Enbridge’s 10-megawatt Flanagan Solar facility in Pontiac, Illinois, supplies some of the power needed by the company’s Flanagan South liquids pipeline system. (Source: Enbridge)

Enbridge is perhaps best known for its expansive oil and gas pipeline and infrastructure network, but the company has been steadily bolstering its renewables position as it gears up for a power surge in the U.S.

During the past 22 or so years, the Calgary, Canada-headquartered company has invested billions of dollars to create a renewable and power portfolio of nearly two dozen wind farms and 15 solar farms alongside geothermal, hydrogen and power transmission projects.

With more than 2 gigawatts (GW) of renewable projects either in development or under construction across the U.S., it doesn’t appear to be changing courses—even as other companies pull back on renewables in pursuit of higher returns or in reaction to U.S. regulatory uncertainty.

As the need for clean and lower-carbon power grows, Enbridge is among the companies taking an all-of-the-above approach to providing affordable and reliable energy with sustainability in mind.

Recently, the company sanctioned its $1.1 billion Sequoia Solar project in Texas with long-term power purchase agreements (PPA) in place with AT&T Services and Toyota. The 815-megawatt (MW) solar project will be developed in two phases and is scheduled to enter service in 2025 and 2026.

“If you were to drive from Dallas to Abilene on I-20 about 25 miles east of Abilene, you’ll basically see this project on both sides of the highway,” said Thomas Carbone, vice president of power business development for Enbridge. “It’ll be one of the largest solar projects in North America when it’s fully built out.”

During third-quarter 2024, the company and partner EDF Renewables also put the 250-MW Fox Solar Phase II project into service in Ohio. Construction of the 177-MW Phase III is underway, and the project is scheduled to enter service in the fourth quarter. A long-term PPA is in place with tech giant Amazon for 100% of the solar farm’s production, Enbridge said.

The projects are taking shape as power demand rises.

Rising demand

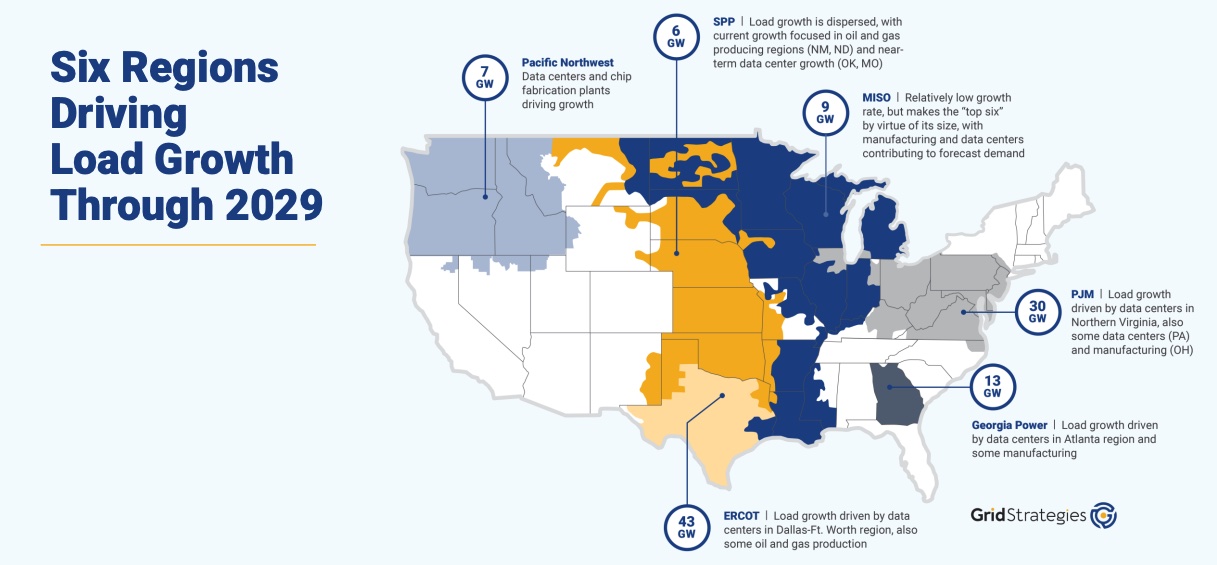

Based on annual planning reports submitted by power grid managers to the Federal Energy Regulatory Commission, U.S. power demand could grow to 67 GW within the next five years, according to a December report published by Grid Strategies.

But preliminary estimates show an additional 61 GW of growth by 2029— pushing forecasted demand up 15.8%, or 128 GW.

Growth will be driven by a rise in artificial intelligence, advanced manufacturing, electrification of transportation and buildings, oil and gas production and hydrogen fuel plants, according to the report.

“If the updated forecast is correct, annual peak demand growth will average 3% per year over the next five years,” Grid Strategies said in the report. “While 3% growth may seem small to some, it would mean six times the planning and construction of new generation and transmission capacity.”

Load growth in the Electric Reliability Council of Texas, for example, is forecast to jump by 43 GW due to data centers in the Dallas-Fort Worth region and some oil and gas production, according to the report.

“There’s such load growth now that we’re seeing here in Texas and across the country, the challenge there is getting that power to where the load is,” Carbone said, adding transmission is a major challenge. “We have great resources for wind and solar. That is sort of disconnected with where we see load growth and how do we do that. Do we move to more of distributed models of bringing energy generation closer to load? Do we invest in the longer-term high voltage transmission systems? All of that is in play at the moment. I don’t think there’s one single bullet that’s going to resolve that challenge.”

Texas is among the regions were Enbridge sees great potential for more renewable projects based on not only resource availability but also the regulatory environment. The Lone Star State is already among the nation’s leaders in solar and wind power generation.

“Texas in general has been a really good market both for regulatory perspective, the business climate perspective and also from a landowner perspective. Using the land for agriculture, for cattle, for oil and gas, renewables is what they’re used to,” Carbone said.

Integrated solutions

In other parts of the U.S., Enbridge also benefits from having a renewable energy footprint near its so-called power pipeline super systems, Carbone said, “and now with the acquisition of Dominion’s gas utilities in the fall also very close to some of our gas distribution utility service territories as well.”

The pipeline operator acquired three gas utilities from Virginia-based Dominion Energy in a $14 billion deal in 2023. The deal included the purchase of East Ohio Gas Co., Questar Gas Co. and its related Wexpro companies and Public Service Co. of North Carolina Inc. (PSNC). Enbridge became the largest natural gas utility in the U.S. in October 2024 with the closing of its $3.1 billion acquisition of PSNC, which serves more than 600,000 customers in North Carolina.

“What we’re trying to see is … can we provide an integrated solution where it’s not just clean and renewable energy, but it’s also firmer, dispatchable power as well,” Carbone said. “That may be done in partnership with other companies. Obviously, we can bring the gas and bring some of our interconnection knowhow.”

Carbone, who worked for renewables developer Tri Global Energy before it was acquired by Enbridge in 2022, has been in the renewables business for more than two decades. In the early days, he said, the industry was chasing resources in areas with the best wind or solar irradiance.

“Those are still important today. But even more important now is where can I inject that power and get the least amount of curtailment where I still have a competitive price,” he said. “So, a lot more effort is going into strategically selecting our locations based on transmission availability and where load growth is.”

Developing projects with acceptable returns that compete against the rest of the portfolio is still required. “One of the tenets of Enbridge investments, as well, is that these assets have contracted revenues and longer-term contracts of typically at least 15 years,” Carbone said. “So that gives us that sort of ongoing steady cash flow outlook and it allows Enbridge to consistently meet its dividend targets as it has done for the last 29 years.”

Facing challenges

The business, however, is not without challenges. Carbone singled out permitting for both gas generation and renewables as well as community engagement.

“I’ve learned being at Enbridge for two years, given the fact that it has done linear development where you’re building a 300-mile pipeline, you’re going through many jurisdictions and there’s a lot of stakeholders you have to deal with,” Carbone said. “It really [requires] a hands-on approach and sensitive approach to how do you address community engagement and get support.

“I think Enbridge does as good if not better than almost anybody that I’ve seen,” he added. “We’re certainly benefiting from that capability of power generation side when we’re dealing with communities with large-scale solar and wind developments.”

RELATED

Permitting Reform Stalls in Congress Despite Industry Support

With a new administration set to enter the White House, thoughts are also on any potential changes in tax policy and tariffs that could impact business.

“There’s also renewable energy credits that are generated, but also the tax benefits, right, whether it’s investment tax credits or production tax credits or even some of the bonuses that go along with those. So, we’re pretty sensitive to what those decisions would look like. … Having been in renewables for 25 years, I’ve seen the ebbs and flows and the ups and downs of the tax policy, and we just have to adapt to it. There are some things that you can do in anticipation of that, looking at potentially how you might strategically procure or safe harbor equipment or start construction on some projects maybe earlier than planned. We’re just going to work with whatever is there.”

Probably of greatest concern is the effects of tariffs on supply chains, he added.

“The good news is that on the wind side, the three or four major wind turbine manufacturers have already done a lot to create domestic supply and then on the solar side, [there’s been] a pretty significant ramp up over the last two years on building U.S.-based assembly facilities for solar panels.”

Curbing inflation and bringing down interest rates to help fuel the economy would be even better for the energy industry, he added.

Enbridge has between 6 GW and 7 GW of renewable power capacity in its development pipeline. The company said it forecasts EBITDA of about $700 million for its renewable power and generation business for 2025, driven by incremental contributions from North American solar and EU offshore wind projects.

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.