It is becoming increasingly likely, with supply and demand balances tightening, that the downturn in crude prices is temporary. That belief has pushed West Texas Intermediate (WTI) prices above $60 per barrel. Though the market is still oversupplied and will continue to face challenges until the end of the year, the long-term outlook is still strong.

The biggest improvement for WTI has been declining storage levels at the Cushing, Okla., hub as refinery runs are well above 90% capacity. Since Cushing plays such an important role in the U.S. crude market, working the big storage off at the hub would have a very positive impact on the market.

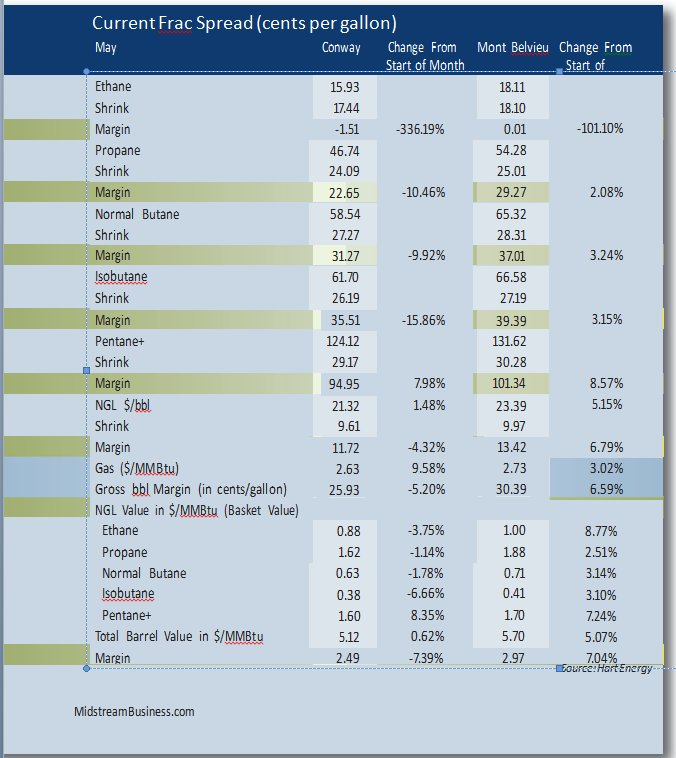

Unfortunately, these improvements haven’t carried over to the NGL market, as prices were largely down as May began. Ethane prices remain stagnant at under 20 cents per gallon, but it is looking more and more likely that demand will move upward in the coming months, which will also tighten supplies in the market because cracking is expected to increase. This will bring more of the volumes currently being rejected to the market.

Price, Shrink of 42-gal NGL barrel based on following: Ethane, 36.5%; Propane, 31.8%; Normal Butane, 11.2%; Isobutane, 6.2%; Pentane+, 14.3%, Fuel, frac, transport costs not included. Conway gas based on NGPL Midcontinent zone, Mont Belvieu based on Houston Ship Channel. Shrink is defined as Btus that are removed from natural gas through the gathering and processing operation.

Ethane prices are beginning to see light at the end of the tunnel but propane prices look like they may trend lower. Targa Resources Partners LP recently declared force majeure at its Hattiesburg, Miss., storage hub following the announcement from Norfit had olk Southern Railroad that that it had embargoed inbound railcars to the hub due to congestion, effective May 1, on an indefinite basis.

The railway specifically cited both the Targa hub as well as Enterprise Products Partners LP’s hub in the region as having too many incoming cars. If this situation doesn’t clear up sooner than later, then propane—at the moment cheaper than gas—could begin to be burned as a fuel in western Canada, the Northern Tier states and Northeast. This would have a negative impact on Mont Belvieu, Texas, NGL hub prices.

This is more troubling since propane decreased a further 3% in early May at both Mont Belvieu and the Conway, Kan., NGL hub. The good news—if you can call it that—is that neither price was the lowest this year, so there remains hope that any further price drop will only hit the previous floor and not drop to a new yearly low.

Natural gas prices had a major uplift the first week of May as the storage injection level was lower than anticipated, which implied that demand was up. This increase had a negative impact on frac spread margins, but it is unlikely gas prices can sustain this rally.

Recommended Reading

PHX Insists Shareholders Reject WhiteHawk’s Latest Offer

2024-11-14 - PHX Minerals’ board maintained its stance on Nov. 14 that WhiteHawk’s latest offer was not in the best interest of its stockholders.

Ovintiv Swaps the Uinta for Montney in Multiple M&A Moves

2024-11-15 - Ovintiv is expanding greatly in the Canadian Montney Shale play through a US$2.38 billion deal with Paramount Resources and exiting the newly booming Uinta Basin in Utah with a $2 billion sale to FourPoint Resources.

Oxy CEO Sheds Light on Powder River Basin Sale to Anschutz

2024-11-14 - Occidental is selling non-core assets in the Lower 48 as it works to reduce debt from a $12 billion Permian Basin acquisition.

Coterra Eyes Wolfcamp D, Penn Shale Upside with $3.95B Permian M&A

2024-11-15 - With $3.95 billion in Permian M&A, Coterra is adding new Delaware Basin locations in the Bone Spring, Harkey and Avalon benches—and eyeing upside from deeper zones.

Roth-Backed SPAC To Take Public Permian Gas, Helium Producer

2024-11-13 - A blank-check company backed by Roth Capital Partners and Craig-Hallum Capital Group aims to combine with Permian gas and helium producer New Era Helium.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.