SandRidge Energy is acquiring interests in Cherokee assets in western Oklahoma for $144 million in cash. (Source: Shutterstock/ SandRidge Energy)

Midcontinent E&P SandRidge Energy is getting deeper in the Western Anadarko Basin through M&A.

SandRidge signed an agreement to acquire producing assets and leasehold interests in the Cherokee play of the Western Anadarko for $144 million in cash, the Oklahoma City-based company said after markets closed on July 29. The seller wasn’t disclosed.

The company also entered into a joint development agreement regarding future development of certain acquired assets. SandRidge did not name the company it is partnering with.

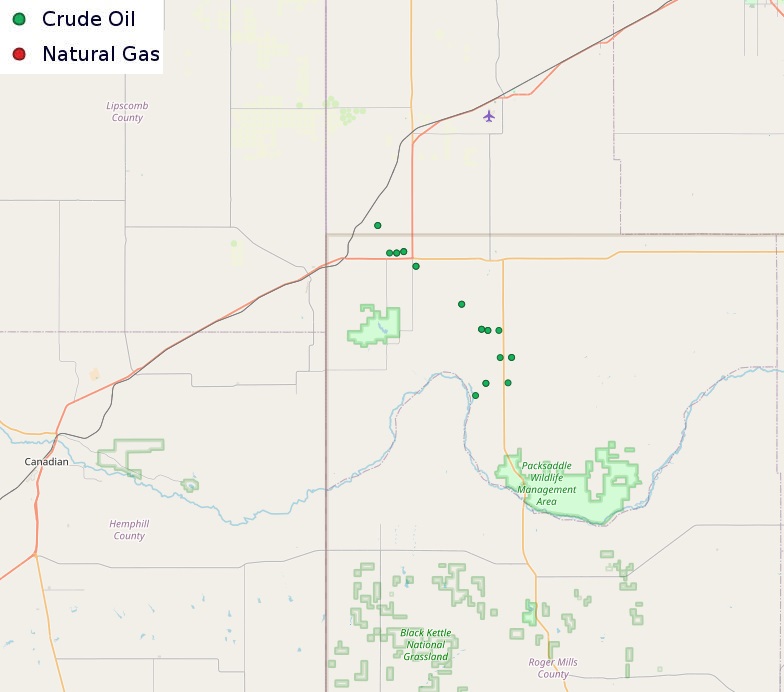

The transaction includes net production of approximately 6,000 boe/d (~40% oil) primarily focused in Ellis and Roger Mills counties, Oklahoma.

Horizontal drilling activity targeting the Cherokee interval has been mainly led out of Ellis County—but has extended south into Roger Mills and Custer counties.

The deal includes 42 producing wells and four DUCs scheduled to be turned to production this year.

SandRidge is picking up leasehold interest in 11 drilling spacing units (DSU), adding inventory of up to 22 2-mile lateral wells in the core of the Cherokee play.

SandRidge will jointly develop the DSUs with “a partner who has a demonstrable history of successful operations in the Cherokee play,” the company said. Under terms of the agreement, SandRidge will operate the new wells after they begin production.

“The acquired producing assets and DSUs flange up with areas where we've been recently investigating the potential for new SandRidge-operated drilling opportunities,” SandRidge President and CEO Grayson Pranin said. “As we operate and jointly develop the acquired assets, our team will be well positioned to evaluate and execute on future organic growth opportunities.”

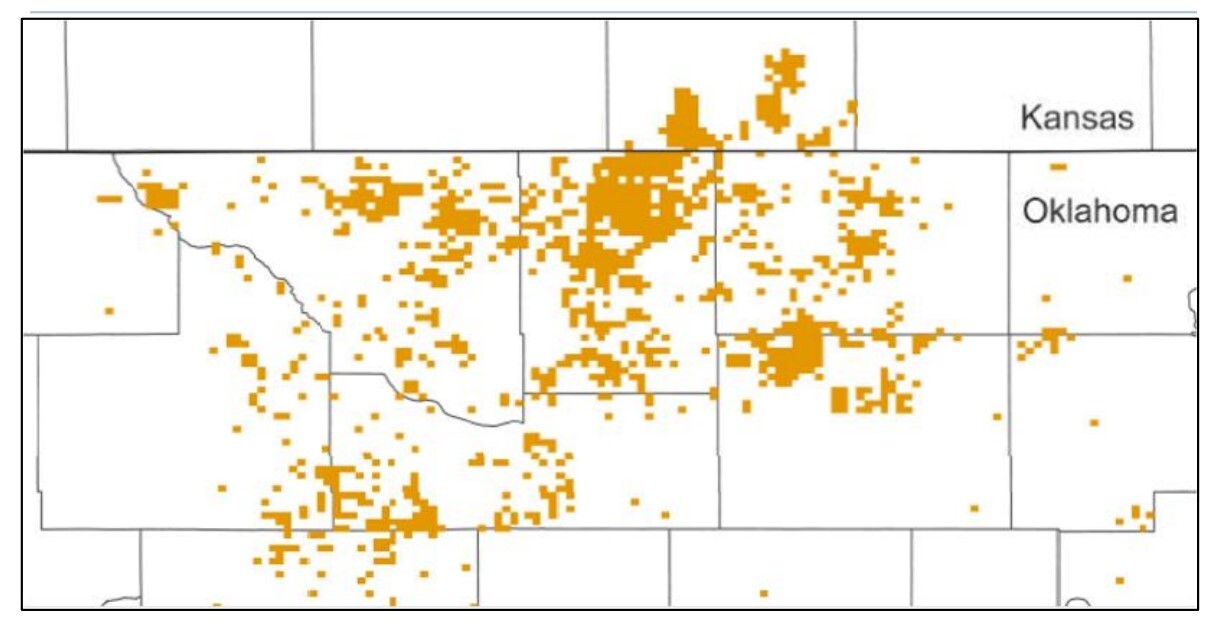

At year-end 2023, SandRidge held interests in 548,895 gross (364,201 net) leasehold acres across Oklahoma and Kansas.

The company hasn’t been particularly acquisitive of late. In July 2023, SandRidge upped its interest in 26 producing wells operated by the company in the northwest STACK play for $10.6 million.

In February 2021, SandRidge closed a $47 million sale of its North Park Basin assets in Colorado, completing a transformation into a pure-play Midcontinent E&P.

The year before, SandRidge announced selling its skyscraper in Oklahoma City for $35.4 million in net proceeds—a move to alleviate concerns that the company could re-enter bankruptcy after exiting a brutal Chapter 11 reorganization process in 2016.

SandRidge’s daily production averaged 16,900 boe/d (55% gas; 45% liquids) during 2023, according to investor filings.

Winston & Strawn LLP is serving as SandRidge's legal adviser on the transaction.

Recommended Reading

CNOOC Makes Oil, Gas Discovery in Beibu Gulf Basin

2025-03-06 - CNOOC Ltd. said test results showed the well produces 13.2 MMcf/d and 800 bbl/d.

DNO ‘Hot Streak’ Continues with North Sea Discovery

2025-03-26 - DNO ASA has made 10 discoveries since 2021 in the Troll-Gjøa exploration and development area.

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

Shell Takes FID on Gato do Mato Project Offshore Brazil

2025-03-23 - Shell Plc will be the operator and 50% owner, with Ecopetrol holding 30% interest and TotalEnergies 20%.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.