(Source: Quantent Energy Partners)

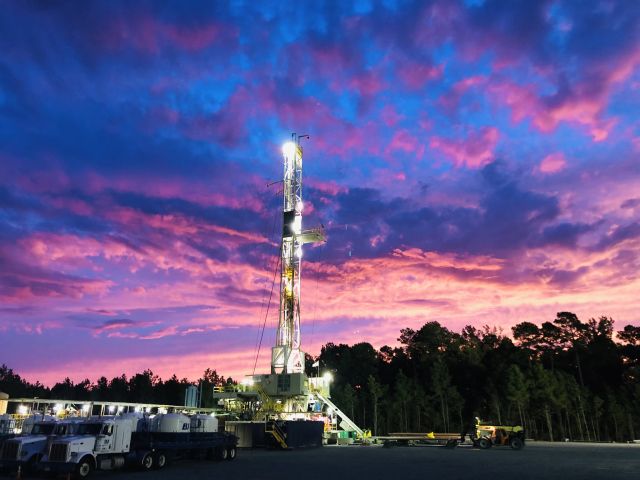

Post Oak Energy Capital has closed an equity commitment to Quantent Energy Partners LLC, which simultaneously completed its initial acquisition of natural gas assets in the Haynesville Shale.

Quantent’s acquisition includes more than 7,000 net acres located in North Louisiana, underpinned by an attractive combination of producing wellbores and operated development inventory, according to a Sept. 9 press release. Financial details of the transaction weren’t disclosed.

Quantent has cultivated “a deep pipeline of opportunities” and is engaged in pursuing assets and development projects across the region. The company is working to grow its footprint in the Haynesville.

The Quantent management team has extensive operating experience in the region and intends to target upstream development opportunities in the Haynesville and Bossier shale formations across North Louisiana and East Texas.

Headquartered in Oklahoma City, Quantent’s leadership includes industry veterans and co-founders Kevin DeLay, CEO, and Todd Nance, COO. The Quantent management team’s key leadership has a long history of successfully drilling and completing horizontal wells targeting the Haynesville formation in partnership with Post Oak.

“We are proud to announce the successful formation of our partnership with Post Oak and the completion of our initial acquisition,” DeLay said in the press release. “Our team has a deep familiarity with building upstream ventures in collaboration with Post Oak in the Haynesville and are confident that we have a partner that will provide us with the support and resources required to succeed. We are excited to continue to leverage our operational track record to drive value from the acquired asset base as well as subsequent opportunities in the region.”

Post Oak’s Frost Cochran, managing director and founding partner of Post Oak, said the private equity firm is pleased to again partner with Quantent in its newest venture and is “highly confident in their ability to unlock value in a region where they possess a distinguished track record of assembling and developing upstream assets.”

“The growing need for responsible development and operation of natural gas assets that are strategically located in close proximity to key demand centers in the Gulf Coast region will complement Quantent’s strategic approach to building its latest upstream enterprise,” Cochran said.

Recommended Reading

Advanced Tech Not Delivering Results? Get Skillsets Up to Speed, EY Says

2025-03-03 - The EY Future of Energy Survey found that a skill gap runs across the oil and gas industry, making it difficult for advanced technologies to deliver on their promised results, an EY executive said.

What's Affecting Oil Prices This Week? (March 3, 2025)

2025-03-03 - For the upcoming week, Stratas Advisors expects oil prices to continue bouncing around but overall trend upward.

NextDecade Plans 3 More Trains at Rio Grande LNG

2025-02-28 - Houston-based NextDecade continues to build the Rio Grande LNG Center in Brownsville, Texas, as its permits filed with the Federal Energy Regulatory Commission continue to go through the legal process.

Diversified Closes Summit Natural Resources Deal for $42MM

2025-02-27 - Diversified Energy Co. Plc closed its deal with Summit Natural Resources to buy operated natural gas assets and midstream infrastructure for approximately $42 million, the company said Feb. 27.

Vår Energi Makes Third Oil Discovery in Barents Sea

2025-02-27 - Vår Energi has discovered a third offshore oil reserve in the Goliat area of the Norwegian Continental Shelf as part of an exploratory collaboration with Equinor.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.