The company projects annualized EBITDA of about $50 million from the assets— a multiple between 2.5x and 3x, SandRidge said. (Source: Shutterstock/ SandRidge Energy)

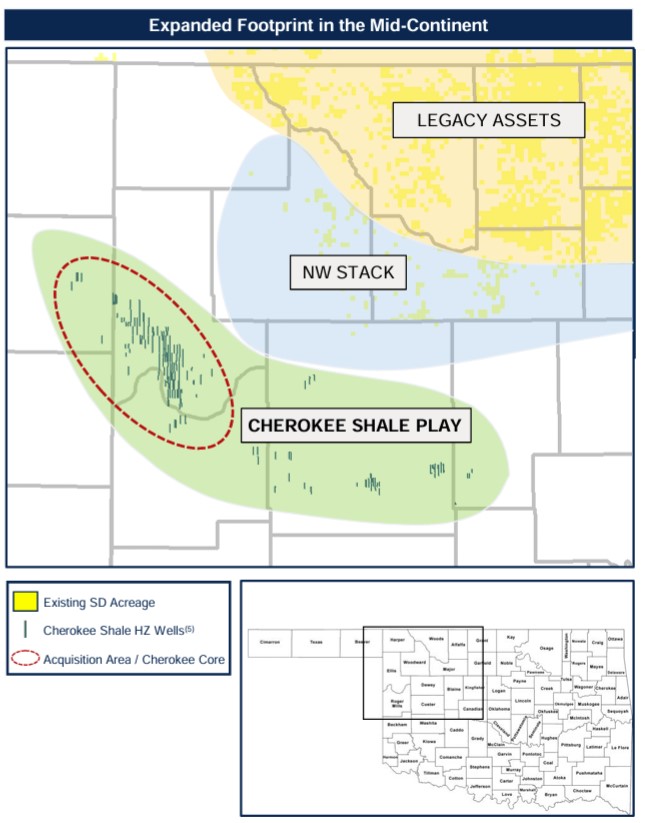

Midcontinent E&P SandRidge Energy has closed a $144 million cash deal for producing assets and leasehold interests in the Cherokee play of the Western Anadarko Basin. The acquisition cost is before customary purchase price adjustments.

The seller wasn’t disclosed.

The deal, announced in July, adds net production of 6,000 boe/d (40% oil) in Ellis and Roger Mills counties, Oklahoma, along with 42 producing wells and 4 DUCs. SandRidge also acquired two newly completed wells scheduled to be turned to production in 2024.

The company projects annualized EBITDA of about $50 million from the assets— a multiple between 2.5x and 3x, SandRidge said.

In July, the company also entered into a joint development agreement regarding future development of certain acquired assets. SandRidge did not name the company it is partnering with.

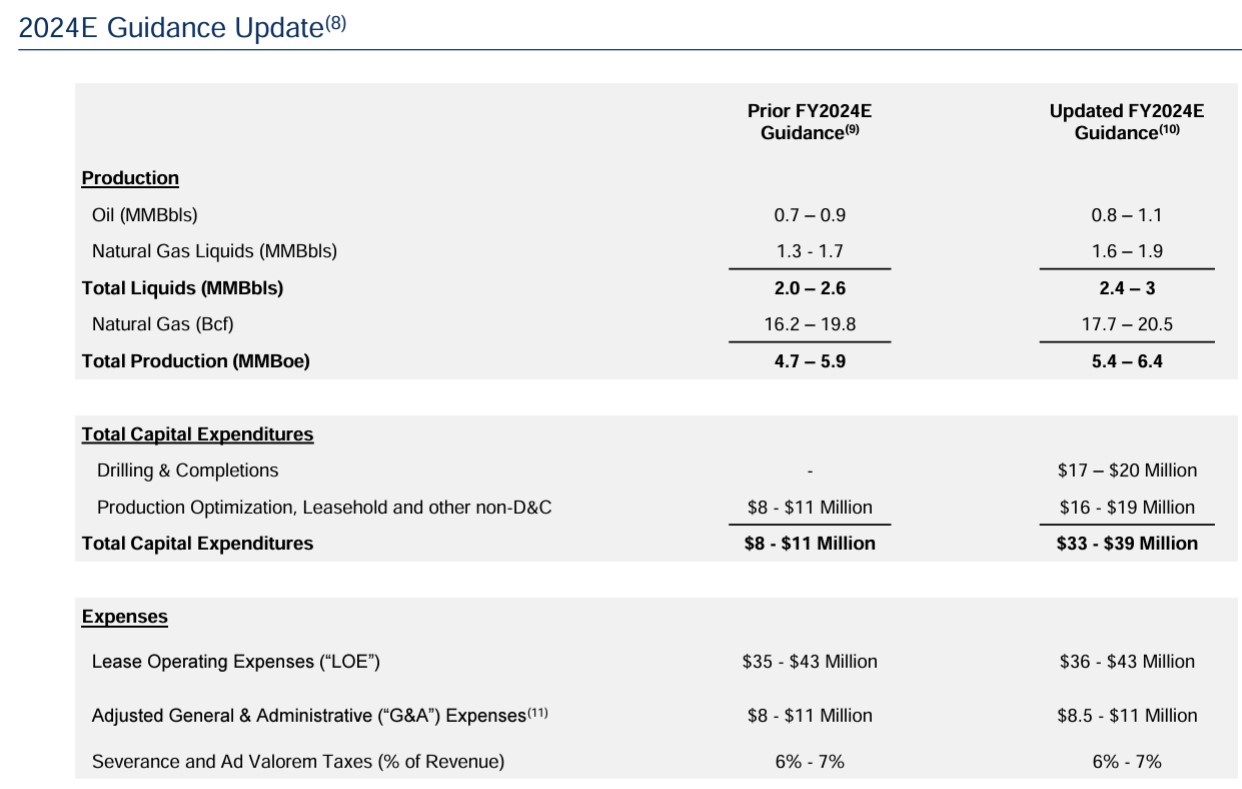

SandRidge’s daily production averaged 16,900 boe/d (55% gas; 45% liquids) during 2023, according to investor filings. SandRidge estimates that with the bolt-on, it will produce 5.9 MMboe in 2024 at the midpoint of its guidance. That’s 11% higher than its previous 2024 guidance of 5.3 MMboe for the year.

Winston & Strawn LLP is serving as SandRidge's legal adviser on the transaction.

RELATED

Recommended Reading

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

McDermott Completes Project for Shell Offshore in Gulf of Mexico

2025-03-05 - McDermott installed about 40 miles of pipelines and connections to Shell’s Whale platform.

M&A Competition Off to the Races as Mesa Minerals Kicks Off Fourth Iteration

2025-04-16 - The Mesa Minerals IV launch comes as M&A competition grapples for mineral and royalty interests, no matter the basin, says Mesa Minerals CEO Darin Zanovich.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.