As the Permian Basin matures and global oil demand grows, Dan Pickering, chief investment officer for Pickering Energy Partners, offers his thoughts are on the basin’s future, costs, demand and the price of oil at Hart Energy's Executive Oil Conference & Expo. (Source: Hart Energy)

Is the Permian Basin the world’s marginal barrel?

“I suspect that it’s pretty close to that. Most people are producing flat out,” Dan Pickering, chief investment officer for Pickering Energy Partners, said at Hart Energy’s DUG Executive Oil Conference & Expo. “If we’re going to keep producing at 6 million barrels a day here, what’s the price required to get there?”

Today, the Permian Basin remains the world’s most prolific oil and gas basin as operators have advanced drilling and completion techniques to boost production and improve breakeven prices. They are drilling 4-mile laterals, upsizing well spacing and using U-turn, or horseshoe, well designs to improve efficiency, boost production and lower costs. They are producing more with fewer rigs, and some are bolting on contiguous acreage to further unlock synergies.

The action has improved production rates and breakevens, with ample producers outnumbering marginal ones. However, as the Permian Basin matures and operators talk about so-called Tier 2 and Tier 3 areas with less favorable reservoir rock quality and potentially lower output, thoughts are on the basin’s future, costs and the price of oil.

Sure, the world still needs affordable oil and gas, especially in developing nations, even as the global drive to lower emissions continues with a push for more renewable energy and lower-carbon energy. But at what cost?

“The basin is going to have to continue drilling. We’re on a treadmill and at 6 million barrels a day, you don’t stop spending and maintain production, right? We will see a decline if we don’t keep spending,” Pickering said.

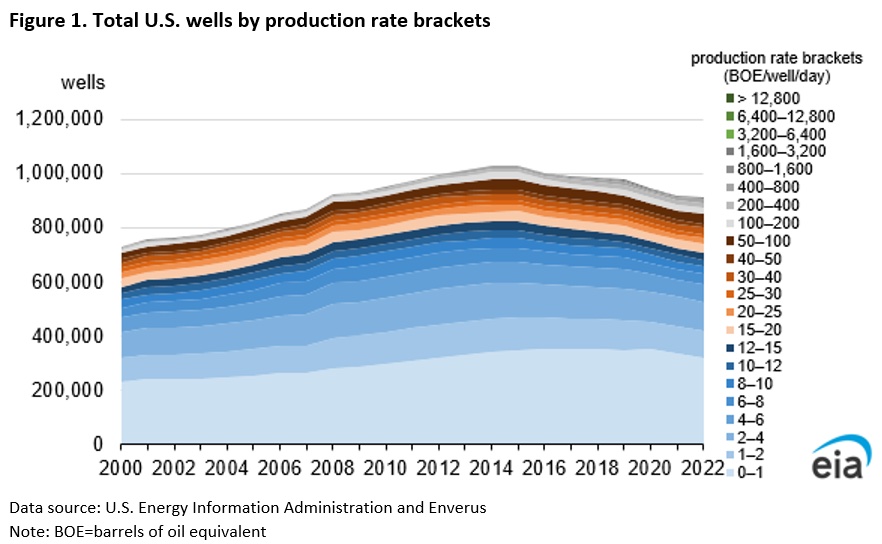

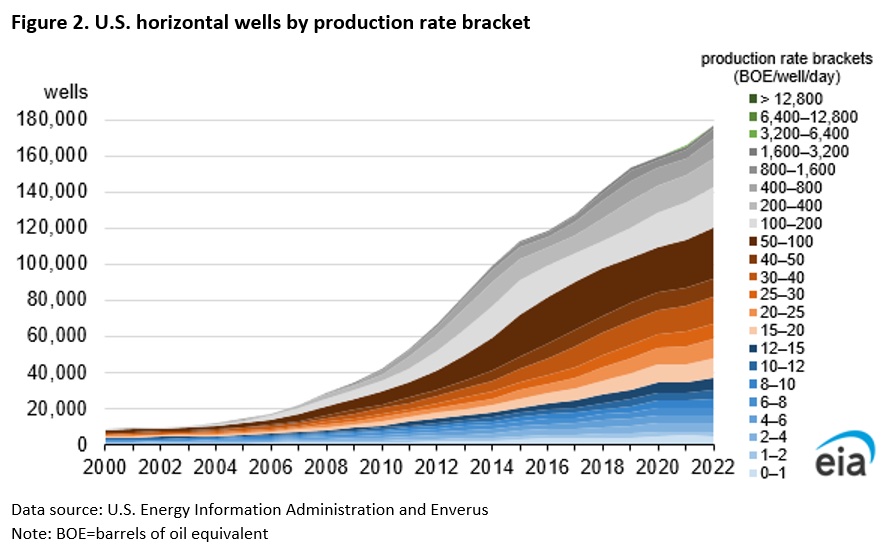

Stripper wells dominate the U.S. oil and gas well count. They account for less than 10% of the nation’s oil and gas production, with horizontal wells producing far more oil and gas, according to the U.S. Energy Information Administration.

Peak Permian?

Hydraulically fractured horizontal wells in shale formations such as the Permian typically decline faster than vertical wells in conventional reservoirs. Predictions vary on when Permian Basin oil and gas production will peak, but analysts and experts see production growing in the near term.

Jefferies’ model shows the basin peaking at around 7 MMbbl/d in the 2030.

However, “none of that analysis accounts for new strata. None of that analysis accounts for new fracturing or stimulation techniques,” Jefferies’ Pete Bowden, the global head of industrial, energy and infrastructure investing, said in an exclusive video interview with Hart Energy. “And one of the things that my 25 years in the business has taught me is that good oilfields find a way to keep getting better. The Permian is certainly an example of that.”

Enverus forecasts Permian production will be nearly 8 MMbbl/d by the end of the decade. Speaking during DUG EOC, Daniel Romero, the director of energy strategy for analytical firm Enverus, also said crude prices will too rise along with demand.

The firm in October said the global economy will need about an additional 7 MMbbl/d of liquids production and about 40 Bcf/d of more natural gas by 2030. It expects North America will be capable of delivering 30% to 40% of this at mid-cycle prices of $70 to $80 WTI and $3.50 to $4/MMBtu Henry Hub prices.

But Enverus pointed out that “sub-$60/bbl WTI PV-50 breakeven oil resource has become considerably scarcer in the U.S. since 2022. This is driving global investors and operators to start looking outside of the U.S. for low-cost oily locations.”

The latest Federal Reserve Bank of Dallas survey of E&P firms show companies operating in the Permian’s Delaware need $64/bbl WTI to profitably drill a new well. It’s $62/bbl in the Permian’s Midland.

WTI was trading at nearly $69/bbl early Nov. 27.

In a cyclical business, oil prices can swing wildly with excess capacity and geopolitics at play.

“In a $70 world, Tier 3 is optionality out in the future,” Pickering said, adding there are lots of good resources in the basin. Getting to Tier 2 and Tier 3 acreage will be a function of time and price, he said, noting the Permian is ways away from Tier 2 becoming Tier 1 and Tier 3 becoming Tier 2.

“If the Permian is the marginal barrel in the world five years from now, prices are going up for sure because … the world’s still going to need our 6 million barrels a day,” he added before turning to stripper wells. “I think we’re going to have plenty of them. And eventually the business goes from how well can you drill wells to how well can you produce them.”

The classification of marginal wells, which are not necessarily stripper wells (though the terminology is often interchanged), depend on the price of oil and production costs. A stripper well is defined by the U.S. Internal Revenue Service as a well that produces 15 barrels or less of oil per day or 90,000 cubic feet or less of natural gas per day.

Looking ahead, Pickering sees big companies producing many wells at smaller volumes.

“But that’s the history of this business. We’ve been doing that forever and people know how to do that,” he said. “I’m optimistic about both the small ball and the big ball, both being pretty active for the foreseeable future.”

Recommended Reading

Baker Hughes: US Drillers Add Oil, Gas Rigs for Third Week in a Row

2025-02-14 - U.S. energy firms added oil and natural gas rigs for a third week in a row for the first time since December 2023.

Blackstone Buys NatGas Plant in ‘Data Center Valley’ for $1B

2025-01-24 - Ares Management’s Potomac Energy Center, sited in Virginia near more than 130 data centers, is expected to see “significant further growth,” Blackstone Energy Transition Partners said.

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

Cummins, Liberty Energy to Deploy New Engine for Fracking Platform This Year

2025-01-29 - Liberty Energy Inc. and Cummins Inc. are deploying the natural gas large displacement engine developed in a partnership formed in 2024.

US Drillers Add Oil, Gas Rigs for First Time in Eight Weeks

2025-01-31 - For January, total oil and gas rigs fell by seven, the most in a month since June, with both oil and gas rigs down by four in January.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.