Carl Isaac, President and CEO of Sabine Oil & Gas, speaks during Hart Energy’s DUG Gas Conference & Expo in Shreveport, Louisiana, on March 19, 2025. (Source: Hart Energy)

SHREVEPORT, La.—Sabine Oil & Gas plans to add a fourth rig on its East Texas leasehold next month.

Sabine aims to keep the fourth rig deployed “hopefully for the rest of the year,” if the company is comfortable with natural gas prices staying elevated, said President and CEO Carl Isaac.

East Texas pureplay Sabine Oil & Gas has held steady at three rigs since the beginning of the COVID-19 pandemic, Isaac said. Two rigs are in the Haynesville, one in the Cotton Valley.

“That three-rig program delivered 500 MMcf/d in April of 2022,” Isaac said March 19 during Hart Energy’s DUG Gas Conference & Expo in Shreveport, Louisiana.

Some production was curtailed amid low natural gas prices in 2023 and 2024, he said. Sabine produced an average of 462 MMcf/d in 2024, according to data from Enverus Intelligence Research.

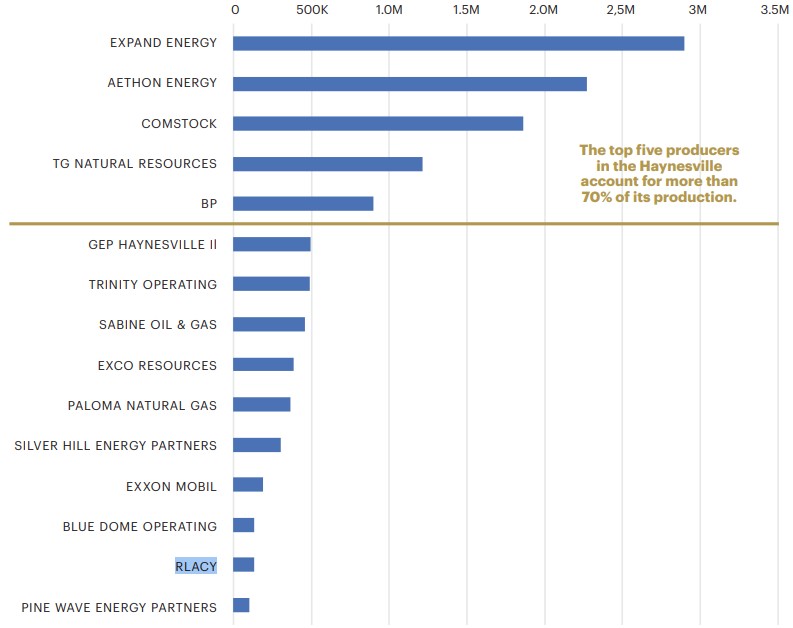

Sabine is the eighth-largest gas producer in the Haynesville play, by Enverus’ count.

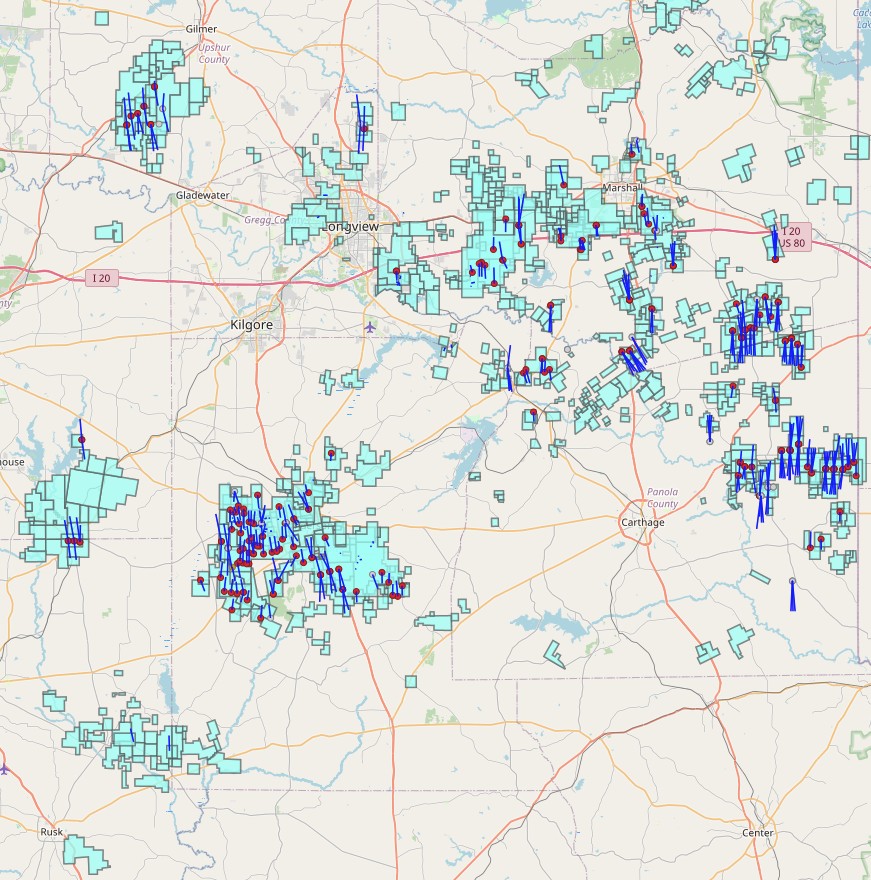

Sabine has large, operated positions in Panola, Harrison and Rusk counties, Texas. Sabine also has assets in Upshur, Cherokee, Gregg and Smith counties.

The company has around 280 undeveloped Haynesville and Cotton Valley locations at a $3.30/Mcf Henry Hub price, Isaac said.

At a $4.50/Mcf price, Sabine’s inventory is around 550 locations to drill in East Texas.

The 12-month Henry Hub strip price averages $4.70 as of March 19, according to CME Group data; 24-month strip is $4.34.

RELATED

Sources: Citadel Buys Haynesville E&P Paloma Natural Gas for $1.2B

A&D activity

Sabine has been a buyer and a seller in the Haynesville play, a basin red-hot with M&A attention.

The company has acquired about 170,000 Haynesville and Cotton Valley acres since 2017. Last year, Sabine acquired around 60,000 acres, Isaac said.

Sabine is 100% owned by Osaka Gas USA, the U.S. division of Japanese energy firm Osaka Gas.

Osaka Gas acquired a 35% working interest in Houston-based Sabine’s East Texas Haynesville assets in 2018, before buying the rest of the company the following year.

Sabine will also look to divest some “newer generation” horizontal assets from its portfolio this year, Isaac said.

“We will continue to sell the lowest-margin wells in our portfolio as we get an opportunity,” he said.

Experts say buyers want Haynesville Shale exposure as U.S. natural gas prices rise and gas demand grows to fuel LNG exports, AI data centers and power generation.

In February, hedge fund giant Citadel acquired Haynesville Shale E&P Paloma Natural Gas for $1.2 billion, Hart Energy reported. Paloma Natural Gas was backed by private equity firm EnCap Investments LP.

Last summer, private Haynesville operator Aethon Energy acquired Tellurian’s upstream assets for $260 million.

Sabine, however, isn’t looking to sell. Its parent company, Osaka Gas, has forecasts for natural gas demand to extend into the 2050s.

“That gives us a little room to plan,” Isaac said. “We’re not going anywhere.”

Haynesville production is expected to rise to 18 Bcf/d by the end of 2026, up from 14.1 Bcf/d in the fourth quarter of last year, according to the U.S. Energy Information Administration’s (EIA) latest forecast.

RELATED

Operators Look to the Haynesville on Forecasts for Another 30 Bcf/d in NatGas Demand

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Ovintiv Names Terri King as Independent Board Member

2025-01-28 - Ovintiv Inc. has named former ConocoPhillips Chief Commercial Officer Terri King as a new independent member of its board of directors effective Jan. 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.