Gutted oil and gas exploration budgets are not expected to be refilled in 2017. The dollars that left since the downturn have put companies in a heightened state of penny pinching.

Despite massive inventory overhangs, funding for new discoveries will be necessary to meet future demand. Lately, finding more supply in an era of oil glut has taken a back seat to making low oil prices profitable.

For that reason, exploration should return to profitability by next year, partly driven by lower expenses. As lower commodity prices drained profits, companies sought cheaper drilling methods and rigs, embraced new technology, tweaked designs and took advantage of oilfield services discounts.

“After a decade in the doldrums, the majors’ returns from conventional exploration improved to nearly 10% in 2015,” Andrew Latham, vice president of exploration for Wood Mackenzie, said in a statement regarding its recently released 2017 global exploration report. “The rest of the industry is heading in the same direction. Fewer, better wells promise a brighter future for explorers.”

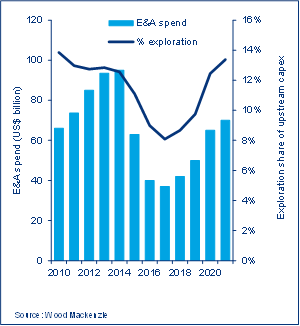

In all, investment is expected to match 2016 levels of about $40 billion, Wood Mackenzie said, while noting spending could fall further. “On the bright side, lower costs mean well counts may hold up close to 2016 numbers. Flat budgets should mean exploration’s headcount cuts are now mainly in the past.”

The consulting firm forecasts that upstream investment for exploration will fall to 8%, which would represent a new low.

Last week Chevron Corp. (NYSE: CVX), for example, unveiled its 2017 capital and exploratory investment program of $19.8 billion, including $17.3 billion for upstream. The spending plan is at least 15% lower than projected capital investments for 2016.

“Our spending for 2017 targets shorter-cycle time, high-return investments and completing major projects under construction,” Chevron Chairman and CEO John Watson said. “In fact, over 70% of our planned upstream investment program is expected to generate production within two years.”

However, analysts at Barclays noted the amount set aside for Chevron’s exploration spending is probably too little.

“Exploration spending is roughly $1/bbl in 2017, less than what would be considered a fully sufficient program to replace production,” Barclays said. “We expect funding to be redirected to exploration over the next few years and 2017 should mark the cycle-low of the company’s spending level, given rising oil prices.”

Wood Mackenzie’s exploration outlook also shed light on some trends that could unfold next year. An area to watch is deep water, where analysts believe more than half of the new discoveries will be found.

“Here some well costs will fall to US$30 million or less, with full-cycle economics that are positive at less than US$50 per barrel," Latham said.

Just as in the last two years, Wood Mackenzie says the majors and “bolder independents” will drill most of the wells to watch.

Wood Mackenzie report expectations and exploration themes include:

- The best finds will come from frontier areas or new plays;

- HP/HT plays and icy offshore Arctic areas will be avoided; and

- Parts of North Africa, Eastern Europe and Latin America could provide pipe gas exploration opportunities.

The forecast was delivered as the industry looks forward to better days ahead. A promise by OPEC members to cut production, followed by some non-OPEC producers including Russia to do the same, has added to optimism. OPEC agreed to lower output by 1.2 million barrels per day (MMbbl/d) in November, while some non-OPEC producers agreed Dec. 10 to lower output by 558,000 bbl/d. Oil demand is expected to grow by roughly 1.2 MMbbl/d in 2017, according to the International Energy Agency.

Although the majors found ways to increase returns on conventional exploration last year, the number of conventional oil and gas discoveries has fallen in recent years. Earlier this year Wood Mackenzie told Hart Energy that the number of such discoveries globally dropped to 191 in 2015, which is less than half of the average number of discoveries made in the previous nine years.

RELATED: Conventional Oil, Gas Discoveries Fall As Commercialization Concerns Arise

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

Woodside Reports Record Q3 Production, Narrows Guidance for 2024

2024-10-17 - Australia’s Woodside Energy reported record production of 577,000 boe/d in the third quarter of 2024, an 18% increase due to the start of the Sangomar project offshore Senegal. The Aussie company has narrowed its production guidance for 2024 as a result.

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

Oxy’s Hollub Drills Down on CrownRock Deal, More M&A, Net-zero Oil

2024-11-01 - Vicki Hollub is leading Occidental Petroleum through the M&A wave while pioneering oil and gas in EOR and DAC towards the goal of net-zero oil.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

Are Shale Producers Getting Credit for Reining in Spending Frenzy?

2024-12-10 - An unusual reduction in producer hedging found in a Haynes and Boone survey suggests banks are newly open to negotiating credit terms, a signal of market rewards for E&P thrift.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.