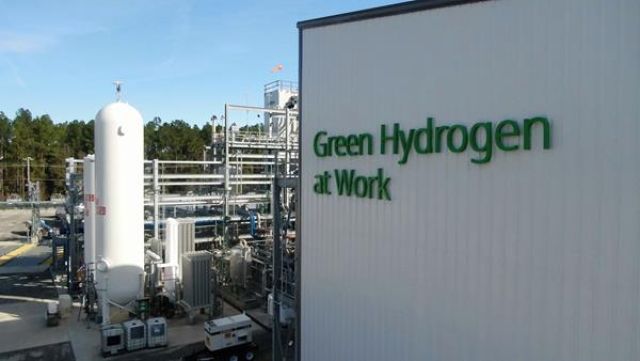

Plug Power has started producing liquid green hydrogen at its Georgia plant. (Source: Plug Power Inc.)

Plug Power said on Jan. 23 that it has secured over $1 billion in government funding and started producing liquid green hydrogen at its Georgia plant, sending the company's shares up about 20% in morning trade.

The hydrogen fuel cell firm said it has finalized a term sheet negotiation with the U.S. Department of Energy (DoE) for a $1.6 billion loan facility.

The company has been facing liquidity issues amid supply challenges in the liquid hydrogen market in North America, and had raised going concern doubts in November. It also planned a $1 billion equity raise earlier this month.

"This funding, when received, will support the development construction and ownership of up to six hydrogen production facilities, significantly advancing green hydrogen deployment in the United States," CEO Andrew Marsh said during an investor call.

"With our Georgia plant operational, and the Tennessee plant coming online, we expect a significant reduction in costs," he added.

Talking about the Georgia plant, Marsh said while "the construction took slightly longer than expected," the facility will bolster Plug's supply of liquid hydrogen deliveries to its customers for material handling operations, fuel cell electric vehicle fleets and stationary power applications.

The plant, which the company said is the largest liquid green hydrogen plant in the U.S. market, is designed to produce 15 tons per day of liquid electrolytic hydrogen.

"The DoE loan facility seems well baked, but we have to wait until the second half of 2024. Seems they are getting the finance options they need and wiggling out of a very tight spot," said Craig Irwin, an analyst at Roth Capital Partners.

As companies are moving towards their net-zero emission targets, hydrogen, a zero-emission gas at point-of-use, serves as both a fuel and as energy storage, helping them reduce their carbon footprint.

The company said the production is expected to positively impact its bottom line and provide an additional step change in fuel margin expansion.

Recommended Reading

LNG, Crude Markets and Tariffs Muddy Analysts’ 2025 Outlooks

2024-12-12 - Energy demand is forecast to grow as data centers gobble up more electricity and LNG liquefaction capacity comes online in North America, but gasoline demand may peak by 2025, analysts say.

US Crude Oil Stocks, Excluding SPR, Fall to 2-Year Low, EIA Says

2025-01-15 - Crude inventories fell by 2 MMbbl to 412.7 MMbbl in the week ending Jan. 10, the EIA said, compared with analysts' expectations in a Reuters poll for a 992,000-bbl draw.

Oil Prices Ease as US Tariffs On Mexico Paused for a Month

2025-02-03 - WTI crude futures were down $0.04, or 0.01%, at $72.49 after climbing as much as 3.7% earlier in the session to reach their highest since Jan. 24 at $75.18.

Predictions 2025: Downward Trend for Oil and Gas, Lots of Electricity

2025-01-07 - Prognostications abound for 2025, but no surprise: ample supplies are expected to keep fuel prices down and data centers will gobble up power.

US Crude Stocks Fell Last Week as Exports Jumped, EIA Says

2024-12-18 - Crude inventories fell by 934,000 bbl to 421 MMbbl in the week, the EIA said, compared with analysts' expectations in a Reuters poll for a 1.6-MMbbl-draw.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.