The report stated that although the U.S. wind industry’s dependence on imports have fallen to its lowest level in a decade, it remained dependent on imports. (Source: Shutterstock)

U.S. President Donald Trump’s proposed tariffs on Canada, China and Mexico could send onshore wind costs up by 7%, according to a Wood Mackenzie report, potentially stymieing growth.

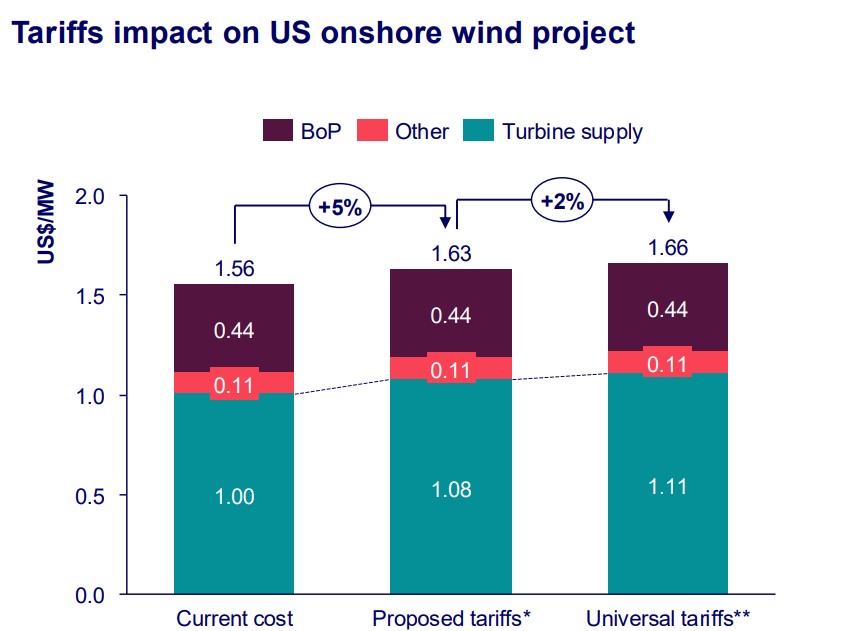

Wood Mackenzie on Feb. 11 said the 25% tariff on imports from Canada and Mexico—which were postponed—plus the additional 10% tariff on Chinese imports could also lead to a 5% rise in overall project costs for U.S. onshore wind projects. Such projects are dependent on imports for equipment such as blades, drivetrains and electrical systems.

Trump’s move to impose tariffs on allies and political adversaries alike comes in an effort to protect U.S. national security interest and leverage America’s economic position. Tariffs could also bolster the U.S. manufacturing industry, create jobs and raise revenue. However, the action has sparked outrage by long-time allies, which are vowing to retaliate with their own tariffs.

“In a scenario with universal 25% tariffs on all imported products, the impact would be even greater, with turbine costs potentially rising 10% and overall project costs increasing 7%,” said Endri Lico, principal analyst at Wood Mackenzie. “This would have material impacts on the industry, putting some projects at risk due to economic factors.”

Backed by federal tax incentives such as the production tax credit and other Inflation Reduction Act (IRA) incentives, onshore wind capacity had climbed in the U.S. as average wind turbine heights and rotor diameters inched up. Data from the Department of Energy’s (DOE) latest Land-Based Wind Power report show installed capacity increased about 6.5 gigawatts (GW) to nearly 150.5 GW in 2023.

The report stated that although the U.S. wind industry’s dependence on imports have fallen to its lowest level in a decade, it remained dependent on imports.

“Wind-related imports decreased to $1.7 billion in 2023 from $2.3 billion in 2022, mirroring the decrease in annual wind capacity additions,” the DOE said in its report. “Almost 70% of all wind-specific imports that are tracked through trade codes came from Mexico, Germany, Spain and India, with the remaining imports mostly from Canada and various countries in Europe and Asia.”

Wood Mackenzie said the proposed tariffs could increase the levelized cost of energy (LCOE) by 4% in the near term, while the universal 25% tariffs could cause the LCOE to rise by 7%.

Additional orders regarding tariffs were handed down by Trump this week.

The president on Feb. 10 signed proclamations that restored a 25% tariff on steel and a higher 25% tariff on aluminum, up from 10%, in a move to “protect America’s critical steel and aluminum industries, which have been harmed by unfair trade practices and global excess capacity.” The tariffs had been put in place during Trump’s first term as president, creating jobs and boosting economies.

The latest move by Trump also aims to close existing loopholes that the White House says were exploited by China and others with excess steel and aluminum capacity. Countries in the EU, along with Argentina, Australia, Brazil, Canada, Japan, Mexico and South Korea, were exempt from the tariffs, which the White House said inadvertently created loopholes.

Analysts don’t anticipate the steel tariff to have a major impact on wind, according to Lico.

“All manufacturing processes of items that are structural in nature, with respect to any steel or iron items that are Applicable Project Components, must take place in the U.S., except metallurgical processes involving refinement of steel additives,” Lico told Hart Energy in a statement. “The IRA’s local content requirements made it very clear that steel needs to be made-in-U.S. for a project to be eligible for subsidies.”

Meanwhile, onshore wind players and others await specialization of the tariff legislation to assess the impact.

“Tariffs imposed during the previous Trump’s term had minimal impact on the U.S. wind power segment, while a looser monetary policy may soften tariffs’ impact,” Lico said.

He added, “We anticipate that wind manufacturers will adopt a mix of measures to mitigate tariffs’ impact, including rerouting and restructuring their supply chains and assembly lines, strengthening U.S. localization and increasing their prices.”

Wind turbine manufacturer GE Vernova addressed the global supply chain, including tariffs, in its annual report released recently. The company said it purchases about $20 billion in materials and components sourced from more than 100 countries.

“To address these challenges, we maintain strong supplier relationships and prioritize opportunities to localize our supply chain to serve our distinct geographies, while at the same time allowing us to maintain a globally diverse supply chain for operational resiliency,” the company said.

GE Vernova announced Jan. 29 plans to invest nearly $600 million in U.S. factories and facilities over the next two years. This includes plans for GE Vernova’s wind segment to invest about $100 million in manufacturing facilities in Florida, New York, North Dakota and Texas.

Recommended Reading

Bottlenecks Holding US Back from NatGas, LNG Dominance

2025-03-13 - North America’s natural gas abundance positions the region to be a reliable power supplier. But regulatory factors are holding the industry back from fully tackling the global energy crisis, experts at CERAWeek said.

LNG, Data Centers, Winter Freeze Offer Promise for NatGas in ‘25

2025-02-06 - New LNG export capacity and new gas-fired power demand have prices for 2025 gas and beyond much higher than the early 2024 outlook expected. And kicking the year off: a 21-day freeze across the U.S.

Expand CFO: ‘Durable’ LNG, Not AI, to Drive US NatGas Demand

2025-02-14 - About three-quarters of future U.S. gas demand growth will be fueled by LNG exports, while data centers’ needs will be more muted, according to Expand Energy CFO Mohit Singh.

Segrist: American LNG Unaffected by Cut-Off of Russian Gas Supply

2025-02-24 - The last gas pipeline connecting Russia to Western Europe has shut down, but don’t expect a follow-on effect for U.S. LNG demand.

LNG Leads the Way of ‘Energy Pragmatism’ as Gas Demand Rises

2025-03-20 - Coastal natural gas storage is likely to become a high-valued asset, said analyst Amol Wayangankar at Hart Energy’s DUG Gas Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.