Last year saw a record number of reverse merger transactions, although 2021 marked the first time that many of such transactions involved SPACs. (Source: Shutterstock.com)

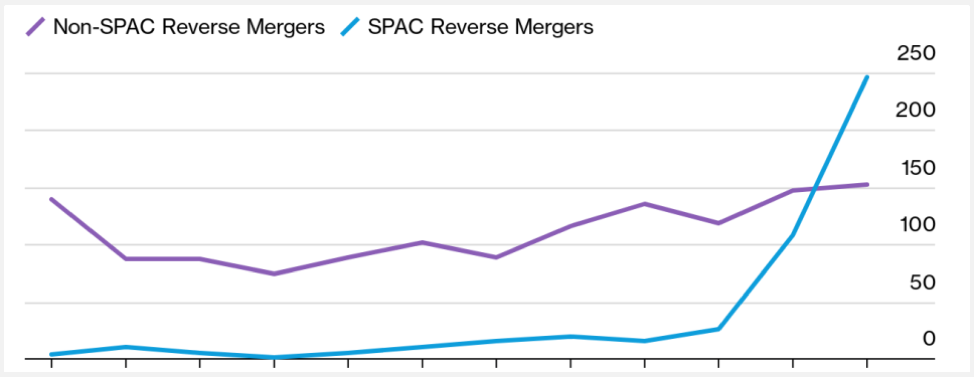

Last year saw a record number of reverse merger transactions, with 398 reverse mergers valued at nearly $135 billion, according to figures tracked by Bloomberg Law. Although 2021 marked the first time that many of such transactions involved special purpose acquisition companies (SPACs), which totaled 246 out of the 398 transactions, it still marked a record-high number of non-SPAC reverse mergers (152).

What is a Reverse Merger?

The concept of a reverse merger, in short, holds that a privately held company acquires a publicly-traded company. In so doing, the private company can gain access to public equity markets without going through the lengthy process of an IPO filing. Although a reverse merger typically has the advantage of a shorter timeline over an IPO, there are still some requirements that companies involved in a reverse merger should keep in mind. This is particularly true as SEC scrutiny has recently increased around reverse mergers, both of the SPAC and traditional non-SPAC variety.

Among these requirements are the fair value measurements related to ASC 805, Business Combinations. In a reverse merger, like with all acquisitions, ASC 805 requires the allocation of the purchase consideration to identified tangible and intangible assets. However, in a reverse merger, the establishment of the purchase consideration to be allocated can be more difficult to accomplish. Often, shares of the acquiring (private) company are issued as consideration, so the shares of the acquiring company may need to be valued. The value of private company shares to be issued might not always align exactly with the value of the acquired publicly-traded company; market conditions and other forces may bring about changes in the respective stock prices between the time that the transaction is announced and the time that it closes. The valuator should keep in close communication with the management of the acquirer, and the respective auditor, to ensure that there are no surprises when the transaction closes and the final purchase price allocation is performed.

Things to Consider in a Reverse Merger

Sometimes in a reverse merger, a question may arise as to whether a control premium should be applied to the consideration being paid. This will require the valuator to understand the terms of the purchase agreement and to understand whether a control element has already been priced into the transaction. For example, in the acquisition of a limited partnership, a general partner may have also been acquired in the transaction. Often, the amount paid for this general partnership interest may represent the “control” factor, i.e., the ability to affect change in the projected cash flows, above and beyond the acquisition of the limited partnership.

Another issue that may arise in a reverse merger is the existence of non-controlling interest. In some instances, certain shareholders may elect not to participate in the exchange transaction. In such instances, the value of the non-controlling interest would need to be measured, and this value would be based on the value of the stand-alone company in which the non-controlling interest is held, not on the value of the combined entity.

In the event of a reverse merger, these considerations, along with the associated accounting considerations, make it more critical than ever to have a strong, defensible valuation supporting the purchase price allocation.

About the Author: Kevin Cannon is a director in Opportune’s valuation practice based in Houston. He has 17 years of experience performing business and asset valuations and providing corporate finance consulting. His specific experience includes valuations of businesses and intangible assets for purchase price allocations, impairment, tax planning and portfolio valuation purposes for companies in a variety of industries, including oil and gas, oilfield services and industrial manufacturing.

About the Author: Kevin Cannon is a director in Opportune’s valuation practice based in Houston. He has 17 years of experience performing business and asset valuations and providing corporate finance consulting. His specific experience includes valuations of businesses and intangible assets for purchase price allocations, impairment, tax planning and portfolio valuation purposes for companies in a variety of industries, including oil and gas, oilfield services and industrial manufacturing.

Recommended Reading

Oilfield Services Firm Flowco Files IPO Paperwork

2024-12-09 - Oilfield services provider Flowco filed paperwork for an IPO, one of several energy-focused players seeking to test the public markets.

SM Energy Adds Petroleum Engineer Ashwin Venkatraman to Board

2024-12-04 - SM Energy Co. has appointed Ashwin Venkatraman to its board of directors as an independent director and member of the audit committee.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

Artificial Lift Firm Flowco Seeks ~$2B Valuation with IPO

2025-01-07 - U.S. artificial lift services provider Flowco Holdings is planning an IPO that could value the company at about $2 billion, according to regulatory filings.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.