Source: Hart Energy

Keane Group Inc. (NYSE: FRAC) will up its pressure pumping services by 25% in the Permian Basin and the Bakken with a deal to buy RockPile Energy Services LLC for $284.5 million, Keane said May 18.

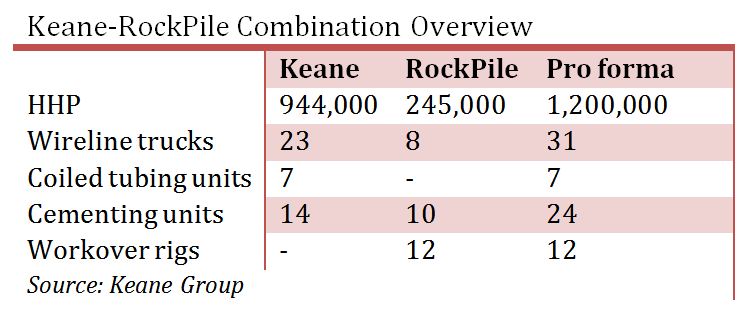

With the acquisition, Houston-based Keane stands to top its fleet out at 1.2 million hydraulic horsepower (HHP) while augmenting its presence in the nation’s most active shale plays, including the Permian, Bakken, Marcellus/ Utica and Scoop/Stack.

The deal continued North American pressure pumping consolidation that included the March joint venture (JV) between Schlumberger Ltd. (NYSE: SLB) and Weatherford International Plc (NYSE: WFT) to create a 2.55 million HHP juggernaut called OneStim. Barclays valued the JV at $3.8 billion.

Keane said its deal works out to about $1,000 per horsepower for 245,000 HHP and bundled wireline units after accounting for working capital and asset values.

“The acquisition of the RockPile business bolsters FRAC’s presence in both the Rockies/Bakken region as well as the Permian Basin region,” said John Daniel, senior research analyst at Piper Jaffray & Co. “Overall, we think this is a smart deal.”

Combined, Keane and RockPile would control 315,000 active horsepower in the Bakken and 415,000 active horsepower in the Permian.

“With line of sight into full utilization of our own fleet by year-end, we believe this strategic, consolidating acquisition adds even greater growth to our platform in an immediately accretive transaction and doing so at attractive economics in line with newbuild” costs, James Stewart, Keane’s chairman and CEO, said in a May 19 conference call.

RockPile’s business bears service and geographic similarities to Keane. The six-year-old company owns a fleet of 245,000 HHP as well as wireline trucks, workover rigs and cement units.

Stewart said the acquisition provides greater service density and an expanded platform that also provides Keane with further capabilities in other service offerings including cementing and workover product in the Bakken.

RockPile, based in Denver, will receive $135 million cash; Keane stock; $26.5 million for capex and adds a contingency payment of up to $20 million should Keane’s common stock price dip below $19 during a nine-month trading period.

Following the close of the transaction, Keane’s net debt will rise to about $228 million and $200 million in liquidity.

Keane executives said RockPile’s gross profit per fleet performance is in line with Keane’s expectation of up to $11 million dollars annualized gross profit per fleet by the end of the third quarter.

Keane expects the transaction to close by July.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.