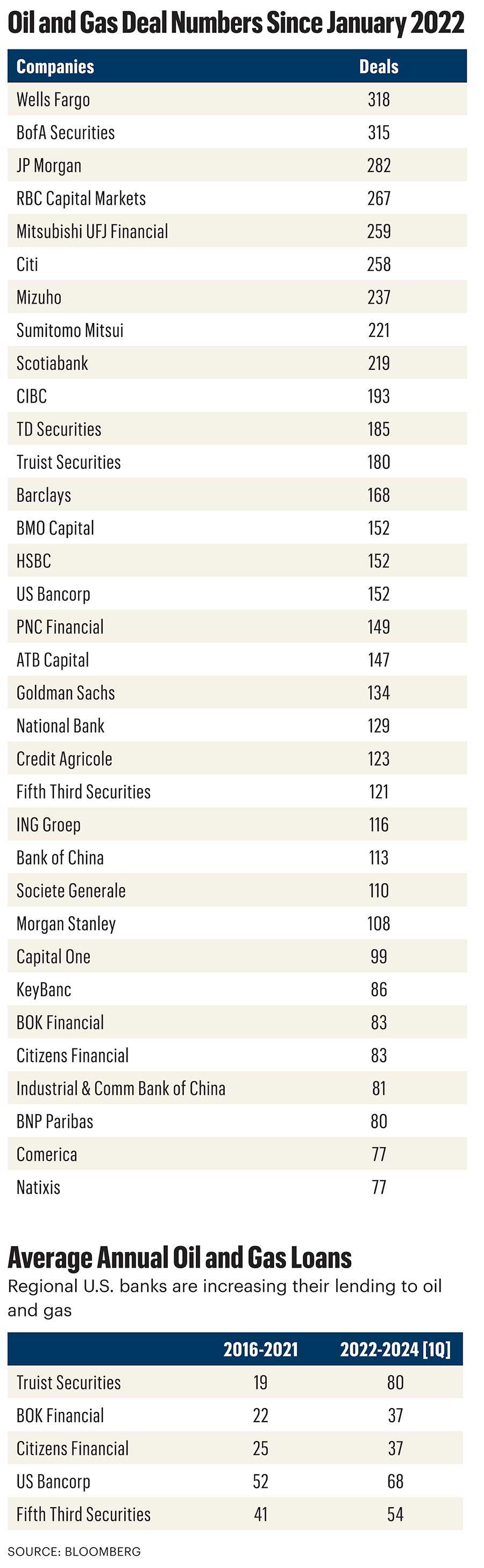

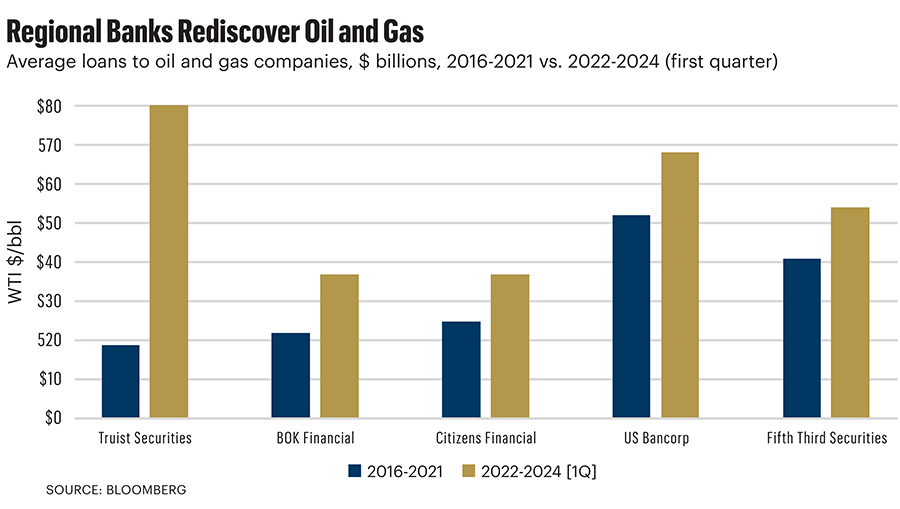

Regional banks across the U.S. are swooping in and grabbing market share in oil and gas investing as a shift in lending logic pulled dozens of large commercial banks from the space.

Consolidation, ESG pressure and lingering capital discipline angst have carried more weight in recent years, beginning generally with the exodus of top European banks, whose climate fears made them squeamish toward the space.

In the most recent example of Euro flight, UBS’ acquisition of Credit Suisse, the merger of Switzerland’s two largest lenders, showed what can happen when two big banks combine during the net-zero trend. Both have committed to phase out carbon emissions from their portfolios by 2050.

Inside of 10 years, the commercial banking sector has shrunk from more than 60 active energy lenders to about 35, said Jeff Treadway, senior vice president of energy finance at Comerica Bank.

“When deal flow picked up again post-COVID, the bar for new investment was raised higher. To stay in the business, many banks had to tighten the fairway of what was acceptable, whether it was structure, deal metrics, asset quality, management teams or the equity sponsors,” he told Hart Energy.

What’s more, big U.S. money center banks are focused on high-grading their portfolios with a focus on publicly listed companies that offer capital markets opportunities, said Marc Graham, managing director and head of energy at Texas Capital.

“Into the space vacated by these lenders, we have seen regional banks become more active,” he told Hart Energy.

In the aftermath of COVID, some banks were slower to return to the space than others, as Richard Butler, senior vice president and head of energy at Fifth Third Bank in Houston.

“The space has seen regional and smaller banks, including new entrants, fill the gap,” he said.

As states such as Texas have withdrawn their money management responsibilities from investment groups such as Blackstone, which are perceived as pivoting away from fossil fuels, red state-lenders have another opening.

Bryan Chapman, market president for energy lending at First Horizon Bank, said the Memphis, Tennessee-based bank has pledged to support Texas leaders’ divestment.

“I think a lot of people just thought there was going to be this big switch that was going to get flipped. And so, you saw oil prices crashing, and then you ended up seeing this clean energy kind of skyrocketing,” Chapman told Hart Energy. “Over the last couple of years, you’ve really seen a complete reversal. The margins in those clean energy deals are very, very low. When interest rates went up, there’s just not enough margin in those deals to sustain that kind of increase in the cost of debt capital.”

Upstream companies are running their businesses with less debt and stabilizing growth with a focus on generating free cash flow to pay dividends, repurchase shares or fund distributions to private equity sponsors, Chapman said.

“They’ve just structurally shifted to a more conservative capital structure because no one’s going to bail you out of a bad balance sheet. If you want to have some leverage in negotiations, you have to have low debt,” he said. “So, if someone’s going to pay cash, you’ll have the ability to pay off your debt.”

Bulls on parade

The majority of E&P lenders are open for business, said Marisol Salazar, senior vice president and manager for energy financial services at BOK Financial. Entering 2024, millions of dollars in payoffs have been a result of consolidation.

“When you look at a huge portion of your book, having paid off by selling those companies at the end of 2023 [and during the first part of this year], you see banks that are pretty hungry,” she told Hart Energy. “Couple that with a lot of discipline amongst both bankers and companies, and that leverage has been pretty low.”

Capital remains available to the upstream space, said Haynes and Boone attorney Kraig Grahmann, but companies must recognize that the sources have changed. Diversified New York City-based private equity funds, pensions and European banks are being replaced by family offices, private credit term loan providers and regional banks, all of which are significantly more active today than just a few years ago, Grahmann said.

“If a company recognizes this shift and develops relationships with the new players, they will improve their odds of attracting capital,” he said.

This year a window is also opening for E&Ps to access credit and debt markets. Companies are adding new lenders to their revolving credit facilities and others have successfully accessed the capital markets.

“The strong credit profile of the industry is drawing investors back into the sector. Consolidation of operating companies has resulted in the return of capital to lenders and investors alike,” Grahmann said. “That capital is being put back to work.”

Calculating exposure

Climate concerns remain a hurdle for the industry, and some lenders have opted to lessen their exposure to fossil fuels. Across the board of regional lenders, that translates into an opportunity set—and access to capital for disciplined borrowers—that is growing.

Salazar said oil and gas is a major focus for BOK, and the institution has taken advantage of banks that either initially pulled out of energy or cap how much money they devote to energy.

“Whether it’s because they want to keep a cap or because of ESG, we continue to have that focus and continue to add market share,” she said.

It’s not that commercial lenders are immune to ESG concerns; it’s only one part of calculus that goes into whether financing is profitable.

“Texas Capital recognizes that our borrowers should be good stewards of the environment, be good social citizens and have appropriate governance practices in place,” Graham said.

As a Texas state-registered bank, Texas Capital exists to “support the breadth of the Texas economy and all of the industries that contribute to it.”

“We are unapologetic supporters of the oil and gas industry because of its contribution to the Texas and U.S. economy,” he said. “We take a pragmatic approach to how the nation sources its energy.”

Recommended Reading

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

Partnership to Deploy Clean Frac Fleets Across Permian Basin

2024-12-13 - Diamondback Energy, Halliburton Energy Services and VoltaGrid are working together to deploy four advanced electric simul-frac fleets across the Permian in an effort to enhance clean and efficient energy solutions in the region.

Tracking Frac Equipment Conditions to Prevent Failures

2024-12-23 - A novel direct drive system and remote pump monitoring capability boosts efficiencies from inside and out.

ProPetro Agrees to Provide Electric Fracking Services to Permian Operator

2024-12-19 - ProPetro Holding Corp. now has four electric fleets on contract.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.