(Source: Shuttestock.com)

Private equity firms Post Oak Energy Capital and Genesis Park, the backers of Layne Water Midstream, have sold their interests in the company, according to a July 10 press release. The buyer and financial details of the deal weren’t disclosed.

Layne is a private water and infrastructure company, primarily in the Delaware Basin, founded in 2016 by Layne Christensen, according to the company’s web site. In April 2019, Post Oak and Genesis Park, through investment partnerships each company managed separately, provided a $200 million equity commitment to Layne.

Since then, the companies have worked together to grow the water midstream company’s footprint, primarily in the Delaware Basin.

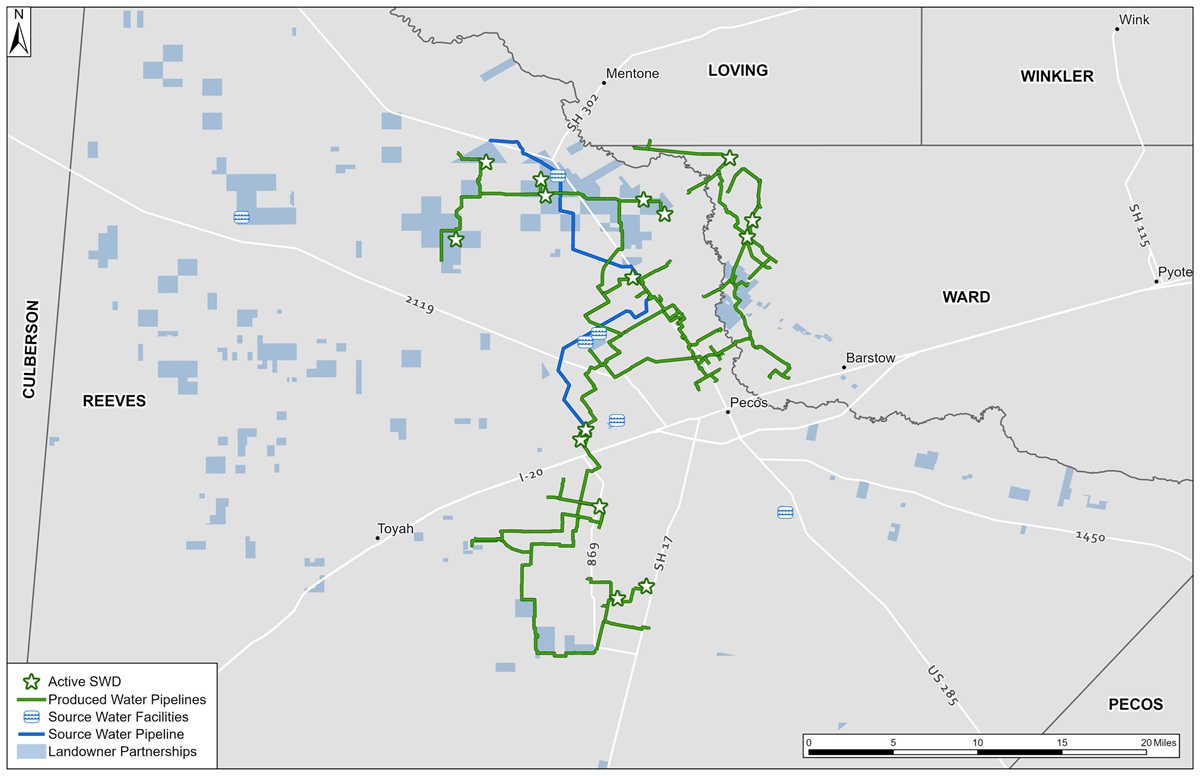

Layne operations include about 200 miles of pipeline and 15 saltwater disposal facilities with a 400,000 bbl/d capacity, according to the company’s website. The company also has several land owner partnerships throughout the northern Midland Basin.

Nomura Greentech acted as financial adviser and Willkie Farr & Gallagher LLP acted as legal counsel to the sellers in connection with the transaction.

Recommended Reading

E&P Highlights: March 10, 2025

2025-03-10 - Here’s a roundup of the latest E&P headlines, from a new discovery by Equinor to several new technology announcements.

Petrobras to Deploy Baker Hughes Completion Technology Offshore Brazil

2025-03-20 - Baker Hughes will be combining its completions technologies with conventional upper and lower completions solutions at Petrobras’ offshore developments.

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Baker Hughes: US Drillers Add Oil, Gas Rigs for Third Week in a Row

2025-02-14 - U.S. energy firms added oil and natural gas rigs for a third week in a row for the first time since December 2023.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.