Cenovus Energy looks to new technologies and innovative processes to better compete in a lower-for-longer environment.

If oil is headed lower for longer, Cenovus Energy Inc. (NYSE: CVE) plans to be cost-competitive in the new price environment. The company is already one of the lowest cost producers in the Alberta oil sands. But over the next decade or so, Cenovus plans to introduce new technologies and innovative processes that it hopes will drive down costs even further—maybe by as much as 33%.

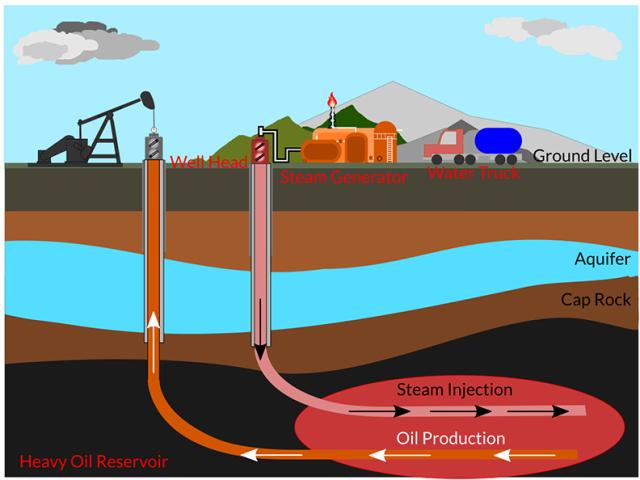

The man who oversees all that innovation is Harbir Chhina, Cenovus’ chief technology officer. The chemical engineer, who joined the company in 1988 when it was still Alberta Energy Company—later to be spun off as Cenovus while the gas business became Encana—is a legend in the Alberta oil patch, a pioneer who led commercialization of the SAGD (steam-assisted gravity drainage) process in the early 1990s, opening the oil sands to growth that wasn’t possible with mining alone.

“For me, for my generation, Harbir is the godfather of in situ development,” Drew Zieglgansberger, a Cenovus employee who considers Chhina a mentor, told Alberta Venture. “We were the first company to do SAGD on a commercial scale and it was almost entirely on his back.”

The period from roughly 2000 to the present is the first phase of SAGD, according to Kevin Birn of IHS MarkIt, and the technology appears ready for a next-generation leap forward in efficiency and effectiveness.

Three technologies are key to future SAGD success for Cenovus: substituting solvent for steam, big data and analytics, and well pad design.

Lowering steam to oil ratios (SOR) with solvents

SAGD requires steam, which is created by burning natural gas, which in turn raises costs and greenhouse gas emissions. Cenovus has been experimenting for years with what it calls “solvent-aided process.” Solvents can be any light hydrocarbon (e.g. propane, ethane, butane) that reduce the viscosity of the bitumen (which has the consistency of peanut butter), allowing it to be pumped to the surface. Chhina says each solvent has slightly different properties, which his team needs to understand better as they optimize the process. “We’ve looked at combining solvents. Just because we start with one solvent doesn’t mean we have to stay with that solvent,” he said in an interview. “Then, how much is it going to help the SOR? How much is it going to help the oil rate? Commodity prices will dictate which solvents we go with.”

Chhina says the next big push will be transitioning from high-temperature (250 degrees Celsius) to low-temperature solvents that are effective in a 100-degree environment. “If we could make that work, that would drop our steam oil ratio by 75% which is a game-changer,” he said. “Lower temperature solvents is where the focus should be. There are companies looking at electrical heating and things like that, those technologies are on our watch and wait list.”

Dinara Millington, research director for the Canadian Energy Research Institute, recently supervised a study that showed the biggest benefit of using solvents was an increase in “the uplift in the production flow...the well or the project produces above the original production capacity. You utilize a similar amount of energy but you're producing more.” Cenovus expects a 10% increase in production from employing solvents and 20% lower non-fuel operating costs.

Big data analytics

Mark Mills of the Manhattan Institute wrote a study two years ago predicting big data and the ability to understand it using analytics software and machine learning would drive down American shale production costs to levels similar to the vaunted low-cost Saudi fields. Today, Cenovus is collecting five to 10 million data points every three seconds and using the insight to optimize every facet of SAGD operations. “Data-analytics is the future and we have partnered up with ConocoPhillips, who's been applying that technology through the Eagleford, where they were able to cut their costs by 30-40%,” says Chhina. “Rather than re-inventing the wheel, we are learning through partnerships with companies that have already done this before.”

Millington says that a significant benefit of big data is steam flood and heat management. “You find better ways to regulate steam and where it’s going, to optimize the different pressures of steam that you would inject,” she said. Chhina agrees, and points to Cenovus’ “better forecasting of our wells and a better steam usage to make sure we’re distributing the steam properly throughout the field.” Millington estimates analytics can reduce production costs by up to 20%. Cenovus says analytics is part of a $125 million in operating costs reduction it forecasts for the near future.

Well and well pad design

The company has targeted another $500 million savings through “capital efficiencies,” including re-designed well pads and longer-reach horizontal wells.

“We went from four to now we're seeing 12 or even 16 well pairs per pad. That standardizes and modularizes your operations, reduces your land footprint,” says Millington.

Cenovus said in an email that it is implementing a “zero-base design approach,” which begins with the most basic equipment and infrastructure required for each phase in the production cycle, then adds more equipment or infrastructure as it becomes necessary, repurposing the equipment. Savings ranged from 30% to 60% for materials, planning, engineering and procurement, and field construction time. One SAGD project CERI studied gained a 20% to 50% reduction in the cost of wells and pads, which generally account for 20% of the total capital expenditure of any SAGD project.

Chhina estimates Cenovus SAGD cash operating costs—which have already been reduced by 30% since the 2014 oil price crash - at seven to 10 dollars a barrel, depending on the field. He thinks another 20% reduction is possible over the next decade or so. If the company hits that target, cash operating costs could be as low as just over $5 to $8 a barrel, in which case Cenovus will be very well positioned for a “lower for longer” market.

Recommended Reading

E&P Highlights: Jan. 13, 2025

2025-01-13 - Here’s a roundup of the latest E&P headlines, including Chevron starting production from a platform in the Gulf of Mexico and several new products for pipelines.

Analysts’ Oilfield Services Forecast: Muddling Through 2025

2025-01-21 - Industry analysts see flat spending and production affecting key OFS players in the year ahead.

US Drillers Add Oil, Gas Rigs for First Time in Eight Weeks

2025-01-31 - For January, total oil and gas rigs fell by seven, the most in a month since June, with both oil and gas rigs down by four in January.

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-01-10 - The oil and gas rig count fell by five to 584 in the week to Jan. 10, the lowest since November.

Baker Hughes: US Drillers Keep Oil, NatGas Rigs Unchanged for Second Week

2024-12-20 - U.S. energy firms this week kept the number of oil and natural gas rigs unchanged for the second week in a row.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.