Post Oak has recently backed a number of teams, most recently committing equity behind Delaware Basin-focused Ichthys Energy Partners. (Source: Shutterstock/ Post Oak Energy Capital)

Post Oak Energy Capital is continuing to roll out new portfolio companies across the Lower 48—including the Permian Basin and Haynesville Shale—with its latest move on Oct. 15 backing Utica liquids player Tiburon Oil & Gas Partners.

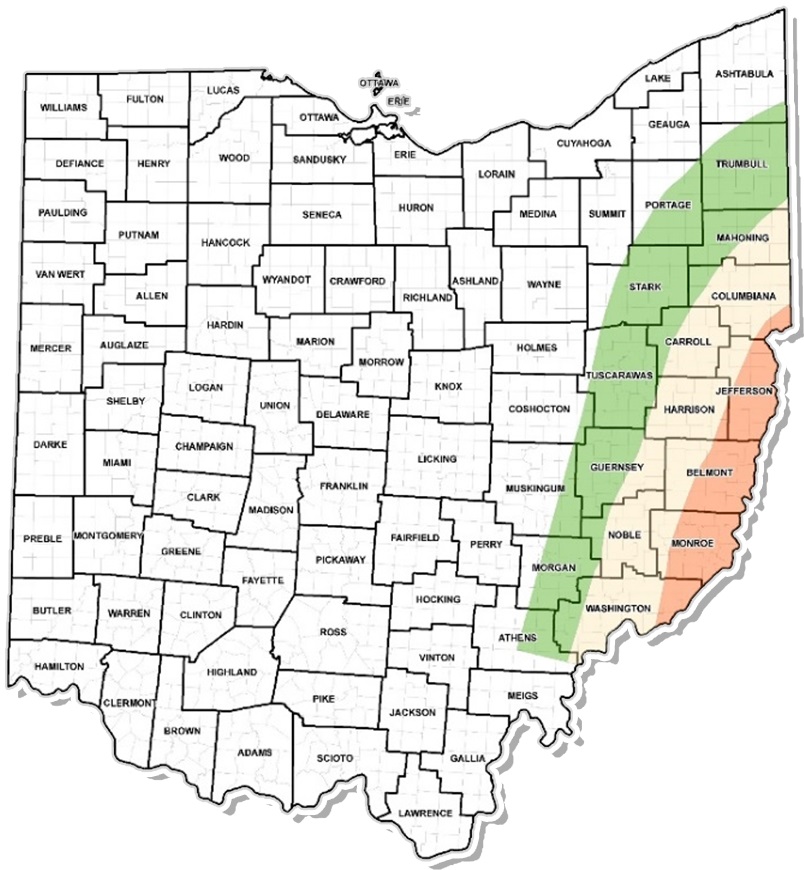

Tiburon closed on an initial acquisition of leasehold in the liquids-rich portion of the Utica Shale in Ohio in conjunction with the equity backing by Post Oak, along with commitments from Tiburon’s management team and other investors.

Post Oak has recently backed a number of teams, most recently committing equity behind Delaware Basin-focused Ichthys Energy Partners. Ichthys has not yet made an acquisition. In September, Post Oak also backed Quantent Energy Partners LLC, which completed an initial acquisition of natural gas assets in the Haynesville Shale.

Tiburon has received its initial unitization permit to develop a portion of its existing Utica position and is in the process of aggregating additional leasehold to move forward with its first phase of development.

Tiburon’s leadership team played an instrumental role in executing growth at Carrizo Oil & Gas, Post Oak said. The team has “a successful track record of working together in Appalachia and other key U.S. unconventional basins,” Post Oak said.

Based in Houston, Tiburon’s leadership includes industry veterans Scott Hudson, president and CEO; Andy Agosto, vice president of commercial and reserves; David Friedman, vice president of land; and Coleby Weinstock, vice president of operations.

Frost Cochran told Hart Energy earlier this month that Post Oak wants to sponsor younger management teams, such as the leadership behind Ichthys, that are “just getting started with their first company.”

Cochran said private equity has to constantly source new young teams “who have the skill sets and capabilities … with some support from us from the capital side. And whatever we can do to try to match assets with teams, we do as well,” he said.

Tiburon CEO Hudson said the company has a well-defined lease and drill strategy, paired with a strong management and execution team, that will position it to effectively access the Utica region's resources.

“With a solid foundation already established in the region, our focus will be on efficiently drilling and developing our leasehold while continuing to grow our position,” Hudson said.

Henry May, Post Oak director, said the Tiburon team organically generated an attractive position in the Utica, “and we are pleased to formalize the investment and partner with this incredibly talented team.”

“The liquids rich window of the Utica is experiencing a developmental renaissance, and we appreciate the opportunity to provide capital and insights alongside Tiburon to responsibly develop an asset that will provide both decades of critical energy supply to consumers and attractive returns to our investors,” May said.

Holland & Knight LLP served as legal adviser to Tiburon and Latham & Watkins LLP served as legal adviser to Post Oak in connection to the formation of Tiburon.

Recommended Reading

NatGas Shouldering Powergen Burden, but Midstream Lags, Execs Warn

2025-02-14 - Expand Energy COO Josh Viets said society wants the reliability of natural gas, but Liberty Energy CEO Ron Gusek said midstream projects need to catch up to meet demand during a discussion at NAPE.

Market Volatility Sidelining Some Energy Investment

2025-03-18 - Needed permit reform will take time and general policy uncertainty could slow-play natural gas projects.

Bottlenecks Holding US Back from NatGas, LNG Dominance

2025-03-13 - North America’s natural gas abundance positions the region to be a reliable power supplier. But regulatory factors are holding the industry back from fully tackling the global energy crisis, experts at CERAWeek said.

FERC Chair: Gas Needed to Head Off US Grid’s ‘Rendezvous with Reality’

2025-03-13 - Federal Energy Regulatory Commission Chairman Mark Christie is pushing natural gas to feed U.S. electrical grids before a “rendezvous with reality” occurs.

NextEra Energy, GE Vernova Partner to Bolster US Grid

2025-01-27 - The CEO of NextEra Energy, which has entered a partnership with GE Vernova, said natural gas, renewables and nuclear energy will be needed to meet rising power demand.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.