Phillips 66 is also buying EPIC’s 885-mile NGL pipeline. (Source: Shutterstock)

Phillips 66 (PSX) has entered into a definitive agreement to buy EPIC Y-Grade GP LLC and EPIC Y-Grade LP, which own various subsidiaries and long haul NGL pipelines, fractionation facilities and distribution systems, for $2.2 billion cash.

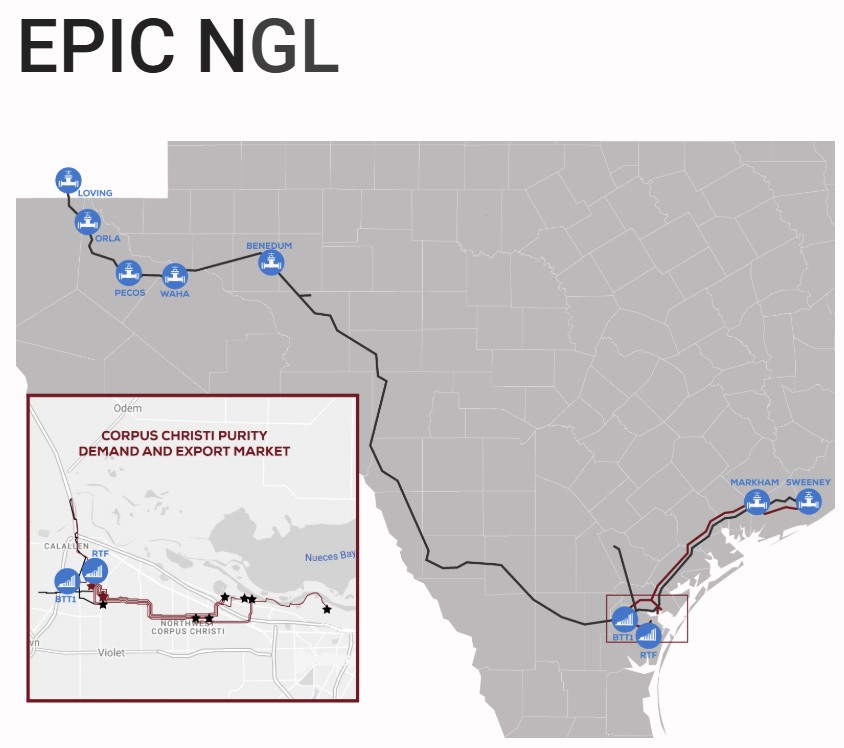

Phillips 66 said EPIC’s NGL business consists of two 170,000 bbl/d fractionators near Corpus Christi, Texas, approximately 350 miles of purity distribution pipelines. Phillips 66 is also buying EPIC’s 885-mile NGL pipeline. The line, with 175,000 bbl/d capacity, links production supplies in the Delaware and Midland basins and the Eagle Ford Shale to fractionation complexes and the Phillips 66 Sweeny Hub.

EPIC is backed by Ares Management Corp.

“This transaction bolsters Phillips 66’s position as a leading integrated downstream energy provider,” said Mark Lashier, chairman and CEO of Phillips 66, in a Jan. 6 press release. “This transaction optimizes our Permian NGL value chain, allows Phillips 66 to provide producers with comprehensive flow assurance, reaching fractionation facilities near Corpus Christi, Sweeny, and Mont Belvieu, Texas, and is expected to deliver attractive returns in excess of our hurdle rates.”

EPIC NGL is in the process of increasing its pipeline capacity to 225,000 bbl/d and has sanctioned a second expansion to increase capacity to 350,000 bbl/d, Phillips 66 said. Phillips 66 said it does not expect to increase its recently announced 2025 capital program in connection with the expansion.

EPIC NGL has also identified a third fractionation facility that could bring its fractionation capacity up to 280,000 bbl/d, Phillips 66 said. The facilities connect Permian production to Gulf Coast refiners, petrochemical companies and export markets and will be highly integrated with the Phillips 66 asset base, the company said.

The transaction is subject to customary closing conditions, including required regulatory clearance.

Kirkland & Ellis advised EPIC Y-Grade LP on the transaction.

Recommended Reading

Will TG Natural Resources Be the Next Haynesville M&A Buyer?

2025-03-23 - TG Natural Resources, majority owned by Tokyo Gas, is looking to add Haynesville locations as inventory grows scarce, CEO Craig Jarchow said.

Voyager Midstream Closes on Panola Pipeline Interest Deal

2025-03-19 - Pearl Energy Investments portfolio company Voyager Midstream Holdings has closed on its deal with Phillips 66 for its non-op interest in the Panola Pipeline.

Sources: Citadel Buys Haynesville E&P Paloma Natural Gas for $1.2B

2025-03-13 - Hedge fund giant Citadel’s acquisition includes approximately 60 undeveloped Haynesville locations, sources told Hart Energy.

Japan’s Mitsui Testing Western Haynesville Alongside Comstock, Aethon

2025-03-26 - Japanese firm Mitsui has plans to drill a horizontal well in the emerging western Haynesville play as renewed foreign investment in U.S. shale continues to pick up steam.

NOG Spends $67MM on Midland Bolt-On, Ground Game M&A

2025-02-13 - Non-operated specialist Northern Oil & Gas (NOG) is growing in the Midland Basin with a $40 million bolt-on acquisition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.