Prairie Operating Co. has entered into a definitive purchase and sale agreement to acquire certain Denver-Julesburg Basin (D-J Basin) assets from privately-held Bayswater Exploration & Production in a cash-and-stock deal valued at $602.75 million. (Source: Shutterstock, Prairie Operating Co.)

Prairie Operating Co. has entered into a definitive purchase and sale agreement to acquire certain Denver-Julesburg Basin (D-J Basin) assets from privately-held Bayswater Exploration & Production in a cash-and-stock deal valued at $602.75 million, the companies said Feb. 7.

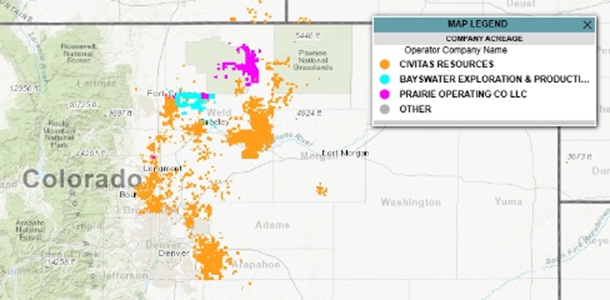

The deal expands Prairie’s D-J Basin footprint, while Bayswater will continue to develop some assets in the basin and keep its holdings in the Permian Basin. The deal’s metrics could also have implications for Civitas Resources, should the company pursue a D-J Basin divestiture.

Prairie said the Bayswater acquisition will add about an average 26,000 boe/d (69% liquids) in net production across ~24,000 net acres in Weld County, Colorado, the company said in a Feb. 7 press release. The transaction will increase the company’s operational scale in the D-J to ~54,000 net acres, including ~600 highly economic drilling locations with about 10 years of drilling inventory.

![[Prairie acquisition map.jpg (Source: Prairie Operating Co.)]](/sites/default/files/inline-images/Prairie%20acquisition%20map.jpg)

Bayswater said separately on Feb. 7 the sale includes 300 producing horizontal wells on 30 pads. The company gave a slightly lower production estimate of 25,000 boe/d. Bayswater said the deal also includes nine DUC horizontal wells and an operated saltwater disposal system.

Following the transaction, Bayswater will retain and operate 70 horizontal wells in the D-J, producing approximately 18,000 boe/d. The company will run one active rig on its remaining Colorado position.

Bayswater will also continue to hold 50,000 acres in Texas’ northern Midland Basin, which the company is actively developing. Bayswater’s Midland position includes 140 horizontal wells producing approximately 20,000 boe/d. The company’s assets there include a large saltwater disposal system. Bayswater affiliate Tejon Treating and Carbon Solutions provides a gas gathering and treating business in the Midland Basin. The Texas assets were unaffected by this transaction.

Prairie’s deal values Bayswater’s proved developed producing (PDP) reserves at PV-20 with a purchase price of $23,500 per net flowing barrel of oil equivalent, Prairie said. The company said it will leverage existing infrastructure to drive operational efficiencies and reduce development costs pro forma for the transaction.

Prairie will fund the transaction with cash and up to 5.2 million share of its common stock. The cash portion will be funded through a combination of cash on hand and borrowings under the company’s credit facility. The company said it has received commitments to expand its borrowing base to $475 million at the closing of the acquisition. Prairie will also apply proceeds from one or more capital markets transactions, subject to market conditions and other factors.

The company expects a leverage ratio of ~1.0x at closing.

Following the transaction announcement, Prairie’s share price fell about 25% to $6.44 per share in mid-day trading on Feb. 7.

“This acquisition delivers compelling strategic and financial advantages and reflects our disciplined, but opportunistic approach to rapidly expand our footprint in the D-J Basin,” said Edward Kovalik, chairman and CEO of Prairie. “Not only will the addition of these high-quality assets be immediately accretive, but they will also accelerate our development plans, enhance operational efficiencies, and drive sustainable, long-term value creation for our shareholders.”

Prairie President Gary Hanna said the acquisition represents a “transformative milestone” for the company by expanding its footprint and production in oil-rich D-J Basin assets.

“Upon closing, we will be well-positioned to deliver significant organic production growth in 2025 and beyond,” he said.

![[Prairie midstream.jpg (Source: Prairie Operating Co.]](/sites/default/files/inline-images/Prairie%20Midstream%20.jpg)

Bayswater has been an operator in the D-J Basin since 2009, and the agreement with Prairie represents the culmination of years of work by the company’s team, said Steve Struna, president and CEO.

“We are proud of the high-quality asset we have built, our reputation as a responsible operator, and the positive impact we have had in surrounding Weld County communities," he said.

The company remain committed to operating in the DJ- Basin and “rebuilding our Colorado footprint with newly raised capital and continuing to responsibly produce Colorado oil and natural gas—the cleanest energy molecules on the planet," Struna said.

Prairie expects to complete the Bayswater acquisition this February, subject to customary closing conditions, with an effective date of Dec. 1, 2024.

The firm of Davis Graham served as Bayswater's legal adviser for the transaction.

Implications for Civitas?

The deal gives some insights into Civitas Resources’ D-J asset values. Civitas has reportedly been weighing a sale of its assets in the basin at a $4 billion price tag.

Gabe Daoud Jr., an analyst at TD Cowen, said Prairie’s deal for the Bayswater assets screens at an implied ~1.6x transaction multiple. Based on Prairie paying $23,500 per flowing boe metric, Civitas 155,000 boe/d suggests a $3.6 billion value for the company’s D-J production.

Daoud said that the $4 billion Civitas asking prices screens light relative to its estimates for Civitas’ net asset value.

“This screens as a PDP-only deal ($25k/flowing on 3Q24 production = ~$3.9Bn) with little/no value placed on undeveloped sticks given regulatory concerns and a short inventory life,” Daoud said in a Feb. 7 report. “At $4Bn this would imply ~2.2x on our '25e DJ only EBITDA of $1.75bn, & a ~23% FCF yield given our estimate of DJ only FCF of ~$900MM.”

That compares to Civitas’ multiple of ~2.4x and a ~23% free cash flow yield.

“Thus a DJ sale would be largely neutral to valuation,” he said. “Overall we carry ~555 MMBoe of [Civitas] DJ resource potential at ~$2.6Bn in our NAV, which combined with PDP value of ~$4Bn would imply ~$6Bn+ for total asset value, but again we'd note it's unlikely a buyer would be willing to ascribe value to undeveloped locations.”

Recommended Reading

Polar LNG Express: North American NatGas Dynamics to Change with LNG Canada

2025-02-21 - The next major natural gas export project in North America has a location advantage with Asian markets. LNG Canada opens up a new pathway that will change the price dynamics for producers.

The Wall: Uinta, Green River Gas Fills West Coast Supply Gaps

2025-03-05 - Gas demand is rising in the western U.S., and Uinta and Green River producers have ample supply and takeaway capacity.

ONEOK, MPLX’s ‘Wellhead-to-Water’ Deal Dominates Permian NGL Race

2025-04-10 - The $1.75 billion ONEOK-MPLX deal reflects how midstream companies are going big in the petrochemicals sector.

Williams Commissions Two NatGas Projects to Expand Transco Network

2025-04-01 - Midstream company Williams Cos. added to its network capacity in the southern U.S. with the commissioning of the Southeast Energy Connector and the Texas to Louisiana Energy Pathway.

Boardwalk Project to Grow Southern Access for Appalachian NatGas

2025-04-02 - Midstream company Boardwalk Pipeline is holding an open season for future new capacity on the Texas Gas Transmission pipeline.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.