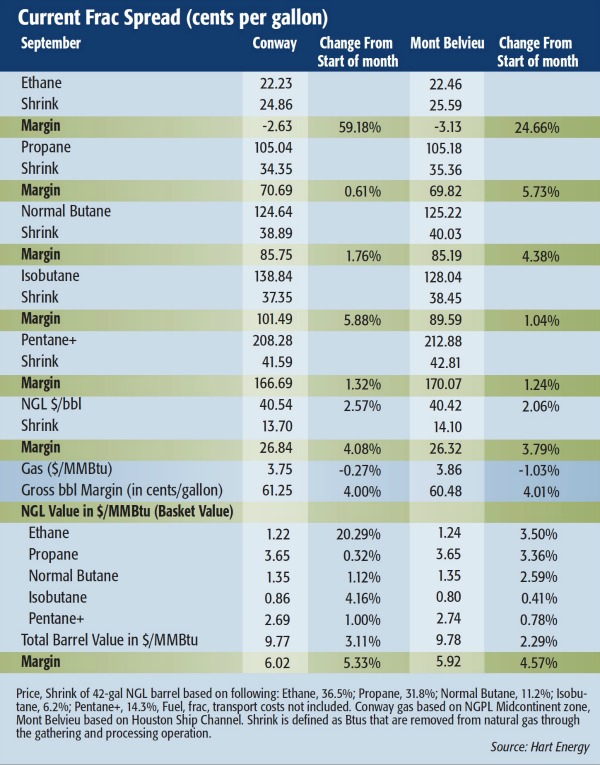

NGL prices improved in early September as several ethane crackers returned to service after undergoing unexpected turnarounds. Surprisingly, the biggest price turnarounds were at the Conway, Kan., hub while improvements at the Mont Belvieu, Texas, hub were marginal with ethane prices decreasing despite the increased cracking available.

Both Westlake Chemical Corp.’s Petro 1 Unit in Lake Charles, La., and Dow Chemical Co.’s LHC-8 plant in Freeport, Texas, restarted after undergoing unplanned maintenance. Dow’s planned turnaround at the LHC-8 facility is likely to occur in late fall. According to reports, the planned turnaround at Chevron Phillips Chemical Co.’s Cedar Bayou cracker in Baytown, Texas, is also expected to be pushed back to 2015. In addition, Formosa Plastics Corp. delayed the planned five-week turnaround at its Point Comfort, Texas, Olefins 1 cracker as a result of steady ethylene spot prices caused by tightening supplies. The turnaround has been moved to late October.

While these schedule changes will increase ethane cracking capacity, ExxonMobil Corp.’s Baytown, Texas, Olefins Plant No. 2 was taken offline for a planned 44-day turnaround. Chevron Phillips Chemical’s Port Arthur, Texas, and The Williams Cos. Inc.’s Geismar, La., plants remain offline while expansions are completed. Both facilities are expected to return to service by the end of October.

Ethane’s challenge

Given these turnarounds, ethane prices are likely to remain challenged at least through the rest of the year as supplies are very high. This has caused prices to remain under 30 cents per gallon for the past few months.

This marks three consecutive weak summers for ethane, largely due to turnarounds. It will take some time for the storage overhang to be worked off, but there is hope that low prices, ample supplies and cracking capacity will entice a petrochemical industry-led run on these excess volumes.

Should this increased capacity bring a price turn, it would be similar to what occurred in the propane market for much of the past year as export terminals opened a new market for the product.

Propane prices were nearly identical at both hubs as export demand increases ahead of Sunoco Logistics Partners LP’s Mariner South project in Nederland, Texas, where operations will begin in early 2015. The U.S. Energy Information Administration reported that propane storage levels increased at a slower rate than anticipated, with a 73 million barrel build the week of Sept. 5. Propane stocks remained at their highest levels in the past 10 years.

Frank Nieto can be reached at fnieto@hartenergy.com or 703-891-4807.

Recommended Reading

Activist Elliott Builds Stake in Oil Major BP, Source Says

2025-02-10 - U.S.-based Elliott is seeking to boost shareholder value by urging BP to consider transformative measures, Bloomberg News reported Feb. 8.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Talos Selects Longtime Shell Exec Paul Goodfellow as President, CEO

2025-02-03 - Shell veteran Paul Goodfellow’s selection as president, CEO and board member of Talos Energy comes after several months of tumult in the company’s C-suite.

Utica Liftoff: Infinity Natural Resources’ Shares Jump 10% in IPO

2025-01-31 - Infinity Natural Resources CEO Zack Arnold told Hart Energy the newly IPO’ed company will stick with Ohio oil, Marcellus Shale gas.

Exclusive: Why Family Offices Favor ‘Lower-Risk’ Oil, Gas Investments

2024-11-22 - Evan Smith, Stephens’ senior vice president for investment banking, describes growth in the company’s network of family offices, specifically those investing in the energy sector, in this Hart Energy Exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.