Hart Energy

Samson Oil and Gas Ltd.’s $41.5 million deal to sell its Foreman Butte Project in North Dakota and Montana will be scrapped, the company said Feb. 1.

Samson said buyer Firehawk Oil and Gas LLC terminated the agreement after indicating that it wanted to proceed but was unable to complete financing for the transaction, announced Jan. 22.

Samson and Firehawk, a private-equity backed company based in Dayton, Ohio, signed a non-binding letter of intent for a purchase and sale. Proceeds from the deal were earmarked for repaying Samson’s liabilities, including its hedge book. An estimated $12 million would have been distributed to shareholders.

The transaction would have required shareholder approval.

Samson said it will now proceed with a previously proposed $30 million refinancing, which would repay the company’s existing lender in full. The $30 million facility would also provide the company with sufficient working capital to recommence Samson’s development drilling program.

However, Samson wants a reduction in some transactional expenses that might result from a new debt facility.

“If those expenses cannot be meaningfully reduced, Samson may elect to pursue another asset sale in lieu of the proposed refinancing transaction,” the company said.

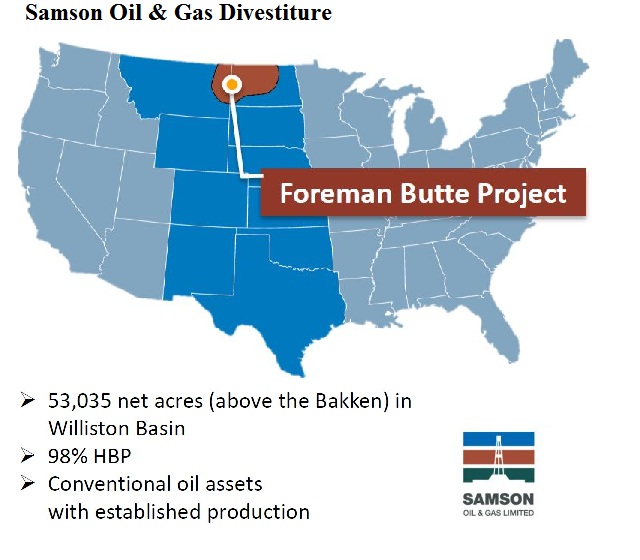

Samson’s Foreman Butte position, also known as the Home Run Field, comprises substantially all of the Australian company’s assets, according to the company press release. Samson also has U.S. offices in Denver.

In 2016, Samson reported holding 53,035 net acres in the Foreman Butte with an average operated working interest of 87%.

In January 2016, Samson acquired the Foreman Butte Project for $16 million and recognized a gain on the transaction of $10.8 million.

Taking allowances for capex, depreciation and the release of associated provisions for asset retirement, the company said it expects to record a profit of roughly $10 million before transactional expenses and costs.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

Partnership to Deploy Clean Frac Fleets Across Permian Basin

2024-12-13 - Diamondback Energy, Halliburton Energy Services and VoltaGrid are working together to deploy four advanced electric simul-frac fleets across the Permian in an effort to enhance clean and efficient energy solutions in the region.

Tracking Frac Equipment Conditions to Prevent Failures

2024-12-23 - A novel direct drive system and remote pump monitoring capability boosts efficiencies from inside and out.

ProPetro Agrees to Provide Electric Fracking Services to Permian Operator

2024-12-19 - ProPetro Holding Corp. now has four electric fleets on contract.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.