Phillips 66 Partners LP has officially pulled out of the long-deferred Liberty Pipeline, which was proposed to support oil production growth in the Rockies and the Bakken shale regions.

In a release on April 5, Phillips 66 Partners said it will record an estimated impairment of between $180 million and $210 million in the first quarter due to its decision to exit the Liberty Pipeline project. The Houston-based pipeline operator also cited effects of recent winter storms on asset utilization and utility costs.

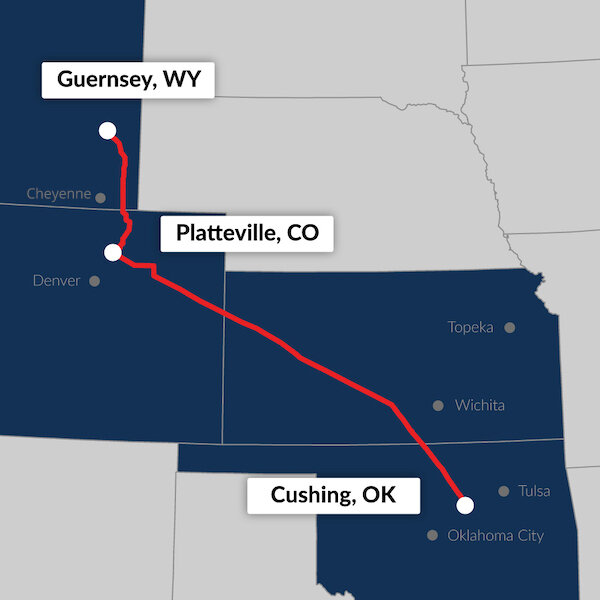

The Liberty Pipeline was a proposed 700-mile pipeline transporting light crude oil from Guernsey, Wyoming to the Cushing, Oklahoma, hub. The roughly $1.6 billion project, to be constructed by joint venture between Phillips 66 Partners and Bridger Pipeline, had been put on hold more than a year ago due to the oil market crash at the onset of the COVID-19 pandemic.

Phillips 66 Partners had previously canceled the planned Red Oak Pipeline from Cushing to the Texas Gulf Coast last October. Both the Red Oak and Liberty pipeline projects were proposed and, subsequently, deferred at the same time.

Recommended Reading

TG Natural Resources Wins Chevron’s Haynesville Assets for $525MM

2025-04-01 - Marketed by Chevron Corp. for more than a year, the 71,000-contiguous-net-undeveloped-acreage sold to TG Natural Resources is valued by the supermajor at $1.2 billion at current Henry Hub futures.

Sempra Plans to Sell Assets, LNG Stakes to Invest in Utilities

2025-03-31 - Infrastructure company Sempra Energy is preparing for major growth coming in electrical demand by selling assets to raise capital.

GeoPark Divests Non-Core Colombia, Brazil Assets, Cuts Workforce

2025-03-31 - GeoPark is selling non-core assets and reducing its headcount, the Colombia-based oil and gas firm said March 31.

Japan's Tokyo Gas to Buy Stake in Texas Shale from Chevron

2025-03-31 - The deal estimated to be worth tens of billions of yen, the Nikkei reported on March 31.

NatGas Rising: WhiteHawk Inks $118MM Marcellus Royalties Deal

2025-03-31 - WhiteHawk Energy is getting deeper in Pennsylvania’s Marcellus Shale with a $118 million deal as demand for natural gas grows.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.