Quantum Capital Group acquired Caerus Oil and Gas’ assets in the Uinta Basin of eastern Utah and the Piceance Basin of western Colorado for $1.8 billion. (Source: Shutterstock.com)

Rockies-focused producer Caerus Oil and Gas sold to Quantum Capital Group through two transactions valued at $1.8 billion.

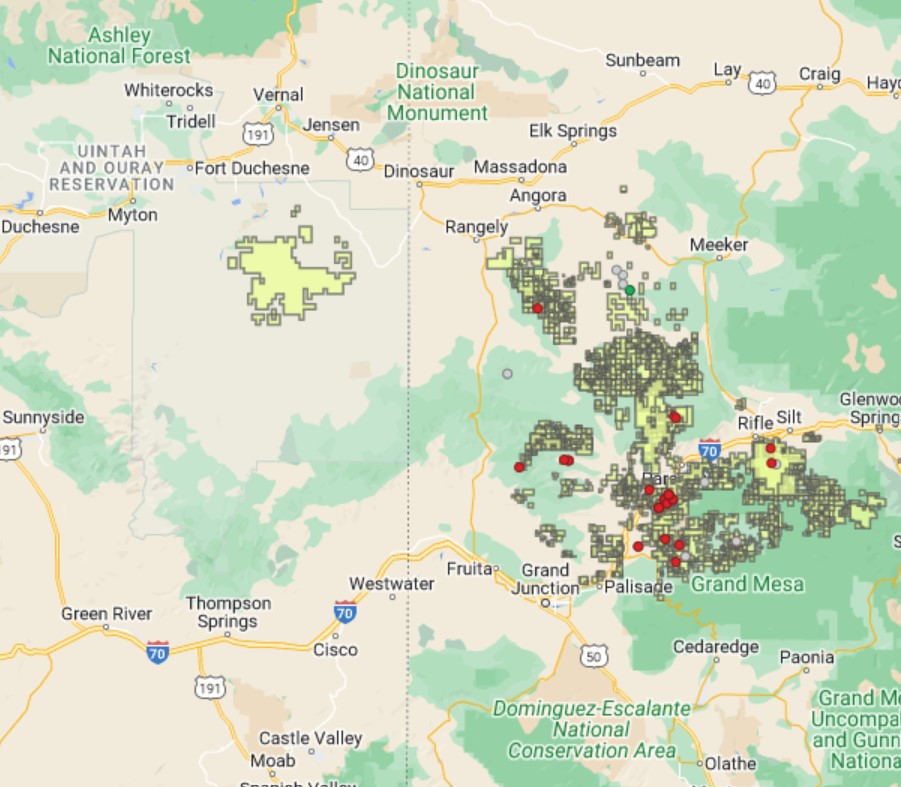

The transactions include Caerus’ footprint of upstream and midstream assets spanning across the Piceance Basin in western Colorado and the Uinta Basin in eastern Utah. The deals also include the assumption of Caerus’ asset-backed securities and other liabilities.

Caerus is owned by a private investor group including Oaktree Capital Management, The Anschutz Corporation and Old Ironsides Energy.

Piceance Basin

A newly formed Quantum portfolio company, QB Energy, will acquire and manage Caerus’ asset base in the Piceance Basin, where the company held approximately 600,000 acres.

QB Energy will be led by industry veteran Roger Biemans, who will serve as president and CEO.

“The Piceance assets represent the largest single asset base atop the second largest gas resource in the continental U.S.,” Biemans said. “QB Energy is acquiring a shallow-decline production base with several decades of repeatable drilling inventory and intends to employ a number of Caerus’ existing capable workforce to ensure continuity in both the field and local communities.”

RELATED

CEO: Berry Seeks Horizontal Drilling Opportunities in Uinta Basin

Uinta Basin

KODA Resources, an existing Quantum portfolio company, will acquire Caerus’ portfolio of approximately 160,000 acres in the Uinta Basin, the companies announced Aug. 19. KODA will also pick up Caerus’ gathering and compression midstream assets in the Uinta.

“KODA has spent years decoding subsurface intricacies of the Uinta gas window, and we believe we are uniquely qualified to assume operatorship and further develop this high-quality production base adjacent to our existing acreage,” said Osman Apaydin, CEO of KODA Resources.

The Uinta Basin has seen increased drilling and consolidation activity this year. In June, SM Energy and Northern Oil & Gas (NOG) teamed up to acquire leading private Uinta producer XCL Resources for $2.55 billion.

NOG will own a 20% undivided stake in XCL valued at $510 million; SM will own the remaining 80% and operate the XCL assets.

RELATED

After $2.55B Deal, NOG and SM to Buy More Uinta Basin Assets

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.