New Mexico gas and helium producer New Era Helium Corp. aims to go public by combining with a blank-check company. (Source: Shutterstock.com)

A blank-check company backed by Roth Capital Partners aims to merge with New Era Helium Corp. in a go-public transaction.

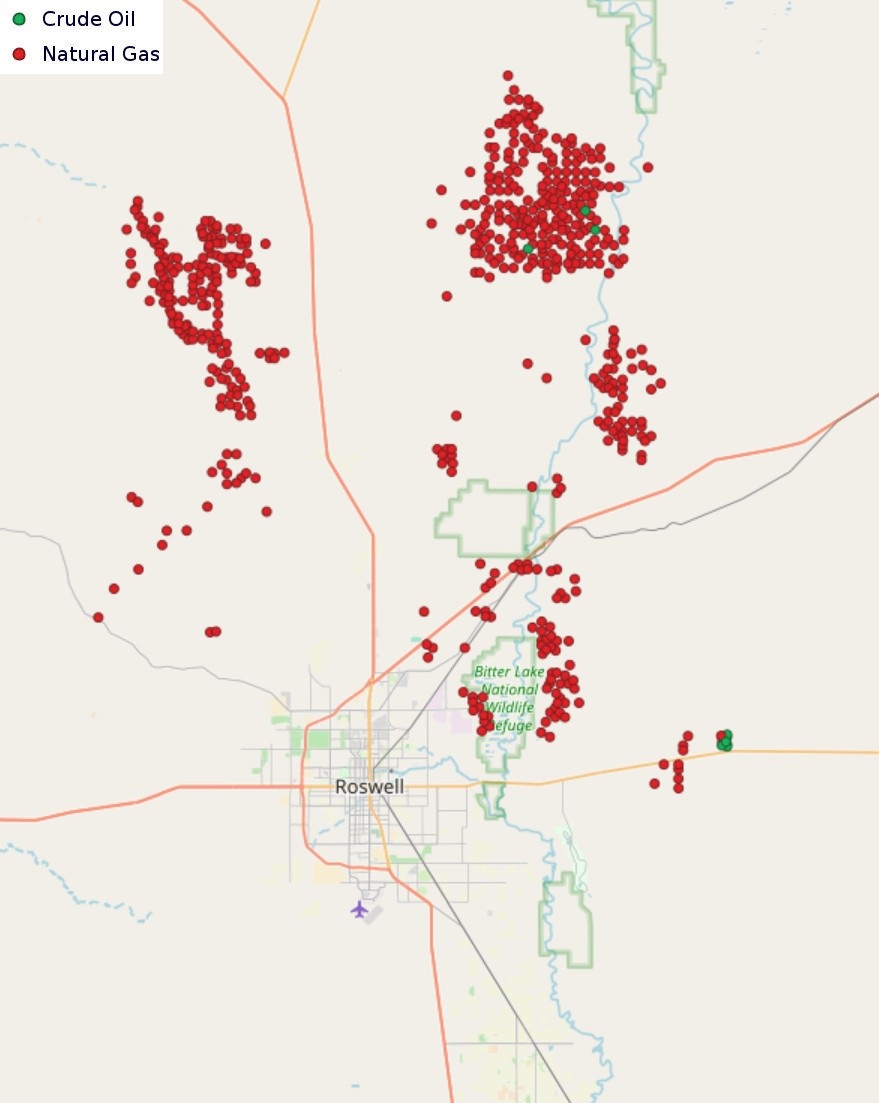

Roth CH Acquisition V Co., a blank-check company publicly listed on the Nasdaq Exchange, agreed to combine with New Era Helium, a natural gas and helium producer with assets in the Pecos Slope Field of New Mexico.

The gas-rich Pecos Slope Field in Chaves County, New Mexico, was discovered by Yates Petroleum in 1977.

Midland, Texas-based New Era Helium (NEH) operates through two subsidiaries: Solis Partners, which owns natural gas- and NGL-producing assets, and NEH Midstream, which will operate a helium refining plant and gathering system in Chaves County.

The company operates over 137,000 gross acres in the Northwest Shelf of the Permian Basin, around 20 miles north of Roswell, New Mexico, according to regulatory filings.

RELATED

SPAC Attack: Clean Energy, Oil & Gas Cashed In on Pandemic-Era Frenzy

NEH has 360.6 MMcf of net proved undeveloped helium reserves and 782.8 MMcf of net provable undeveloped reserves.

The assets are also strategically located no more than 550 miles away from six of the seven helium liquefaction plants in the U.S.

NEH is building its own processing plant in the Pecos Slope Field to produce approximately 87,000 cf/d of gaseous helium, 15.7 MMcf/d of pipeline-ready sales gas and 1,100 bbl/d of NGL. The Pecos Slope Plant will also provide a waste gas stream of around 2.7 MMcf/d, which will be used as fuel gas for compression.

The processing plant is expected to begin operating in the first quarter of 2025.

NEH said it has secured two 10-year offtake agreements for 320 MMcf of helium, representing $113 million of undiscounted cash flow across both contracts.

The company has a “substantial drilling inventory” of 93 proved undeveloped locations and 437 probable undeveloped locations.

Helium, a product recovered from natural gas, is in high demand and low supply around the globe—and not just for party balloons. Helium is widely used in defense applications, medical devices like MRIs and aerospace technologies, among other uses.

Once its Pecos Slope Plant is operational, NEH expects to account for 1.6% of all North American helium production.

NEH is led by CEO Will Gray, who previously held leadership roles at Resaca Exploitation, Cross Border Resources, Dala Petroleum and WS Oil & Gas.

Roth CH Acquisition V Co. is a special purpose acquisition company, or SPAC, managed by affiliates of Roth Capital Partners and Craig-Hallum Capital Group.

The SPAC is led by co-CEOs Byron Roth and John Lipman. Roth has been chairman and CEO of Roth Capital Partners since 1998, which has helped raise over $75 billion for small-cap companies under his management. Lipman is a managing partner of investment banking at Craig-Hallum.

After closing the business combination with Roth CH Acquisition V Co., NEH’s market cap is expected to be approximately $139 million.

RELATED

Hitting the Market Soon: The Entire Federal Helium System

Data centers

Apart from helium production, NEH is targeting power generation as a source of revenue.

On Nov. 12, NEH announced a non-binding partnership with Sharon AI Inc. to form a joint venture (JV) for the design, development and operation of a 900 megawatt (MW), net-zero data center in the Permian Basin.

Under terms of the 50:50 JV, the companies will build an initial 900-MW power plant and the subsequent deployment of Tier 3 data centers.

The partnership has identified a suitable site and preliminary specs for the power plant and data center infrastructure.

The initial 900-MW natural gas-fired power plant also has the potential to expand capacity over time.

The JV will leverage natural gas from the Pecos Slope Field, and NEH will enter into a gas supply agreement with the JV at a mutually agreed fixed cost.

Sharon AI will serve as the exclusive AI and high-performance computing partner for the JV. The company expects to work with its ecosystem partners, including Nvidia and Lenovo, on the data center facility, network architecture and design.

A growing number of gas producers in the Permian Basin are looking at ways to break into power generation and supplying power to AI data centers.

Midland Basin giant Diamondback Energy sees power generation and, potentially, data center development as its next wave of equity investments, the company said in third-quarter earnings this month.

Riley Exploration Permian Inc., a public producer on the Permian’s Northwest Shelf, expanded a JV with Conduit Power to build new power generation and storage assets in the ERCOT market.

RELATED

Diamondback Touts Land, Cheap Gas to Lure Data Centers to Permian

Recommended Reading

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: March 17, 2025

2025-03-17 - Here’s a roundup of the latest E&P headlines, from Shell’s divestment to refocus its Nigeria strategy to a new sustainability designation for Exxon Mobil’s first FPSO off Guyana.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.