“Never sell the mineral rights!”

It’s been a common refrain passed down through generations of American families, their fingers crossed for an eventual payout.

But that refrain is resonating less and less among members of a younger generation who are more and more willing to sell their mineral and royalty interests to larger players, experts say.

A generational shift is bringing an increased supply of oil and gas mineral and royalty assets to market—and buyers have taken notice.

“I think as the generations changed, the minerals went from the Baby Boomers and are now getting into the next generation of folks,” said Darin Zanovich, president and CEO of Mesa Minerals III. “They’re not as sentimental to those folks anymore.”

But minerals buyers aren’t out to rip off families and steal grandma’s mineral rights, either. Offers have become more sophisticated—similar terms to those made to corporate oil and gas buyers—and that could be “life-changing” for families seeking to monetize, Zanovich said.

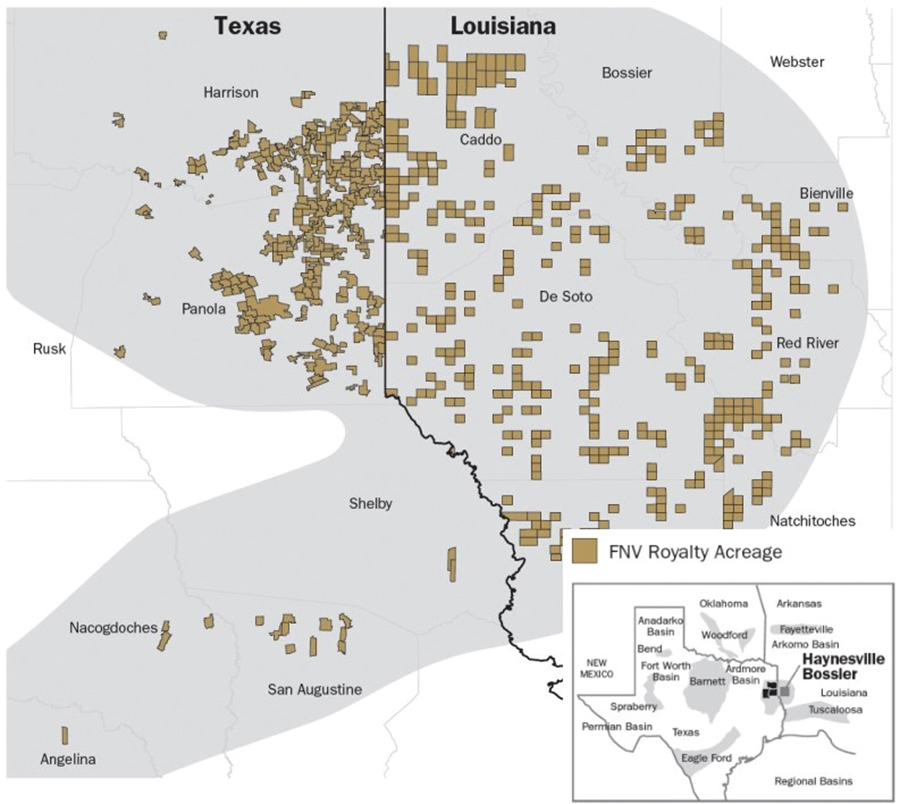

Zanovich’s latest venture, NGP-backed Mesa Minerals III, is buying up mineral and royalty interests in the Haynesville Shale and in the Permian Basin, two of the most productive oil and gas basins in the Lower 48.

Mesa III deployed more than $160 million in its first 12 months and had its commitment from private equity backer NGP upped to $250 million, Zanovich told Oil and Gas Investor.

The company announced an acquisition of around 6,200 net royalty acres in the core of the Haynesville in April. It is an area where Zanovich and the Mesa franchise have had a lot of experience: Both of Mesa III’s predecessor companies built up Haynesville mineral positions and exited through separate transactions with Franco-Nevada Corp.

Mesa III is also focused on buying interests in the Permian Basin, the nation’s top oil-producing region. But asking prices in the Permian are sky high, so Mesa has been more active in the Haynesville.

“We see conversions happen at such a faster rate in the Haynesville than in the Permian,” Zanovich said. “We believe most of the core in the Haynesville is going to be developed in the next seven years or less.”

But the company still wants to buy a piece of the Permian, Zanovich said. Many members of Mesa’s current team have experience in the prolific oil basin.

“We have over 50 buyers that work for us across the Haynesville and the Permian, which makes us one of the largest ground game teams that’s out there,” he said.

League of their own

Changes to the minerals and royalties landscape have caused many public players to get bigger, but scores of privately held aggregators are getting in on the action, too.

Private companies such as Elk Range Royalties, 1979 Royalties, WhiteHawk Energy and Phoenix Capital Group have also been active in the minerals M&A space alongside Mesa Minerals.

The surge of minerals interest and activity is a far cry from a decade or so ago, when Zanovich first entered the space on the executive management team at Haymaker Minerals & Royalties. Haymaker went on to sell the majority of its assets for over $450 million in cash and stock in 2018.

“When we got in the space in 2013, I don’t even think we could get five guys in a room to go have drinks and talk about minerals and royalties,” he said.

Much has evolved in the minerals and royalties sector over the past decade, from the teams to the term sheets. Offers to buy subsurface rights have become more sophisticated and more attractive to potential sellers, Zanovich said.

Minerals and royalties aggregators are now making landowners the kinds of offers that would typically be made to an oil and gas company.

“We’re doing a full [net asset value] workup on their, call it, 40 acres that we’re buying,” Zanovich said, “and we could easily be wrong on our timing, or our type curves.”

“We can’t buy it for a measly PDP multiple on their cash flow,” he said. “We’ve got to actually pay these people what this is worth, and that’s what we’re doing now.”

The teams chasing minerals and royalties deals have also upped the ante: Experts on the Mesa III team include petroleum engineers, reservoir engineers, geologists, landmen and other functions that might be more traditionally found at an E&P company.

Private equity is increasingly keen on the minerals and royalties space because of the returns early players like Haymaker—backed by Kayne Anderson and KKR funds—were able to generate on their investments.

“From Haymaker to Mesa I and Mesa II, we’ve delivered north of a 2x return net to our investors on every deal that we’ve done out there,” Zanovich said.

Those attractive 2x-to-3x net returns are attracting greater volumes of institutional capital into the sector, he said.

Minerals and royalties are attracting more investment because of the sector’s lower risk profile compared to the E&P sector. Owning minerals and royalties delivers exposure to the oil and gas commodity cycle but without the headaches of D&C costs and operational spending.

Minerals and royalties players essentially make a one-time purchase of the subsurface rights and hold them in perpetuity.

“We always say that we’re in the underground real estate business,” Zanovich said. “What we’re doing right now in Mesa III, for example, is buying mineral and royalty rights—underground real estate—in the Permian and Haynesville.”

Room to run

The minerals and royalties space is getting bigger: The market value of public minerals and royalties peer companies doubled to $30 billion from 2019 through 2024, according to an RBC analysis.

Transactions are getting bigger, too: The sector has seen some of its largest M&A deals get inked in just the past few years—including the $4.8 billion merger between Sitio Royalties and Brigham Minerals in 2022.

Late last year, Diamondback Energy subsidiary Viper Energy Partners acquired Permian mineral and royalty interests from GRP Energy Capital and Warwirk Capital Partners for about $1 billion in cash and stock.

Zanovich expects the consolidation trend to continue in the sector.

“It wouldn’t surprise me to see 25% or more of the private mineral ownership be owned by institutional or public companies eventually going forward,” he said.

Investors want size—scale in operations and scale in trading liquidity, said Tim Perry, RBC vice chairman of global energy.

But the entire public minerals and royalties market only makes up a collective $30 billion. Just a single company in the peer group, Texas Pacific Land Corp., has a market value above $10 billion.

RELATED

From Failed Post-Civil War Railroad to Permian Basin Royalties Giant

The sector also needs a higher volume of share-trading activity—or a higher “float”—than it has right now for investors to play in and out of the stock market.

If a big institutional group takes a position in a public mineral and royalty stock, they can’t really sell out of that position without sinking the stock price, Zanovich said.

“[Investors] want something they can get in and out of,” he said, “so it’s got to be big. The market cap’s got to be bigger.”

Zanovich thinks aggregators will continue to be aggressive in pursuing M&A around the Lower 48 as they search for scale.

Tie-ups between the biggest public companies on the market today also aren’t off the table.

“Honestly, you need to combine Viper, Sitio, all these guys that are public and put those all into one,” he said. “That would be the type of size that would really get on the radar out there. I think it can happen.”

Recommended Reading

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

Williams Cos. COO Dunn to Retire

2025-03-13 - Williams Cos. COO Micheal Dunn was crediting with helping the company focus on a natural gas strategy.

Ovintiv Names Terri King as Independent Board Member

2025-01-28 - Ovintiv Inc. has named former ConocoPhillips Chief Commercial Officer Terri King as a new independent member of its board of directors effective Jan. 31.

USA Compression Names Chris Wauson as COO

2025-03-07 - Chris Wauson, currently the leader of natural gas compression company USA Compression Partners’ Permian office, has been chosen as the company’s new COO.

Viper Makes Leadership Changes Alongside Diamondback CEO Shakeup

2025-02-21 - Viper Energy is making leadership changes alongside a similar shake-up underway at its parent company Diamondback Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.