Source: Hart Energy

[Editor's note: This story was updated at 2:25 p.m. CT March 6.]

Resolute Energy Corp. (NYSE: REN) is beefing up its Delaware Basin position with a $160 million deal that will increase its holdings in Reeves County, Texas, by 28%.

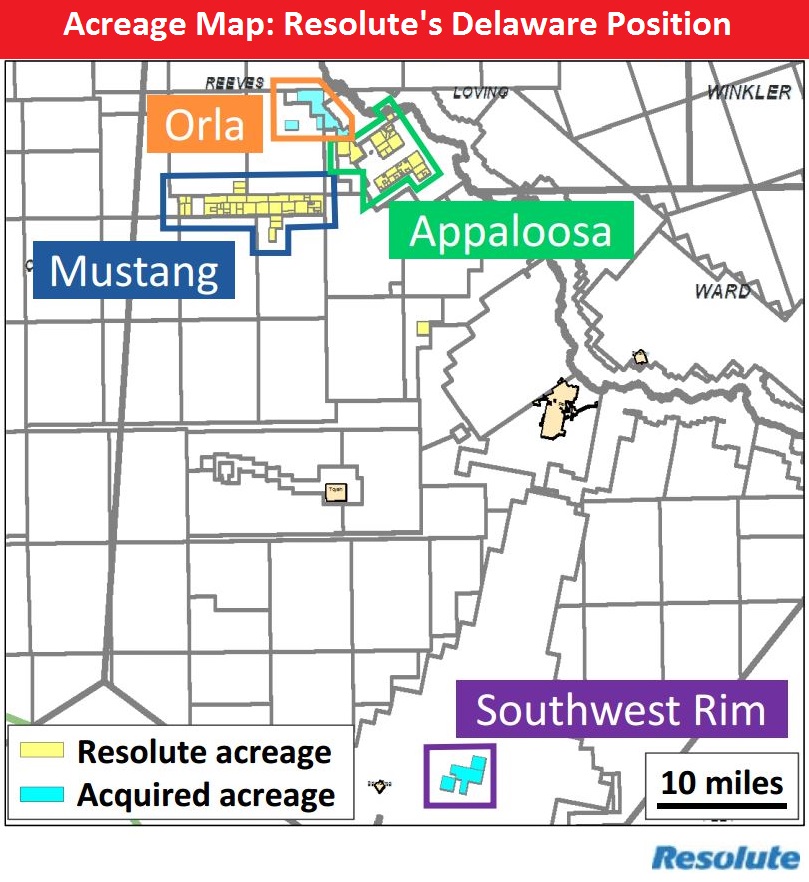

The Denver-based company said March 3 it agreed to acquire producing and undeveloped properties covering 4,600 net acres in Reeves from CP Exploration II LLC and PetroCap CPX LLC, a subsidiary of PetroCap Partners II LP. The properties include acreage in the Orla and Southwest Rim project areas.

The acreage, roughly half of which is adjacent to Resolute’s Appaloosa operating area in Reeves, currently produces about 800 net barrels of oil equivalent per day. The acquisition also includes six drilled but uncompleted wells (DUCs) and 54 net locations targeting the Wolfcamp Shale.

“After adjusting for flowing production as well as the six DUCs, per acre math comes out to $26,000 per acre. However, the real focus area of the acquisition is the Orla block, given that it is adjacent to the company's existing Appaloosa position, where results have been very strong,” David Tameron, senior analyst with Wells Fargo Securities LLC, said in a report.

Assigning value to only the Orla area, Tameron said Resolute’s acquisition totals $55,000 per acre or about $2.2 million per location, which is conservative as the Southwest Rim assets are “certainly worth something.”

In total, Resolute will hold about 21,000 net acres in Reeves upon closing of the acquisition, which is expected in May.

The company has recently been building up its Reeves position, including an acquisition in October for 3,293 net acres from EnCap-backed Firewheel Energy LLC for $135 million.

Highlights:

Orla Project

- 2,187 net acres;

- Adjacent to Resolute's Appaloosa Project and immediately north of its Mustang Project;

- Interests in two operated, 4,500-ft horizontal Wolfcamp wells;

- About 95% operating control of drilling locations;

- Currently estimate of 112 gross (54 net) locations;

- Targets the upper and lower Wolfcamp A and the Wolfcamp B on 80-acre spacing;

- Majority supports drilling mid- to long-lateral lengths;

- Six operated DUCs;

- Four DUCs have about 4,500-ft laterals;

- Two DUCs have about 7,500-ft laterals;

- One nonoperated, 10,000-ft lateral Wolfcamp well is currently being drilled; and

- Additional drilling upside in the Wolfcamp X/Y and Wolfcamp C.

Southwest Rim Project

- 2,405 net acres;

- Development potential in the Wolfcamp and other zones;

- About five miles east of Apache Corp.'s (NYSE: APA) Alpine High development;

- Operated, highly contiguous acreage;

- An average 70% working interest; and

- More than 2.5 years of primary term left on the leases.

“This is exactly the kind of targeted, focused, consolidating opportunity that leverages the strengths of our team and our assets,” Rick Betz, Resolute’s CEO, said in a statement.

Betz said the transaction allows Resolute to add acreage and production without adding “significantly to our staffing and infrastructure needs.”

Resolute said it plans to complete all of the DUCs sequentially immediately following closing of the acquisition and placed on production by mid-July. The company is currently running two rigs in the Delaware and is evaluating adding a third rig in the second half of 2017 to accelerate development of the Orla acreage position.

“As we complete the drilled but uncompleted wells and look to accelerate development of the combined acreage position with a third rig later this year, we expect that this transaction will add materially to our production beginning in the second half of 2017,” Betz said.

To finance its acquisition, Resolute entered a commitment letter for a $100 million bridge financing facility with BMO Capital Markets, which the company said will allow it to close the transaction without an immediate long-term debt or equity issuance.

The acquisition agreement contains certain customary termination rights for Resolute and the sellers. The transaction will have an effective date of May 1.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Utica Oil E&P Infinity Natural Resources’ IPO Gains 7 More Bankers

2024-11-27 - Infinity Natural Resources’ IPO is expected to provide a first-look at the public market’s valuation of the Utica oil play.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

Mexico Pacific Working with Financial Advisers to Secure Saguaro LNG I FID

2024-10-23 - Mexico Pacific is working with MUFG, Santander and JP Morgan to arrange the financing needed to support FID and the anchor phase of Saguaro Energía LNG.

Are Shale Producers Getting Credit for Reining in Spending Frenzy?

2024-12-10 - An unusual reduction in producer hedging found in a Haynes and Boone survey suggests banks are newly open to negotiating credit terms, a signal of market rewards for E&P thrift.

EON Enters Funding Arrangement for Permian Well Completions

2024-12-02 - EON Resources, formerly HNR Acquisition, is securing funds to develop 45 wells on its 13,700 leasehold acres in Eddy County, New Mexico.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.