The sale follows several other divestitures marking regional exits including QEP Resources’ recent $1.7 billion Williston sale as the company aims to become a Permian Basin pure-play. (Source: Hart Energy)

[Editor's note: This story was updated at 2:39 p.m. CST Nov. 20.]

QEP Resources Inc. (NYSE: QEP) said Nov. 19 it will exit the Haynesville Shale region in a divestiture set to finalize the company’s Permian pure-play strategy.

Aethon III, an affiliate of Dallas-based private investment firm Aethon Energy Management LLC, agreed to buy QEP’s Haynesville/Cotton Valley business in northwest Louisiana for $735 million. Aethon III is an investment vehicle formed to acquire onshore assets in North America in partnership with the Ontario Teachers’ Pension Plan and Redbird Capital Partners.

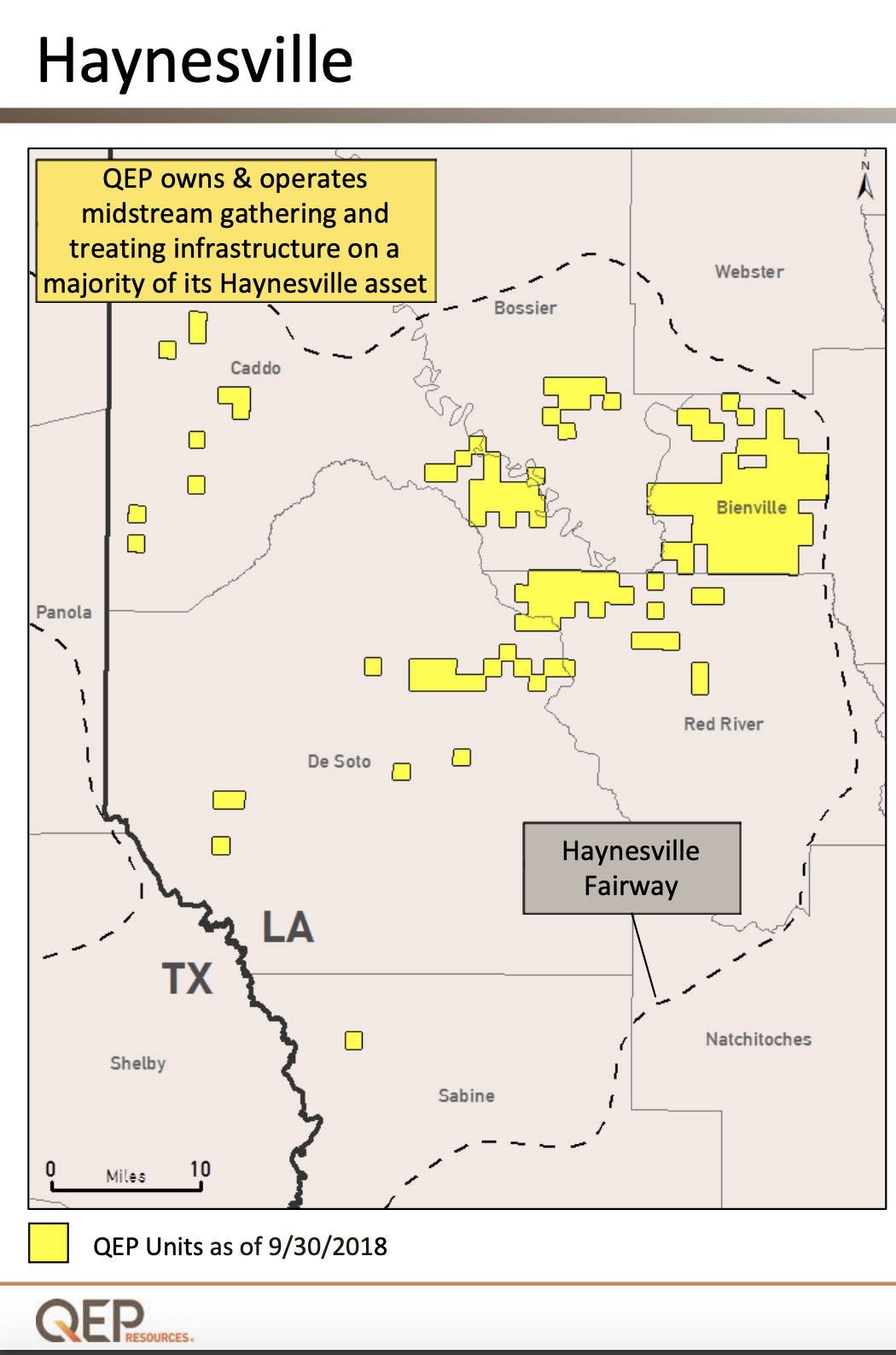

QEP’s Haynesville/Cotton Valley business covers about 49,700 net acres including 137 gross operated producing wells in Northwest Louisiana. Production during the third quarter averaged about 49,500 barrels of oil equivalent per day of production, 100% of which was dry gas. The company also owns and operates midstream infrastructure on a majority of its Haynesville assets.

“The sale of our Haynesville/Cotton Valley business is an important next step in our process of becoming a Permian pure-play company,” Chuck Stanley, QEP chairman, president and CEO, said in a statement.

The sale follows several other divestitures within the past year that marked regional exits by QEP including the roughly $1.7 billion agreement to sell the entirety of its Williston Basin assets in North Dakota and Montana to NGP-backed Vantage Energy earlier this month.

The headline deal price for QEP’s Haynesville exit is roughly in line with previous estimates of roughly $750 million by analysts with Tudor, Pickering, Holt & Co. (TPH).

With most of the proceeds of the company’s Williston sale from earlier this month earmarked for leverage reduction, TPH analysts believe the Haynesville sale will allow QEP to begin executing on its $1.25 billion share repurchase authorization.

“We absolutely think buybacks are the right move given the implication that the market is not paying for growth,” the analysts said in a Nov. 19 research note.

Stanley said proceeds from the Haynesville sale will be used to fund the ongoing development of QEP’s core Permian assets, reduce debt and return cash to shareholders through a share repurchase program.

The company’s latest sale comprises natural gas and oil producing properties, undeveloped acreage and associated gas gathering and treating systems in the Haynesville/Cotton Valley.

QEP put one gross operated well on production in the Haynesville during the third quarter (average working interest 100%). The well had a peak 24-hour IP rate of 34 million cubic feet equivalent per day (100% gas) with a lateral length of 10,622 feet.

Though, by the end of the third quarter, QEP had no drilling rigs in the Hayensville/Cotton Valley region.

As part of the divestiture, Aethon Energy has also agreed to assume all firm gas transportation agreements related to these assets. In addition, QEP will novate natural gas derivative contracts covering roughly 40 billion cubic feet of gas for the last 11 months of 2019 to Aethon.

QEP said it expects to close the Haynesville divestiture in January, subject to closing conditions including regulatory approval. The effective date of the transaction is July 1.

Latham & Watkins LLP provided legal counsel to QEP for the transaction. Weil, Gotshal & Manges LLP and Sidley Austin LLP were Aethon Energy’s legal counsel.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

BP Earns Approval to Redevelop Oil Fields in Northern Iraq

2025-03-27 - The agreement with Iraq’s government is for an initial phase that includes oil and gas production of more than 3 Bboe, BP stated.

DNO ‘Hot Streak’ Continues with North Sea Discovery

2025-03-26 - DNO ASA has made 10 discoveries since 2021 in the Troll-Gjøa exploration and development area.

TechnipFMC Awarded EPCI for Equinor’s Johan Sverdrup Phase 3

2025-03-25 - The Johan Sverdrup Field, which originally began production in 2019, is one of the largest developments in the Norwegian North Sea.

Exclusive: Metal Tariffs Unlikely to Disrupt Lower 48 Supply Chain

2025-03-25 - With tariffs discussions creating uncertainty in the energy sector, Luca Zanotti, Tenaris’ U.S. president, said he sees minimal impact with tariffs on oil country tubular goods, in this Hart Energy exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.