U.S. LNG exports the week of July 8 averaged 11.7 Bcf/d, according to J.P. Morgan Securities, accounting for roughly all of the unloaded Freeport daily export capacity. (Source: Shutterstock)

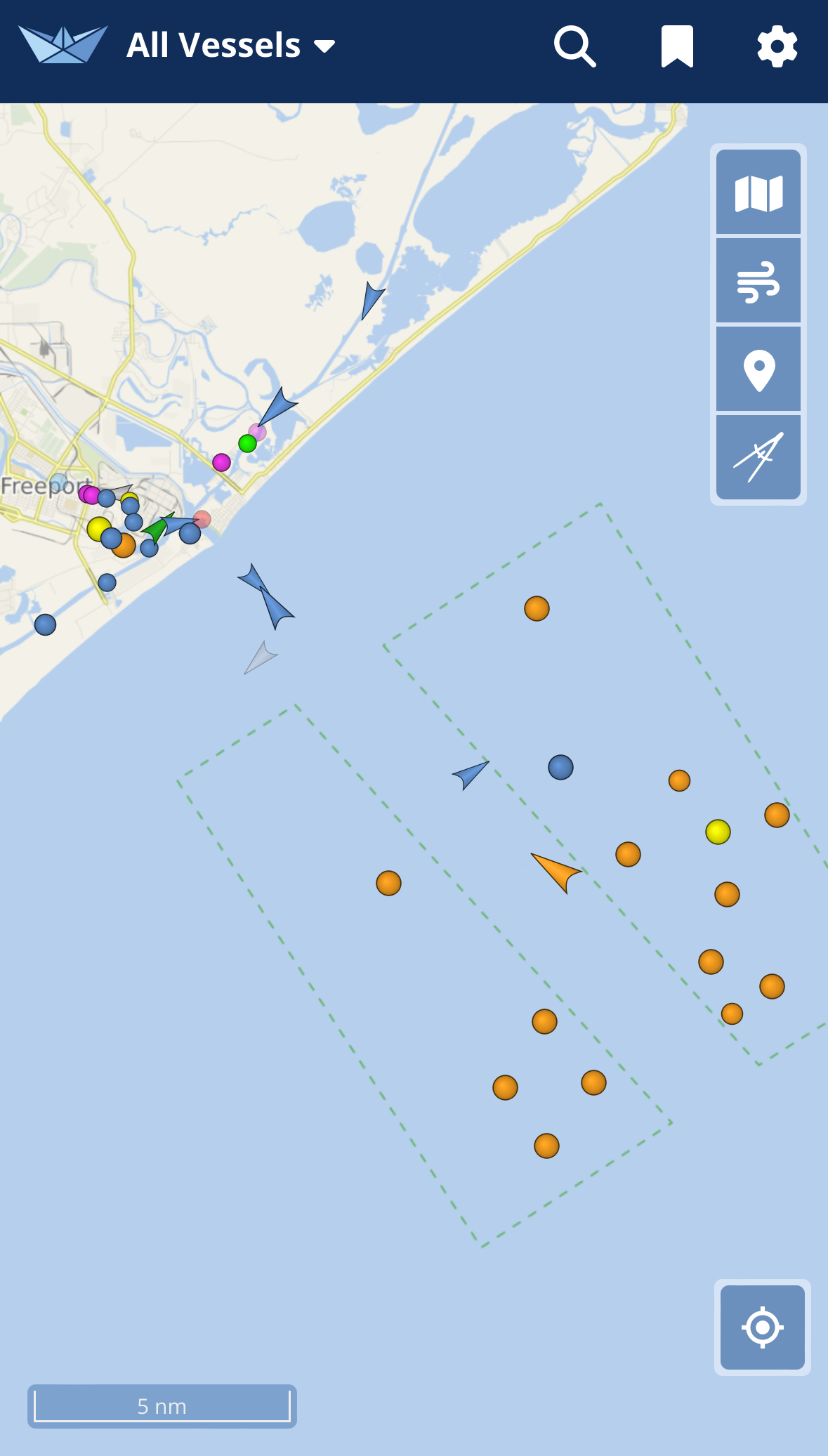

Five LNG tankers were anchored offshore Freeport, Texas, the morning of July 15 awaiting the reopening of Freeport LNG and the port to vessels with drafts of more than 39 ft, according to sources.

LNG tankers’ drafts are, at times, more than 40 ft.

Port Freeport is home to the 2-Bcf/d Freeport LNG export terminal. It closed July 7 ahead of the arrival of Hurricane Beryl, which landed 45 miles west at approximately 4 a.m. July 8 at Matagorda Beach as a Category 1 storm, according to the National Hurricane Center (NHC).

The tropical system sustained hurricane-strength winds for approximately 100 miles inland, according to the NHC.

Nine additional tankers—handling crude oil and refined petroleum products, including LPG—were also parked offshore the port the morning of July 15, according to VesselFinder.

In port were primarily tug boats and an LPG tanker, which has a shallower draft. Another LPG tanker was entering the port the early afternoon of July 15.

A last update by Port Freeport on its full reopening was made the afternoon of July 10: “Updates will be posted as more details are available.”

A spokesman told Hart Energy early afternoon July 15 that the draft restriction had been raised to 39 ft. It did not have a date yet on when all ship traffic would resume. The port’s depth is between 46 ft and 48 ft in average low-water conditions and has an authorized depth of between 51 ft and 56 ft.

Freeport LNG offline

Meanwhile, the Freeport LNG facility was not yet ready to resume loading, it told Hart Energy.

“We are safely progressing our efforts towards the phased restart of our liquefaction operations,” said Heather Browne, Freeport LNG’s director of corporate communications. “We are completing initial repairs on the damage sustained to our [air coolers] … and anticipate restarting the first train this week.

“We plan to restart the remaining two trains shortly thereafter. Production levels after restart will be at reduced rates for a period of time as we continue repairs while operating the facility. Production will steadily ramp up to full rates as these repairs are completed.”

LNG exports

U.S. LNG exports the week of July 8 averaged 11.7 Bcf/d, according to J.P. Morgan Securities, accounting for roughly all of the unloaded Freeport daily export capacity.

Typical daily U.S. exports are between 13 Bcf/d and 14 Bcf/d.

“The decrease … was driven largely by lower volumes from Freeport due to the impact from Hurricane Beryl,” J.P. Morgan analyst Arun Jayaram reported.

LNG loading was also interrupted at Corpus Christi, Texas, which was the hurricane’s target as of the morning of July 7, but the storm drifted eastward that afternoon. The port there reopened the next day.

Corpus Christi was on the west side of the hurricane’s eye—the side typically unscathed by brutal winds and flooding. Instead, the west side of a well-organized tropical storm experiences a mild northerly wind that pushes water south into the Gulf of Mexico.

Tankers at anchor along the Texas coast pushed into the Gulf’s deepwater on July 7 in advance of the storm and began returning to near shore after it blew through the next day.

LNG prices, Mexico exports

The prompt-month price on July 15 was $10.16/MMBtu for LNG delivered to the Dutch TTF (title transfer facility) in the Netherlands, according to CME Group.

The highest contract price for delivery to the TTF through December 2027 is the January 2026 contract at $12.59/MMBtu.

Delivery to the JKM (Japan-Korea Marker) was $12.33, according to CME Group trading on July 15. The highest price for deliveries through December 2029 was the January 2026 contract at $13.99/MMBtu.

Exports to Mexico via pipe were 6.7 Bcf/d—nearly the maximum capacity of some 7 Bcf/d—during the week of July 8, according to J.P. Morgan’s Jayaram. The June average was also 6.7 Bcf/d, he added.

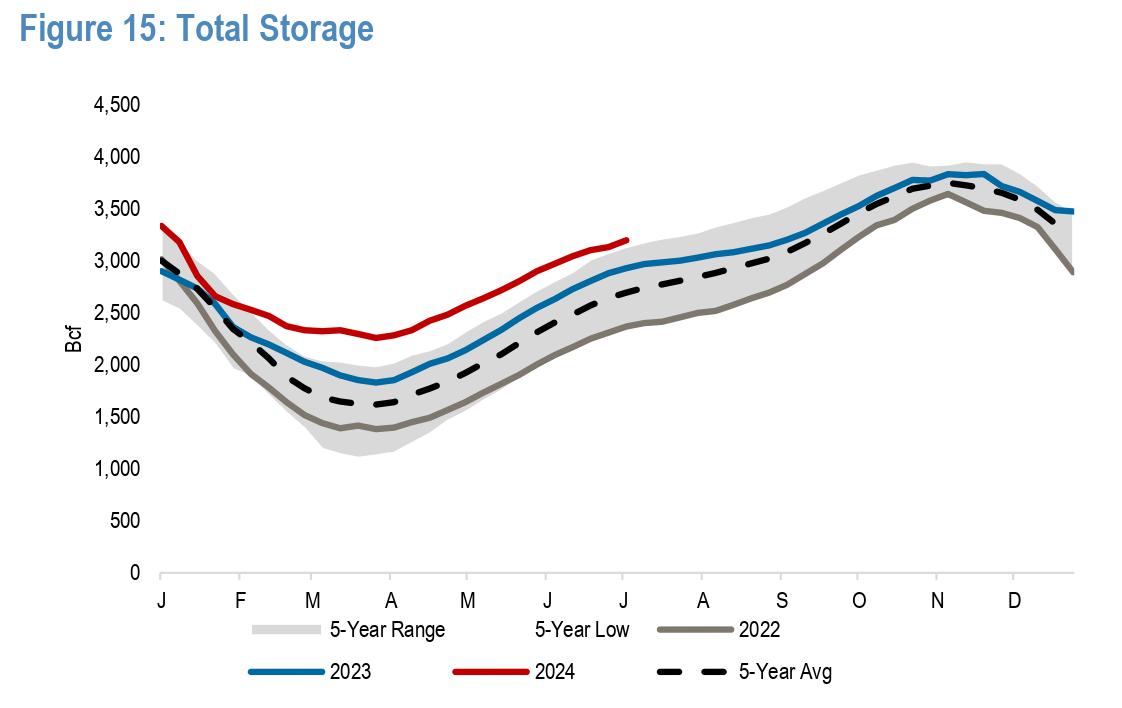

Meanwhile, U.S. gas in storage the week ending July 5 was 3.2 Tcf, according to the U.S. Energy Information Administration’s (EIA) most current weekly count.

The total was up from 2.93 Tcf at the same time in 2023 and up 830 Bcf, or 35%, from the 2.37 Tcf in early July 2022, according to EIA data on historical U.S. gas in storage.

Recommended Reading

Marketed: Hess 3-Well Package in Bakken Shale

2024-12-11 - Hess Corp. has retained EnergyNet for the sale of a three-well Bakken Shale package in Mountrail and Ward counties, North Dakota.

On The Market This Week (Jan. 27, 2025)

2025-02-02 - Here's a roundup of marketed oil and gas leaseholds in Appalachian and the Central basins from select sellers.

Marketed: Slash Exploration Delaware Basin Opportunity

2024-12-17 - Slash Exploration Ltd. has retained EnergyNet for the sale of working interest participation in the Capitan 22301 27-22 State Com #20H wellbore in Lea County, New Mexico.

PE Firm Bluewater to Sell Apex International Energy

2025-02-10 - Since Bluewater first invested in Apex International Energy in 2018, the company has grown to be one of the top 10 upstream producers in Egypt.

Freehold Closes $182MM Acquisition of Midland Basin Interests

2024-12-16 - Freehold Royalties’ acquisition from a private seller includes around 1,300 boe/d of net production and 244,000 gross drilling acres largely operated by Exxon Mobil and Diamondback Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.