Chesapeake COO Josh Viets said AI data centers—particularly those loaded with GPU (graphic processing unit) chips—in the U.S. alone may require an extra 7 Bcf/d and up to as much as an extra 16 Bcf/d. (Source: Hart Energy)

Power-grid operators that are already scrambling to meet current U.S. electricity demand have another thing coming: the 30-times more energy-intensive AI chip revolution.

“They're incredibly power hungry,” Josh Viets, Chesapeake Energy’s COO, said at Hart Energy’s DUG GAS+ Conference and Expo in Shreveport, Louisiana, in late March.

And since AI data centers work night shifts too, that requires on-demand power generation, such as with natural gas rather than solar—or explain to a 10-year-old gamer why Fortnite doesn’t work after dark. (Or just shrug and suggest Googling it.)

Viets said AI data centers—particularly those loaded with GPU (graphic processing unit) chips—in the U.S. alone may require an extra 7 Bcf/d and up to as much as an extra 16 Bcf/d.

Current U.S. natgas consumption for all uses is some 100 Bcf/d as of early April, including exports, according to the Energy Information Administration.

“Of course that is all predicated on how much natural gas contributes to the power sector,” Viets added. “But 16 Bcf/d between now and the end of the decade is a really big number.”

Chesapeake will be the U.S.’ largest gas producer upon successfully merging with Southwestern Energy, totaling 7.3 Bcf/d net, combined. The deal is expected to close later this year, once clearing a federal review.

Toby Rice, president and CEO of EQT Corp., currently the largest U.S. gas producer at 6.1 Bcf/d net, told Hart Energy in March, “When you think about [it], one of these AI chips will consume about as much electricity as a Tesla.”

Nvidia Corp. reportedly has a 90% market share in GPU chips, which are the next-gen chip following the CPU.

“Nvidia plans to produce as many as 8 million AI chips a year,” Rice said.

Altogether AI GPUs may consume as much electricity by 2030 as current residential demand. “That would be a 20% increase in electricity demand,” Rice said.

New in-basin natgas use

Locating more AI data centers in northern Virginia—known today as “Data Center Alley”—and nearby may be a work-around to trying to get Marcellus and Utica gas out of the Appalachian Basin, Rice added.

The basin is constrained to some 35 Bcf/d, while federal regulators have denied new interstate export projects.

The basin could produce 70 Bcf/d if unconstrained, Rice said. “That's a lot of energy we have.”

U.S. electricity demand may grow 81% in five years on a compounded annualized basis, John Ketchum, CEO of powergen operator NextEra Energy, said at CERAWeek by S&P Global in March.

Rice told Hart Energy, “Tech moves at the speed of light and we may not have the time to wait seven or 10 years to get nuclear facilities built to support this growth.

“The only energy source that has proven to meet rapid demand expansion is natural gas.”

Can the grid deliver?

Data centers’ global power-draw was 460 TWh in 2022 and may be more than 1,000 TWh as soon as in 2026, credit-rating firm Morningstar DBRS reported April 1, citing an International Energy Agency forecast.

“AI models and data centers are energy-intensive, requiring not only the direct use of electricity for data processing and storage but also energy for cooling systems to prevent overheating,” Morningstar analyst Jasper Shi wrote.

“Additionally, the energy demand from AI technology is continuous, as many … run around the clock.”

U.S. generating capacity is some 1.3 million megawatts (MW), according to the American Public Power Association.

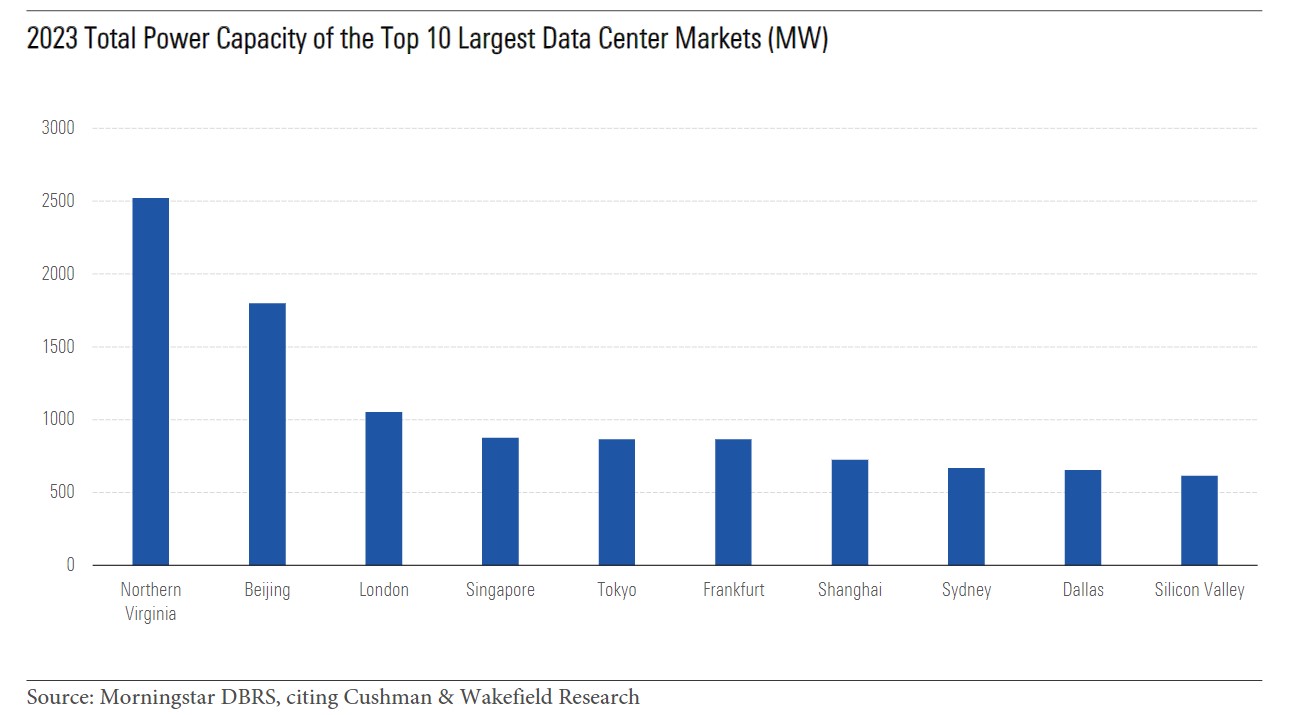

Northern Virginia uses 2,500 MW of power. Shi noted that the area’s provider, Dominion Energy, told center operators last summer it couldn’t serve new facilities.

Grid operator PJM, which also serves Pennsylvania and all or parts of 11 other states, plus Washington, D.C., notified customers that it will be power-short within the next five to seven years, according to power generator Vistra Corp.

Warren Buffett warned in his annual letter to shareholders in February that he has an “ominous” outlook for future U.S. electric-power supply. “When the dust settles, America’s power needs and the consequent capital expenditure will be staggering,” he wrote.

Berkshire Hathaway Energy has 5.3 million power and natural gas accounts in 11 states. Its generating capacity, including in the U.K. and Canada, is 36,000 MW, including capacity under construction.

U.S., not Qatar

And demand growth for U.S. natural gas won’t be just domestically: Allies want AI data centers of their own. So the demand for U.S. LNG exports will grow, according to Rice and Viets.

Viets said, “At the end of the day, what this is telling us is that natural gas will continue to play a vital role in the energy mix going forward.”

Could the U.S. see more industry reshoring as a result of natural gas supply?

“We're already seeing that,” Viets said. “That's even outside of the computing and data infrastructure space.

“And the reason why we can support this going forward so much better than anybody else is because of the abundance of resource that we have.”

In a Hart Energy interview, Viets added, “Combined with EVs and broader electrification across the residential and commercial sectors has just created additional [powergen] upside [for] the natural gas markets.”

If not for U.S. natgas, would America’s and its allies’ data centers be in Qatar?

Rice: “Without the shale revolution, America would be in a very bad spot.”

Recommended Reading

Liberty Capitalizing on Power Generation as Completions Stay Flat

2025-01-31 - New Liberty Energy Inc. CEO Ron Gusek says company is ‘uniquely positioned’ to deliver modular units for data centers.

Oxy CEO: US Oil Production Likely to Peak Within Five Years

2025-03-11 - U.S. oil production will likely peak within the next five years or so, Oxy’s CEO Vicki Hollub said. But secondary and tertiary recovery methods, such as CO2 floods, could sustain U.S. output.

Shell Takes FID on Gato do Mato Project Offshore Brazil

2025-03-23 - Shell Plc will be the operator and 50% owner, with Ecopetrol holding 30% interest and TotalEnergies 20%.

TGS Launches Advanced Imaging Centers for Petrobras

2025-01-21 - TGS' 4D technologies will provide enhanced subsurface clarity in basins offshore Brazil for Petrobras.

APA's Apache Reports Another Oil Discovery on Alaska's North Slope

2025-03-17 - APA Corp. and its partners plan flow tests after the success of the Sockeye-2 exploratory well.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.