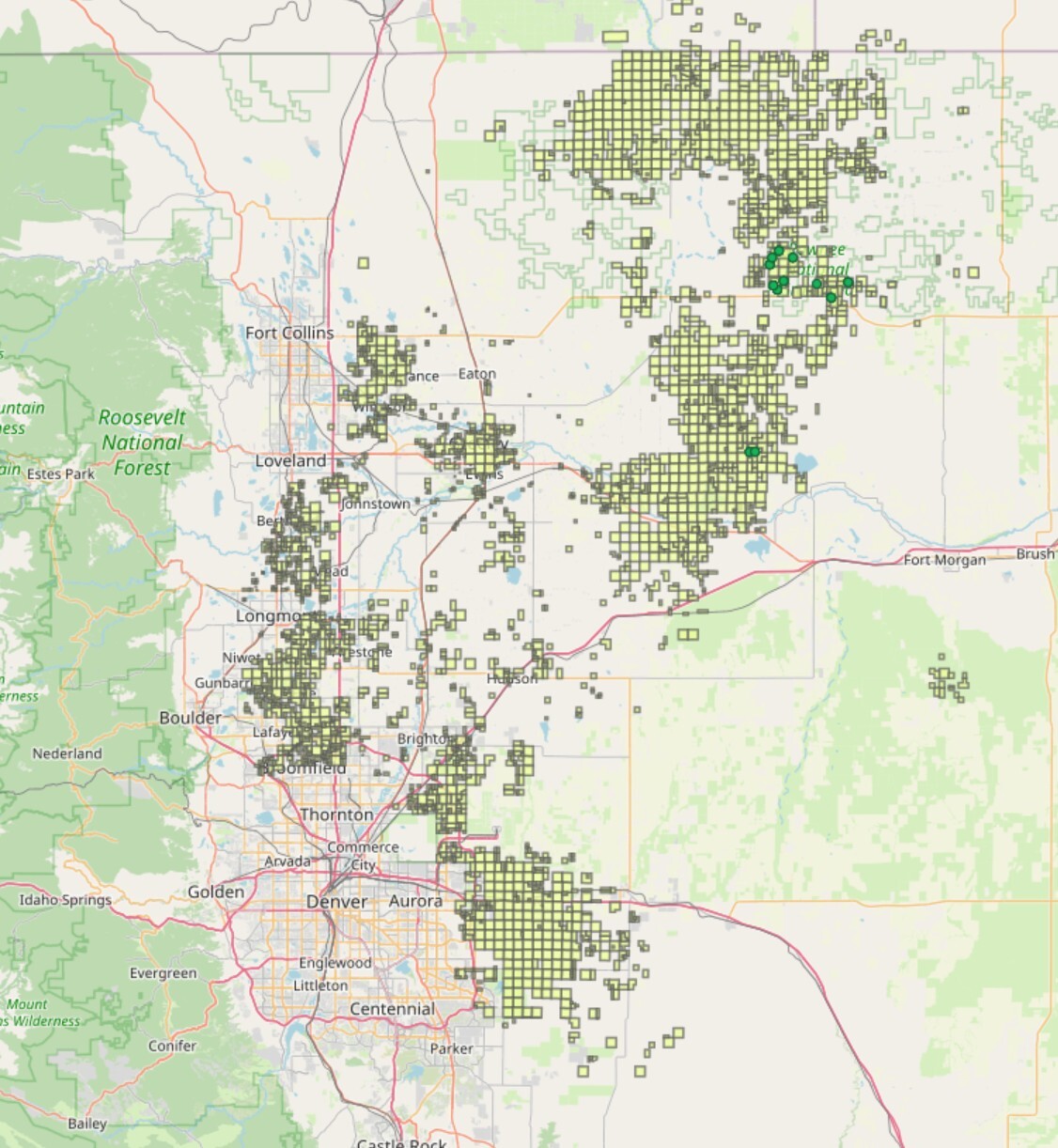

Civitas Resources is reportedly exploring a sale of its oil and gas assets in Colorado’s D-J Basin (pictured). (Source: Shutterstock.com, Civitas)

Civitas Resources could potentially exit its Colorado position and acquire more Permian Basin assets, according to analysts and media reports.

Civitas is exploring a sale of its legacy assets in Colorado’s Denver-Julesburg (D-J) Basin, according to unsubstantiated media reports. The Denver-based E&P has retained a financial adviser to assess buyer interest in the assets.

Civitas Resources did not immediately respond to a Hart Energy request for comment.

Civitas is reportedly open to selling all or only portions of its D-J Basin portfolio. Production from Civitas’ D-J Basin assets averaged around 160,000 boe/d (70,674 bbl/d oil) during the third quarter of 2024.

Civitas’ Colorado assets could potentially fetch approximately $4 billion through a sale. Analysts at TD Cowen said the $4 billion headline price tag would screen as a proved developed producing (PDP)-only transaction, with little if any value placed on undeveloped drilling locations.

Given regulatory concerns within Colorado and the relatively short inventory life of Civitas’ D-J assets, a PDP-only deal “makes sense in our view,” TD Cowen analyst Gabe Daoud Jr. wrote in a Jan. 15 report.

Taking the proceeds from a D-J Basin exit, Civitas could try to acquire Double Eagle IV—one of the most coveted private E&Ps remaining in the Permian’s Midland Basin.

Acquiring Double Eagle IV would logically make sense for Civitas, given their overlapping acreage in the Midland Basin, Daoud said.

But buying Double Eagle would have risks, including a high asking price and only around 424 drilling locations, according to TD Cowen estimates.

Analysts had previously questioned whether Ovintiv, which has been more Permian-focused lately, might make a run at acquiring Double Eagle.

But Ovintiv ultimately turned its attention north to its legacy roots in Canada, acquiring Montney Shale assets from Paramount Resources Ltd. for US$2.38 billion (CA$3.33 billion) in cash.

Ovintiv is also selling its Uinta Basin assets in Utah to privately held FourPoint Resources. The transaction is expected to close in the first quarter.

RELATED

CEO: Ovintiv Passes on Permian Prices for More Montney Condensate

Rocky Mountain high

Civitas was created in 2021 through a combination of three Colorado pure-play producers: Bonanza Creek Energy, Extraction Oil & Gas and Crestone Peak.

But the need for additional inventory outside of Colorado drove Civitas to spend nearly $7 billion on Permian Basin M&A in 2023.

Civitas acquired private equity-backed producers Hibernia Energy III in the Midland Basin for $2.2 billion and Tap Rock Resources in the Delaware Basin for $2.5 billion.

In October 2023, Civitas followed on with a $2 billion acquisition of Vencer Energy, a Midland Basin E&P backed by international commodities trading house Vitol.

Since entering the Permian, Civitas has focused on optimizing costs and drilling efficiently in the D-J Basin.

Civitas is drilling some of the longest laterals in the D-J, including several 4-mile wells that began production last summer, CFO Treasurer Marianella Foschi reported at the 2024 EnerCom Denver conference.

Civitas saw around a 5% reduction in per-foot drilling costs on its 4-mile wells compared to 3-mile wells.

RELATED

Civitas: 4-mile Colorado Laterals A ‘Competitive Edge’ in D-J Basin

Recommended Reading

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

On The Market This Week (April 7, 2025)

2025-04-11 - Here is a roundup of marketed oil and gas leaseholds in the Permian, Uinta, Haynesville and Niobrara from select E&Ps for the week of April 7, 2025.

Blackstone Buys NatGas Plant in ‘Data Center Valley’ for $1B

2025-01-24 - Ares Management’s Potomac Energy Center, sited in Virginia near more than 130 data centers, is expected to see “significant further growth,” Blackstone Energy Transition Partners said.

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.