Phillips 66's move to acquire Pinnacle Midstream was unlikely to be “a strategic surprise for the market,” Piper Sandler analysts said in a note, given that Phillips 66 executives discussed the need to increase the size of its midstream footprint after an earlier acquisition of DCP Midstream in June 2023. (Source: Shutterstock)

Phillips 66 (PSX) announced May 20 that it reached an agreement to buy independent company Pinnacle Midstream. Phillips said the $550 million deal was a strategic move to expand its natural gas gathering and processing assets in the Midland Basin.

“Pinnacle is a bolt-on asset that advances our wellhead-to-market strategy and complements our diversified and integrated asset portfolio,” Phillips 66 Chairman and CEO Mark Lashier said in a press release.

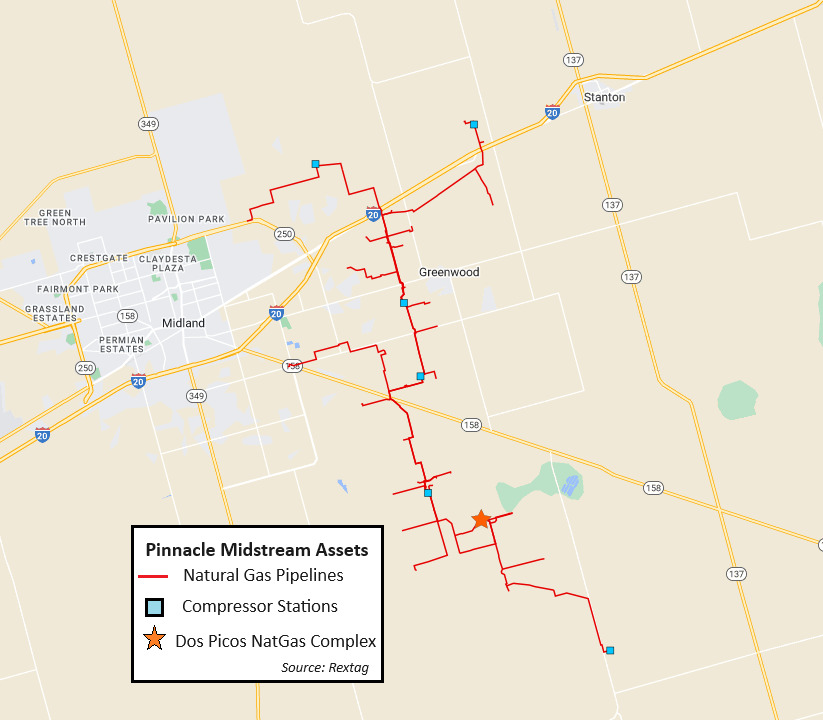

Pinnacle’s assets include the Dos Picos natural gas gathering and processing system: a 220 MMcf/d gas processing plant, 80 miles of gathering pipeline and 50,000 dedicated acres through one of Phillips 66’s focus basins. Phillips said Dos Picos is scalable toward a second 220 MMcf/d gas plant and has strong connections with its downstream infrastructure.

The transaction is expected to close in the middle of 2024, according to the release.

“Pinnacle has established itself as one of the premier midstream providers in the Midland Basin, with a top-notch talented team, first-class operations and infrastructure and world-class customers,” Pinnacle CEO J. Greg Sargent stated in the press release.

A week before the sale was announced, a Pinnacle executive said the company had been built with eventual integration with other infrastructure companies in mind.

Pinnacle Midstream partner and CCO Drew Ward discussed midstream M&A in the Permian on a panel at Hart Energy’s SUPER DUG Conference & Expo in Fort Worth, Texas, on May 15. Pinnacle, like many other private midstream companies, has worked to build a network that would be attractive to potential buyers.

“We have a hyper-focus in our business on checking the boxes on things that some of our peer companies around us would want to complement their business,” Ward said.

Analysts gave Phillips 66 fair reviews for the deal.

Firm Piper Sandler noted the move was unlikely to be “a strategic surprise for the market,” given that Phillips 66 executives discussed the need to increase the size of its midstream footprint after an earlier acquisition of DCP Midstream in June 2023. The deal is the first, but “unlikely the last” transaction as Phillips continues to grow its infrastructure.

Piper Sandler said the deal was likely positive for Phillips 66’ midstream business over the long term, but that investors may be “ambivalent on PSX's midstream business—generally preferring cash return to shareholders.”

In a report on the acquisition, TPH&Co analyst Matthew Blair wrote that the deal "looks like a good fit, but investors are expecting PSX to sell midstream assets rather than buy them."

The firm estimated the deal would generate $80 million in EBITDA and include about $20 million in synergy opportunities for Phillips.

“While the deal looks fine on its own, we suspect investors will react negatively to PSX’s decision on capital allocation,” Blair wrote, noting that Phillips 66 had earlier told investors the company planned to sell $3 billion of non-core assets.

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.