Brian Forbes, partner at A.T. Kearney, discusses price spreads at Hart Energy’s recent North American LNG Exports conference. Source: Hart Energy

North America consumes about 6 trillion cubic feet (Tcf) of natural gas annually, but it produces 7 Tcf from conventional and unconventional sources, thereby setting the stage for the opportunity to export LNG.

But the amount exported, the costs of that supply, the exporters’ netbacks, are all questions still to be answered. Until that time, first-mover projects with cost advantages will win—and natural gas prices may be “messy.” This analysis comes from Brian Forbes, partner at consulting firm A.T. Kearney, who spoke at Hart Energy’s recent North American LNG Exports conference in Houston.

At some point in the future, companies will trade LNG cargos globally and a vibrant spot market will develop, he said. Asian buyers might buy North American LNG and swap it for African or Middle Eastern cargos.

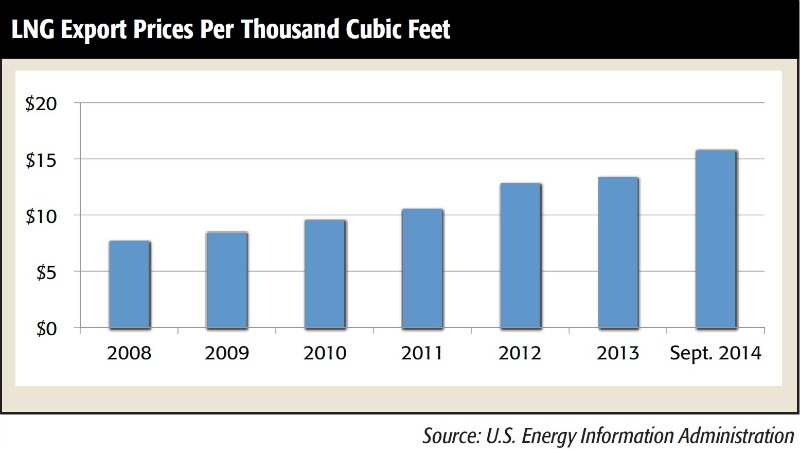

The price spread between supply and the cost of shipping to global markets is the key. “If you do the analysis, the landed cost of U.S. LNG compares favorably to Australia and Africa in most cases; with Russia we are pretty close. This opens up quite a bit if you allow global trading,” he said.

However, it’s not as important how much LNG you sell, as it is where you sell it, Forbes said, although the best markets are to Asian buyers. For example, shipping LNG from the proposed Kitimat project in British Columbia to South Korea costs $1.05 per thousand cubic feet (Mcf), whereas from Sabine Pass on the Louisiana coast, shipping cost rises to $2.41/Mcf. Liquefaction costs depend heavily on how much infrastructure exists at a site and the cost and extent of power generation needed on site.

A big question for U.S. producers is the effect of exports on domestic gas prices. Forbes said he expects U.S. prices to rise once LNG exports start but markets will be “messy” until price equilibrium is reached.

“You could end up with $6 or $7 gas but it might take a year, or maybe six months,” he said. “It’s hard to predict. If more shale fields are in the money and thus have access to more capital, you will see us over drill for gas. This will contribute to that messy equilibrium. The U.S. stays competitive if it stays closer to 6 Tcf of exports, so you want to be one of the first projects built and with fully committed demand.”

Recommended Reading

Surge Closes on Divestment of Alberta Non-Core Gas Assets

2024-12-20 - Surge Energy said it has focused on developing its core Sparky and southeast Saskatchewan crude oil assets, leaving the Alberta non-core assets undercapitalized.

Apollo Funds Acquires NatGas Treatment Provider Bold Production Services

2025-02-12 - Funds managed by Apollo Global Management Inc. have acquired a majority interest in Bold Production Services LLC, a provider of natural gas treatment solutions.

Constellation Bets Big on NatGas in $16.4B Deal for Calpine

2025-01-10 - Constellation Energy will acquire Calpine Corp. in a $26.6 billion deal, including debt, that will give the pure-play nuclear company the largest natural gas power generation fleet.

Exclusive Occidental, CrownRock Merge Into Team of Overachievers

2024-12-10 - Thaimar Ramirez, president and general manager for Occidental Petroleum’s Midland Basin Business Unit, said 100 days after closing the CrownRock acquisition production guidance keeps going higher.

Nabors SPAC, e2Companies $1B Merger to Take On-Site Powergen Public

2025-02-12 - Nabors Industries’ blank check company will merge with e2Companies at a time when oilfield service companies are increasingly seeking on-site power solutions for E&Ps in the oil patch.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.