RSP Permian said deals have made it the majority working interest holder in 14 sections in the Permian. Its capex and production guidance is unchanged. (Source: Hart Energy)

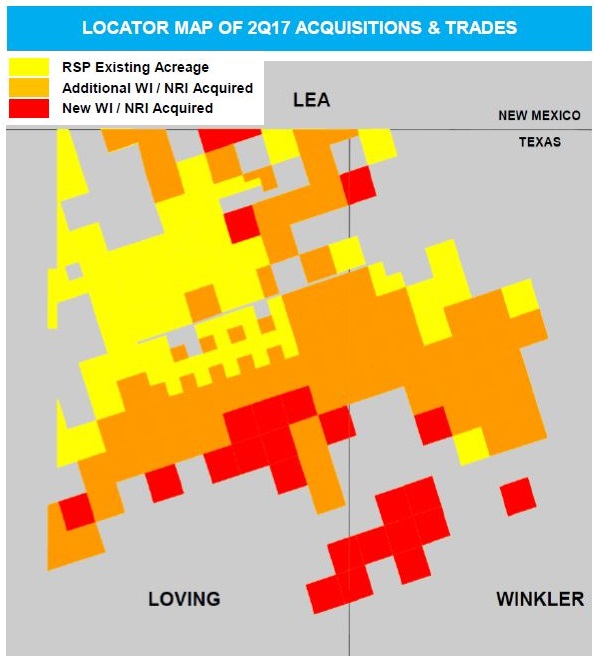

RSP Permian Inc. (NYSE: RSPP) added largely contiguous acreage in the Delaware Basin in Loving and Winkler counties, Texas, in recently closed deals worth $227.9 million, the company said this month.

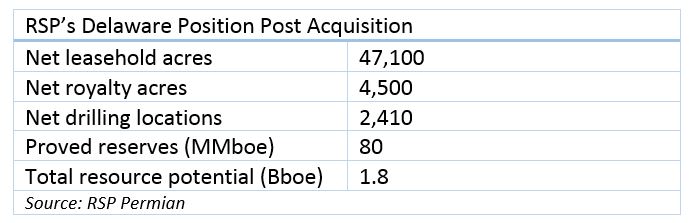

In several transactions, the company acquired 6,000 net acres, 4,500 net royalty acres and average production of 500 barrels of oil equivalent per day (boe/d), the company said in regulatory filings. The sellers were not disclosed.

Steven Gray, RSP’s CEO, said the closed acquisitions are in the heart of its Delaware position and further block up contiguous positions while offering additional length to lateral wells.

Gray said on an Aug. 8 earnings call that wells with increased working and revenue interests were already scheduled to be drilled “without adding any additional operational strain to our organization.”

“The leasehold acquisitions increase our working interest in 14 sections to a majority working interest position and the mineral interests provide immediate uplift to our returns without any incremental capital requirements or production-related expenses on wells drilled in those areas,” Gray said.

Zane Arrott, RSP’s COO, said in 2017 the company is averaging about 6,300-ft laterals in the Delaware. That should get “closer to 7,000 ft on average in 2018,” he said.

RSP acquired 6,000 net acres for $30,000/acre, adjusted for PDP of 500 boe/d and royalty interests, Scott Hanold, an analyst at RBC Capital Markets said. “The acreage is contiguous and within its existing Delaware Basin leasehold.”

Gabriele Sorbara, an analyst at The Williams Capital Group, put the price tag at $22,600 per acre.

The acquisitions were paid with RSP’s revolver, which has a $1.1 billion borrowing base. Management anticipates a 20% to 30% increase in its borrowing base in the fall.

In March, the company closed the second of two Silver Hill deals, taking control of about 41,000 net acres in the Delaware Basin for a total cost of about $2.4 billion in cash and stock. The deal included 15,000 boe/d.

RSP, based in Dallas, also noted on the call it will reduce the number of wells it plans to complete to minimize near-term outspend.

No changes were made to the $625 million to $700 million budget and 53,000 to 57,000 boe/d (71%-73% oil) guidance range. The company expects to achieve its guidance with 5-10 fewer wells, now at 80-85 gross.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Q&A: Pearl Energy Investments Rides the Downturns for 250% ROI

2025-02-25 - Billy Quinn, founder and managing director of Pearl Energy Investments, leads a team that thrives amid the oil and gas investment cycles.

Pearl Energy Investments Closes Fund IV with $999.9MM

2025-02-04 - Pearl Energy Investments’ Fund IV met its hard cap within four months of launching and closed on Jan. 31.

Buying Time: Continuation Funds Easing Private Equity Exits

2025-01-31 - An emerging option to extend portfolio company deadlines is gaining momentum, eclipsing go-public strategies or M&A.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.