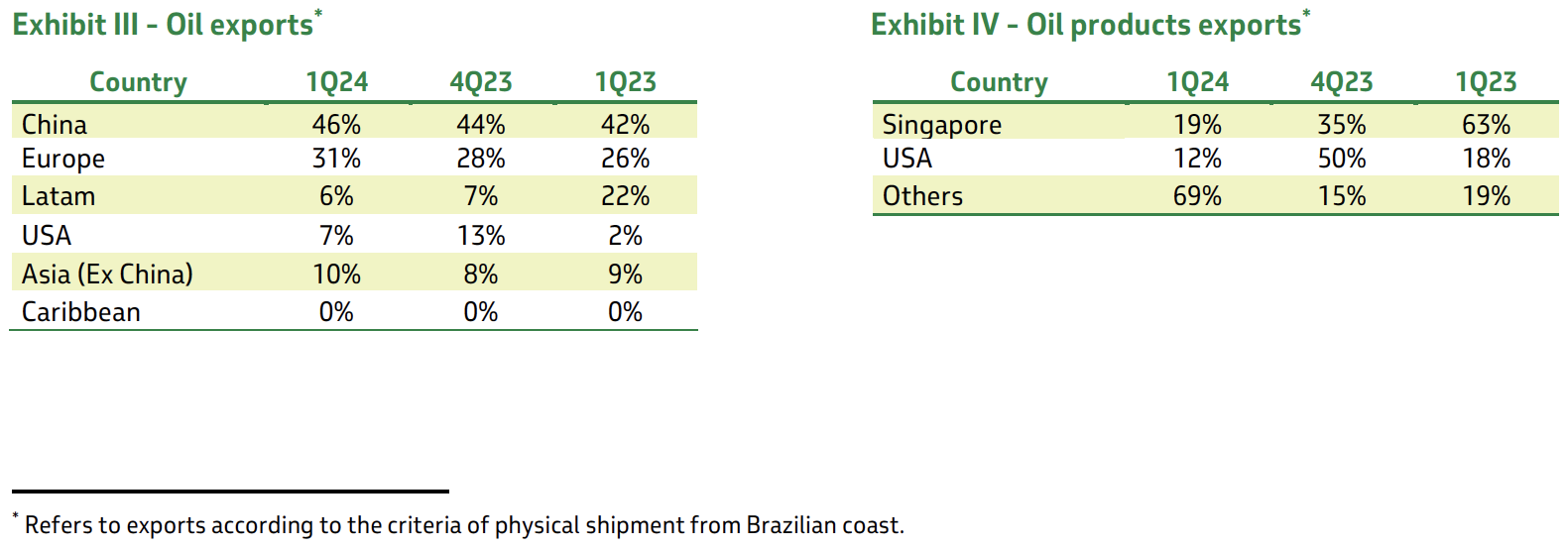

Brazil’s state-owned Petrobras continues to boost the percentage of oil it exports to Asian markets, especially China, which was the final destination of 46% of the company’s exports in first-quarter 2024.

In fourth-quarter 2023, 44% of Petrobras’ oil exports went to China. A year ago, in first-quarter 2023, the company sent 42% of its exports there, the company reported in its quarterly earnings report on April 29.

“The conflict in the Middle East has caused instability in maritime freight rates and, as a result, a change in the flow of our oil exports,” Petrobras said in its earnings release. “Markets that are naturally served by larger ships became more attractive. We were able to exploit this arbitrage by increasing the volume of oil exported to Asian markets, especially China, and we optimized shipments on large vessels to markets such as Europe and the United States.”

Petrobras’ rising export trend to China has continued despite lower actual export volumes.

The Rio de Janeiro-based company’s oil exports averaged 848,000 bbl/d in the first quarter, down 4.2% compared to the previous quarter and a year-over-year decrease of 4.4% compared to first-quarter 2023.

The sequential decline in oil exports was primarily related “to lower oil products exports, especially gasoline, mainly attributed to quality exchange operations in the fourth quarter 2023, as well as maintenance stoppages in the first quarter 2024,” Petrobras said in the report. “This was partially offset by an increase in oil exports, reflecting the lower need to process oil in the refineries.”

RELATED

Deepwater Roundup 2024: Americas

Petrobras to Step Up Exploration with $7.5B in Capex, CEO Says

Production swings

Petrobras reported average production of oil, NGL and gas of 2.77 MMboe/d in the first quarter, down 5.4% compared to fourth-quarter 2023. Pre-salt formation production of 1.85 MMboe/d in the first quarter represented 67% of Petrobras’ total production.

Lower quarter-over-quarter production can be attributed to stoppages, maintenance and natural declines at mature fields, which were partially offset by production from FPSOs Almirante Barroso (Búzios Field), P-71 (Itapu Field), Sepetiba (Mero Field) and Anita Garibaldi (Marlim, Voador and Espadim fields).

Year-over-year, Petrobras’ production was up 3.7% due to the ramp-up of some of those same FPSOs: Almirante Barroso, P-71, Anna Nery, Anita Garibaldi and Sepetiba, as well as the start-up of 19 new wells from complementary projects in the Campos (11 wells) and Santos (eight wells) basins.

Recommended Reading

Pennsylvania City to Turn Coal-Powered Plant into Gas-Fired Data Center Campus

2025-04-03 - Construction on the Homer City Generating Station is expected to start in 2026.

BP’s Cypre Development Off Trinidad and Tobago Delivers First Gas

2025-04-03 - BP Trinidad and Tobago said the Cypre development is projected to deliver approximately 45,000 boe/d at peak.

Sitio Fights for its Place Atop the M&R Sector

2025-04-02 - The minerals and royalties space is primed for massive growth and consolidation with Sitio aiming for the front of the pack.

Exclusive: LNG Takes Control in Meeting Data Center Reliability, Capacity Needs

2025-04-02 - William Seller, solutions architect at DartPoints, shares insight on the impact that data center power demand will have on the natural gas industry, in this Hart Energy Exclusive interview.

Prairie Operating Plans 11-Well Development at Rusch Pad in Colorado

2025-04-02 - Prairie Operating Co. has begun an 11-well development program in Weld County, Colorado, following the closing of its $603 million deal for Bayswater Exploration and Production assets.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.