Samson Oil and Gas will sell the Williston position for about $41 million two years after purchasing the assets, also known as the Home Run Field, for $16 million. (Image: Hart Energy)

[Editor’s note: This is a breaking news article. Please check back for additional details.]

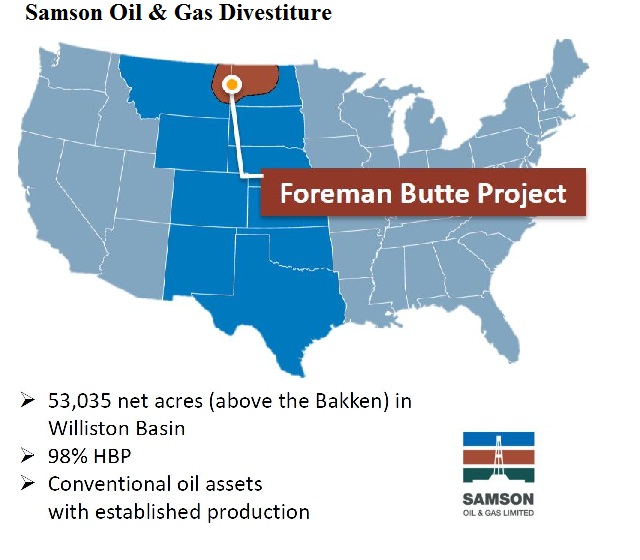

Firehawk Oil and Gas LLC will buy Samson Oil and Gas Ltd.’s Foreman Butte Project in North Dakota and Montana for about $41 million, Samson said Jan. 22.

Samson’s Foreman Butte position, also known as the Home Run Field, comprises substantially all of the Australian company’s assets, according to the company press release. Samson also has U.S. offices in Denver.

In 2016, Samson reported holding 53,035 net acres in the Foreman Butte with an average operated working interest of 87%.

Samson and Firehawk, a private-equity backed company based in Dayton, Ohio, signed a non-binding letter of intent for the assets. Samson said the transaction requires the approval of its shareholders.

The transaction proceeds would go toward repaying all of Samson’s liabilities, including its hedge book. An estimated $12 million would be distributed to shareholders.

In January 2016, Samson acquired the Foreman Butte Project for $16 million and recognized a gain on the transaction of $10.8 million.

Taking allowances for capex, depreciation and the release of associated provisions for asset retirement, the company said it expects to record a profit of roughly $10 million before transactional expenses and costs.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

SM Energy Adds Petroleum Engineer Ashwin Venkatraman to Board

2024-12-04 - SM Energy Co. has appointed Ashwin Venkatraman to its board of directors as an independent director and member of the audit committee.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

NOV Appoints Former Denbury CEO Chris Kendall to Board

2024-12-16 - NOV Inc. appointed former Denbury CEO Chris Kendall to its board, which has expanded to 11 directors.

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

Independence Contract Drilling Emerges from Chapter 11 Bankruptcy

2025-01-21 - Independence Contract Drilling eliminated more than $197 million of convertible debt in the restructuring process.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.